Kinross Gold: Expectations Ahead Of Q4 Results

Gold prices are acting as a tailwind.

KGC is likely to deliver a strong Q4 when it announces results in mid-February.

The long-term outlook will depend on the company's operational performance delivered in-line with targets, and a sustained improvement in gold prices.

The technical price chartand analysts' recommendations also indicate a buy at current prices.

When I last wrote on Kinross Gold (KGC), the stock was trading within the range of ~$3.14-3.18. I suggested potential upside in the company due to a strong outlook for the FY 2019. At present, the stock is trading at ~$3.33 and I think it's high time to consider where the share prices could move from the current levels.

Figure-1 (Source: Kinross website)

Figure-1 (Source: Kinross website)

KGC is expected to announce the financial and operational results for Q4 and the full-year 2018, on February 13, 2019. In this article, I will analyze the short and long term outlook of the company. The short term outlook will also include the potential upside that may accrue from a healthy Q4. In contrast, the long-term outlook will be based on an analysis of the company's fundamental strength and sustained improvement in gold prices. I have also considered the technical price chart and analyst recommendations to consider an investment case in the company.

Gold prices are acting as a tailwind

Since August 2018 gold prices have been on a solid uptrend. They have moved up from ~$1,180/oz. to as high as ~$1,324/oz. and have gained a healthy 13% during the past 6 months (Figure-2).

Figure-2 (Source: Infomine)

In my view, the recent uptrend in gold prices emanates principally from a weaker US dollar. The DXY has witnessed a noticeable decline during the past few months (Figure-3) and this has reflected positively on gold prices.

Figure-3 (Source: Market Watch)

Moreover, the FOMC (Federal Open Market Committee) has recently announced to maintain the funds' rate between 2.25% and 2.5%. This suggests that the performance of the greenback against the precious metal will remain sluggish. Put it another way, gold prices should witness more upside with the next price target at ~$1,350/oz.

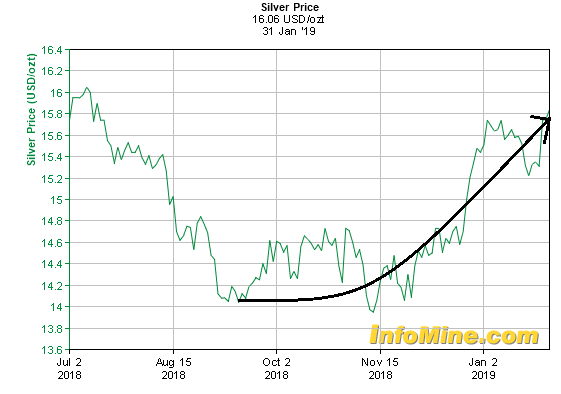

On a separate note, silver prices have generally followed the lead of gold prices. The 6-month price chart of silver shows that silver has gained ~$2/oz. (from ~$14/oz. to ~$16/oz.) after witnessing a record low in August 2018 (Figure-4).

Figure-4 (Source: Infomine)

In my view, silver prices are also an important consideration for the KGC investor because KGC also produces a significant quantity of silver. For instance, KGC sold ~1.07 Moz (read: a million ounces) of silver during Q3. For KGC, silver revenues are used to reduce the cost of production of gold and helps KGC to improve its reported cost of sales per ounce of gold (on a by-product basis). It follows that a sustained increase in silver prices would help improve the mining dynamics of the company.

Growth outlook of KGC:

As mentioned earlier, KGC's Q4 and FY 2018 results are expected in mid-February. In my view, KGC has an attractive outlook in both short term (say, the next 6-12 months) and the long-term (say, the next 3-5 years).

Short-term outlook: A favourable short-term outlook is based on the improvement in gold prices witnessed during Q4 (and that has continued till date). It should be noted that KGC's Q3 was a mild quarter as the company missed on both revenues' and earnings' expectations. In contrast, I expect a stronger Q4 wherein KGC is likely to exceed the revenue expectations. This anticipation is based on the fact that KGC will post significantly higher gold production on a Q/Q basis.

KGC's FY 2018 production guidance ranges between ~2.375 million and ~2.625 million ounces of gold equivalent, and as shown in Figure-5, the company's Q3 and nine-month production stood at ~592 Koz (read: a thousand ounces) and ~1.86 Moz of gold equivalent ounces. Assuming that the company meets the full-year production guidance, we can expect it to produce between ~600-700 Koz during Q4. If we factor in the positive impact of favourable gold prices witnessed during Q4, it's easy to see why KGC is likely to deliver a strong Q4 2018.

Figure-5 (Source: Q3 results)

Long-term outlook: As shown in Figure-6, KGC has a geographically diverse portfolio of operating mines and development projects. In my view, geographical diversification is a positive as it helps in mitigating the geopolitical risks that are generally more prominent in less-developed African countries.

Figure-6 (Source: January Presentation)

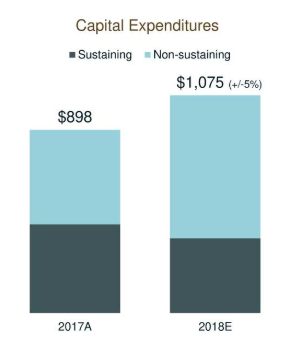

Moreover, the company's planned full-year CAPEX (for FY 2018) stood at ~$1.08 BB. By the end of Q3, KGC had already incurred ~$ 770 MM in CAPEX. This would imply that ideally, KGC will have incurred CAPEX of ~$300 MM during Q4. Compared with FY 2017, a larger proportion of FY 2018 CAPEX (Figure-7) is based on growth CAPEX (or non-sustaining CAPEX). In my view, this is an indicator of the true operational growth that would shape the future of the company.

[Note: By operational growth, I mean the expansion of / developments in its pipeline projects that could significantly enhance the production potential of the company. A brief discussion on these projects is included in a later section]

Figure-7 (Source: January Presentation)

Figure-7 (Source: January Presentation)

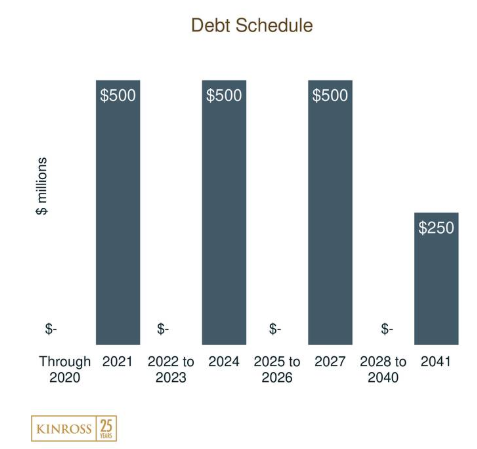

Furthermore, KGC's operational growth will also be fueled by the fact that the company will not have to commit any significant cash for debt repayments in the near future. In fact, the only principal repayment of debt falls due in FY 2021, and subsequently in FY 2024, FY 2027 and finally in FY 2041 (Figure-8).

Figure-8 (Source: January Presentation)

Figure-8 (Source: January Presentation)

In my view, this should mean that the company will go for planned expansion in its projects without much concern about the repayment of debt. So let's consider the major development targets that KGC expects to achieve in FY:

Round Mountain: By mid-2019, it expects to deliver first ore production from Phase W of its Round Mountain project. During the 9-months ended September 2018, this mine had produced ~290 Koz of gold at an average cost of sales of ~$717/oz. In my opinion, even though this mine is not the lowest-cost mine in KGC's portfolio, given the current uptrend in gold prices, an increase in gold output would be a plus for the company. Chile Projects: Moreover, KGC expects to advance feasibility stage studies in its two Chilean projects namely, La Coipa and Lobo-Marte (refer Figure-6). A positive outcome of these studies should help the company make an investment decision. Given that KGC has ~$2.1 BB of liquidity, it should be able to undertake an investment if it encounters positive results on these studies. Fort Knox Gilmore: Gilmore is a brown-field project on KGC's Fort Knox property that is expected to deliver the first production in FY 2020. Given that during Q3 2018, the cost of sales pertaining to the Fort Knox gold production stood at ~$1,015/oz, KGC expects the Gilmore extension to deliver gold production at a lower cost and thus improve the overall dynamics of operations at this mine. Tasiast Mill: KGC has completed the commissioning of Tasiast Phase One and is in the process of negotiating the prospects of Phase Two with the Mauritanian authorities. During Q4 2018, the Tasiast mine delivered strong production in October (~29 Koz). Going forward, we could expect more upside to production as KGC obtains the regulatory approvals for expansion of Phase Two of the mine.KGC's technical picture and analyst recommendations

Based on the technical price chart (Figure-9), we may expect a target price within a range of ~$3.5-3.6 in the short-to-medium term.

Figure-9 (Source: Finviz)

Figure-9 (Source: Finviz)

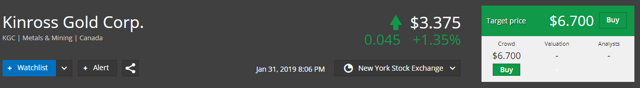

Moreover, when we consider the analyst recommendation, we can see that they have rated the stock as a 'buy' with a long-term target price of ~$6.70 (Figure-10). In my view, such a long-term target price would depend upon the operational performance of the company and its ability to manage costs and deliver the operational performance in line with the targets. However, given the recent momentum in gold prices, it appears that KGC is on track to reach the short-to-medium term price range of ~$3.5-3.6.

Figure-10 (Source: Sharewise)

Conclusion

Based on the preceding discussion, we have seen that KGC is likely to deliver a stronger Q4 compared with Q3. This expectation is based on the fact that gold prices have increased significantly during Q4, and if we assume KGC to deliver production in line with full-year guidance then Q4 will also exceed Q3 in terms of output. This should provide for share price appreciation in the short-term.

In the long-term, KGC will need to deliver in line with operational targets (including those related to the expansion of its projects) and will need to see a sustained improvement in gold prices to witness significant upside from the current levels. Nevertheless, based on analyst's recommendations and a discussion of the company's technical performance, I believe that KGC is still a buy at current prices.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Aitezaz Khan and get email alerts