Kirkland Lake Gold: Further Upside In 2019 As Production Growth To Sustain

Fosterville asset is a production and cash flow game changer and robust production growth is likely to sustain in the next few years.

Fosterville asset has an AISC of less than $500 an ounce and as production from asset increases, the company's cash flow growth is likely to be strong.

Ample cash with zero debt provides high financial flexibility for growth and exploration projects.

Macassa Mine to provide production bump-up in 2022 and this is likely to ensure that the company's production growth sustains for the next 3-5 years.

Investment Overview

Kirkland Lake Gold (KL) has been in my coverage radar since April 18, 2017 when the stock was trading at $7.4. I initiated coverage with focus on the company's production growth and its impact on cash flows. When I re-initiated coverage on August 16, 2017, the stock was already higher by 58% at $11.7 and my coverage focused on improving all-in-sustaining-cost coupled with prospects related to Fosterville asset. As I write again on Kirkland Lake Gold, with focus on the outlook for 2019, coupled with key stock upside triggers, the stock price is higher by 295% since first coverage on April 18, 2017.

I believe that the positive stock momentum for Kirkland Lake Gold is likely to sustain through 2019 and I rate the stock as a "Strong Buy" even after the big rally since initiating coverage. This article will focus on the outlook for gold that is likely to provide momentum to the stock. Importantly, the article will discuss the company specific factors related to production and potential cash flows that will trigger upside for Kirkland Lake Gold.

Bullish On Gold

Before discussing company specific factors that will continue to support the price momentum, I would like to briefly discuss the reasons that support possible breakout for gold after a multi-year trading range. As I write, gold is already above $1,300 an ounce and the following factors can potentially ensure that the precious metal remains firm -

According to the recent IMF update (January 2019), global economic growth is likely to be 3.5% for 2019. The IMF forecast in June 2018 was GDP growth of 3.9% for 2019. Therefore, growth estimates have been revised lower and this would imply potential expansionary monetary policy in countries or regions experiencing lower growth. This is likely to be positive for gold. One of the key reasons that gold has remained sideways is the fact that the dollar has been relatively strong since the fed has pursued contractionary monetary policy (starting December 2015). However, the recent comment by Jerome Powell that the fed "can be patient on interest rate hikes" is the first indication of pause in contractionary monetary policy. This is positive for gold in an environment where trade war has resulted in weakening of global economic growth. The gold demand trend for 3Q18 indicates that central banks purchase of gold was at the highest level since 2015 as central banks increasingly seek to diversify reserves amidst trade wars. Further, even as ETF inflows remained weak, the demand was strong for physical gold and coins. Therefore, investors are increasing exposure to physical gold, which is bullish for the foreseeable future.Considering these factors, I believe that gold is set to trend higher after moving in a narrow range in the last few years. As gold price gains momentum, I expect gold miners to benefit and Kirkland Lake Gold is well positioned to leverage on higher gold prices.

Sustained Production Growth

As I mentioned at the onset, Kirkland Lake Gold stock has surged in the last 18-24 months. This surge has been backed by fundamental factors and one of the key factors is the production growth.

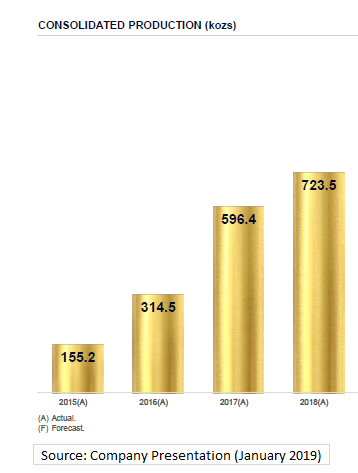

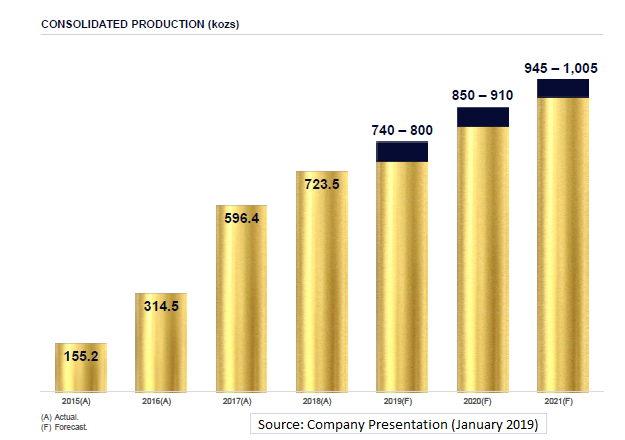

Just to put things into perspective, Kirkland Lake Gold reported production of 314.5Kozs in 2016, 596.4Kozs in 2017 and 723.5Kozs in 2018. Clearly, the company's production growth trajectory has been robust and this has translated into stock upside.

Before talking about the outlook, I must mention here that Kirkland Lake Gold had guided on 2018 production of 670Kozs and the company outperformed by delivering production of 723.5Kozs. I am mentioning this to underscore a quality track record of the company in terms of delivering on guidance.

Coming to the reason to be bullish beyond 2018, Kirkland Lake Gold expects production of 770Kozs in 2019, 880Kozs in 2020 and 975Kozs in 2021. While I am looking at a time horizon of 12-24 months, the key point is that the company's growth trajectory is likely to sustain and with higher gold prices, Kirkland Lake Gold is well positioned to outperform on the revenue and cash flow front.

In terms of specific assets, I had discussed Fosterville asset in my earlier coverage and that remains the game changing asset for the company even for the next few years. To put things into perspective, production from Fosterville has grown from 151.2Kozs in 2016 to 356.2Kozs in 2018. The following points about Fosterville are worth noting -

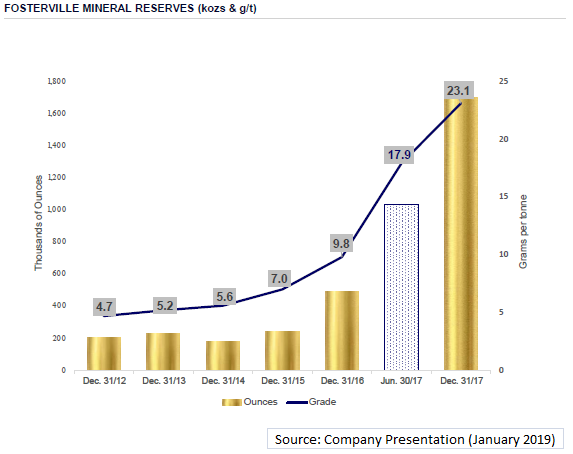

Fosterville asset has witnessed sustained increase in mineral reserves and grade. This is indicated in the chart below.

Importantly, the company is still targeting growth in mineral reserves and grade with $55 million in growth capital to be invested in the asset in 2019. From current grade of 23.1 grams per tonne, the company expects grade to increase to 30 gram per tonne in 2020/21.

The point I am making here is that Fosterville has already proved to be a game changer and the asset will continue to add value to the company. In particular, the asset will remain the production growth driver for the next 24-36 months.

The second important point related to Fosterville asset is that the all-in-sustaining-cost for the first nine months of 2018 was $498 an ounce. The company's expects AISC for 2019 to be in the range of 440-480 an ounce. Even if the AISC is around $500 an ounce, the company's cash flow is likely to be robust in the coming years as gold potentially trends higher. As contribution from the Fosterville asset increases, the company's AISC is likely to among the most attractive in the industry.

Related to a low AISC, it is important to note that Kirkland lake Gold reported free cash flow of $163.1 million for the first nine months of 2018. I expect free cash flows to swell in the coming years and this will have a direct impact on valuations and value creation. I expect sustained increase in dividends and that is likely to translate into stock re-rating.

Fundamentals Support Growth Vision

There is little doubt on the point that the company's key asset for the next few years has potential to deliver in terms of higher production and a competitive AISC. Even if mineral resources sustain at current levels, production growth is likely to remain robust.

An important part of growth analysis is the company's financial flexibility and this section will discuss the reasons why Kirkland Lake Gold is well positioned to pursue aggressive growth investments in the next 12-24 months.

The first point to note is that as of December 2018, Kirkland Lake Gold had cash & equivalents of $332 million. The company expects 2019 sustaining, growth and exploration capital expenditure to be $430 million. Therefore, Kirkland Lake Gold is almost 80% funded for 2019.

In addition, Kirkland Lake Gold reported free cash flow of $163 million for the first nine months of 2018. This translates into an annualized free cash flow of $220 million. With 2019 free cash flow to be potentially higher, Kirkland Lake Gold is positioned to have ample cash to fund capital investments in 2020.

It is also important to note that as of September 30, 2018, Kirkland Lake Gold had zero debt. This provides the company with ample financial flexibility. Just to put things into perspective, the company reported EBITDA of $343.9 million for 2018. Even if the company has a leverage of 1x, there is funding visibility of $300 to $400 million.

Risk Factors

The key risk for Kirkland Lake Gold relates to gold price downside and volatility. However, I would be concerned only if there is a sharp decline in gold price from current levels and I see that as unlikely in the foreseeable future.

To elaborate, the average realized gold price for first nine months of 2018 was $1,275 an ounce and Kirkland Lake Gold reported $163 million in free cash flow during this period. Therefore, even if gold is in the $1,200 to $1,300 range, I will maintain my bullish view on the stock. Further, as production from Fosterville increases in 2019 and 2020, the overall all-in-sustaining-cost will decline and I expect cash flows to be higher even at the same realized gold price.

I also see low financial risk for the company considering the factors that I discussed above. With zero debt and ample cash, the company is well positioned to accelerate sustaining and growth capital expenditure if gold continues to trend higher.

Conclusion

Based on the factors discussed, I am bullish on Kirkland Lake Gold and I expect the stock to trend higher in the next 12-24 months even after a big rally in the recent past. I rate the stock as a "Strong Buy" for the given time horizon and I believe that the stock is one of the best proxy exposure to the precious metal as it trends higher.

I want to add here that I have focused on the Fosterville asset since it will be a production and cash flow game changer in the given time horizon. However, Kirkland Lake Gold is likely to benefit from incremental production from the Macassa Mine beyond 2022. Production from the Macassa Mine is expected to remain stable at approximately 240-250Kozs until 2021, before the production bump-up above 400Kozs in 2022.

Clearly, Kirkland Lake Gold is an attractive growth stock and will reward medium to long-term investors through capital gains and gradually higher dividend income.

Additional Note: The numbers for 2019 forecast and beyond are derived from the Investor Presentation (January 2019)

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Street Smart Investor and get email alerts