Kirkland Lake Gold: What Now?

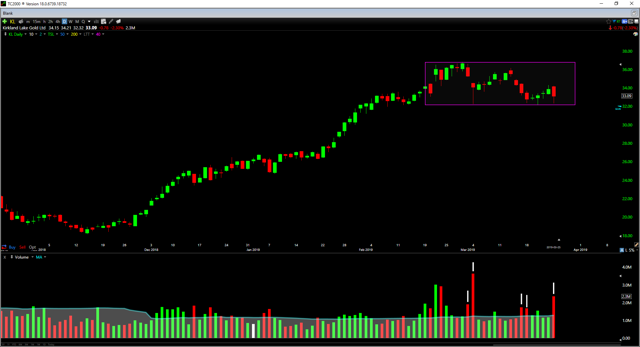

Kirkland Lake Gold continues to see signs mild distribution on its daily chart.

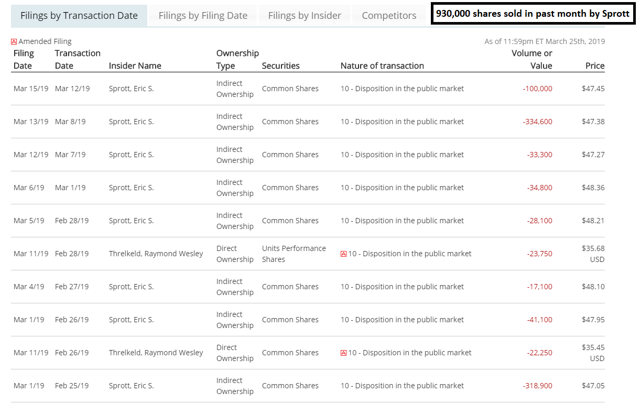

Insider selling has picked up recently, though the amount of shares sold are minor relative to the total position Eric Sprott holds in the stock.

Earnings growth and revenue growth continue to remain strong, but the stock still may need more of a breather before making another move higher.

Kirkland Lake Gold (KL) has long been a favorite of investors fortunate enough to uncover this stock ahead of the herd. I first discussed the stock on this site in June of 2017 in my article "Why I Buy Strength: Featuring Kirkland Lake Gold", and noted that I had gone long the stock at just below $7.00 US. The stock has far exceeded my expectations of what I anticipated its 18-month return might be, and the company's flagship Fosterville Mine continues to fire on all cylinders. Recently, I've got more questions than usual on the stock about why it is not participating in the recent rally in gold (GLD). The easy answer to this is that nothing goes up forever, and what goes up, must either go down or go sideways at some point. I will attempt to address a few of these in this article, as well as give a more current look at the stock's technical picture. At this juncture as a more conservative investor, I don't feel it's time to wade back in the water just yet and buy more shares. The best course of action, in my opinion, was to sell into the earnings rally and hold a smaller core position long-term for longer-term investors.

Just two months ago I noted in a recent article that sentiment on Kirkland Lake Gold was nearing exuberant levels and that it looked like some funds were beginning to sell the stock into strength. While the stock did head another 10% higher into its earnings report, this spike above the $35.00 level was short-lived. Since that time, we've seen some more potential signs of institutional selling with heavier volume on down days than up days over the past few weeks. The stock has now seen five distribution days in 4 weeks following earnings, and this is a definite change in character from the relentless accumulation we saw in 2017 and some of 2018. Distribution days (down days on larger than average volume) do not guarantee a stock has to go lower, but generally, they are a red flag to be careful entering new positions.

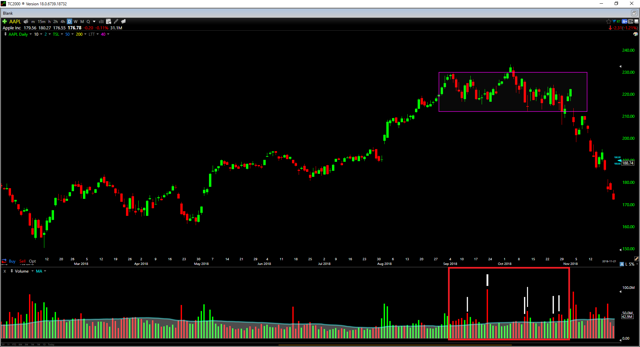

We can see in the above example that Apple (AAPL) exhibited similar characteristics in Q4 2018 ahead of its top, and eventually this led to a base failure on the stock. Kirkland Lake Gold and Apple have very little in common fundamentally, but nothing ever changes in the market, except the market participants. Human nature has not changed over the past few centuries, and the same technical patterns are seen in stocks of all different industries after near parabolic rises. My point in saying this is not that Kirkland Lake Gold is in a bubble, or that it has to drop 40% as Apple did from its highs. My point is just that when a stock has a parabolic rise and sentiment becomes overwhelmingly positive; distribution is not an investor's friend short-term.

Some of this selling has come from Eric Sprott, which is not a surprise as he is up a substantial amount on his position. Over the past three weeks, Sprott has sold over 930,000 shares of stock. While this may seem like an alarming amount at a market value of nearly CAD 40 million, it is worth noting that this only represents about 5% of his total position in the stock which was over 20 million shares in February of this year.

Based on the fact Kirkland Lake Gold's chart is seeing mild distribution, mild insider selling, and is starting to see a character change in price action, I believe there's no reason to initiate new long positions just yet. We can take a look at the change of character in price action below.

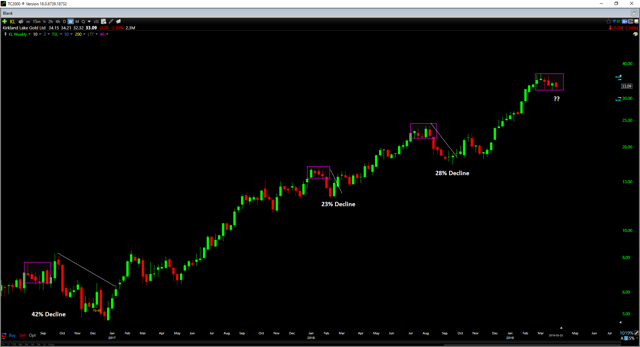

Kirkland Lake Gold has exhibited a pattern over the past few years of running up in a powerful uptrend and then going sideways for four to five weeks which ends up preceding a more significant decline of 20% or more. This is generally characterized by the stock seeing 3 of 4 weeks down in a row, and then a drop through the base typically follows. There is no guarantee that this plays out the same as previous occasions, but this is how the past four instances have played out. As we can see, Kirkland Lake Gold was up 14 of 15 weeks in a row starting in November 2018 and is now down 3 of the past four weeks in a row. This is indeed a change in character from a ratio of 93% of weeks showing a positive gain to only 25% of weeks showing a positive increase over the past month. Once again, this does not guarantee the stock has to decline further from here, but it's clear that a change in price action is present.

Critical support for Kirkland Lake Gold sits at $32.10, and a weekly close below here would be a negative development short-term.

The other red flag is that the stock traded outside its upper channel line during the most recent move up, something it had not done yet since its uptrend began in 2016. This suggests that the stock's recent rise was a parabolic one, and parabolic up-trends often see sharp declines of 20% or more once they finally do top out. The key uptrend line for the stock comes in near the $24.70 level, and as of right now we are still sitting just inside the upper channel line on the stock. This suggests that we are not oversold yet short-term by looking at the bigger picture.

Before I get accused of being a Kirkland Lake Gold bear, let's look at some of the positives and reasons that it's the most impressive gold company in the sector.

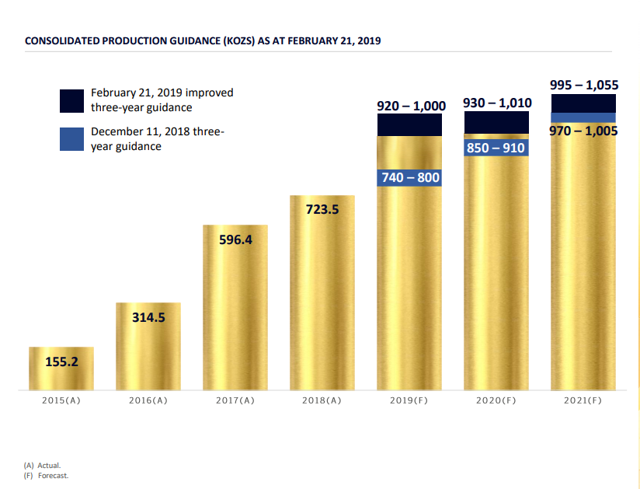

Kirkland Lake Gold's production continues to increase at a rapid pace, with gold production growing from just below 600,000 ounces in FY-2017 to over 720,000 ounces in FY-2018. At the same time as production increased 21%, all-in sustaining cash costs dropped more than 15% to $685/oz. These are some of the best all-in sustaining cash costs in the sector, especially for a producer of this size.

(Source: Company Presentation)

(Source: Company Presentation)

Moving to forward guidance and what the market is most interested in, FY-2019 is expected to be another transformational year for growth. The company plans to produce 960,000 ounces for FY-2019 at the midpoint of its current stated guidance. If they're able to come in at the guidance midpoint of 960,000 ounces, this will represent another year of acceleration in production with over 30% growth.

(Source: Company Presentation)

(Source: Company Presentation)

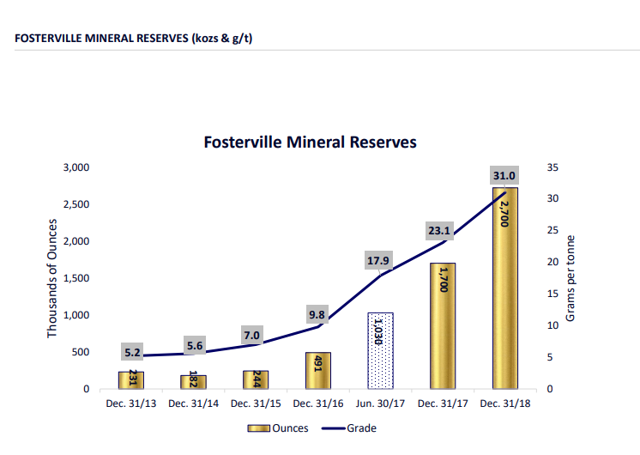

Finally, grades are also increasing at an incredible pace at the company's flagship Fosterville Mine. Fosterville mineral reserves are up to over 2.5 million ounces at a grade of 31.0 grams per ton gold as of last year. This type of growth in both grade and reserves is exceptional as typically the norm is that an increase in reserves comes with a slight drop off in grades.

(Source: Company Presentation)

(Source: Company Presentation)

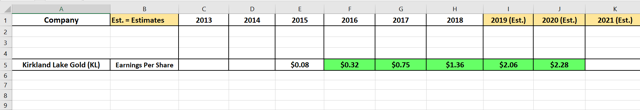

Taking a look at Kirkland Lake Gold's annual earnings per share, the company has clearly broken the mold for what gold investors are used to. Kirkland Lake Gold has managed to grow earnings every single year, and is expecting to see 50% earnings growth for FY-2019 based on analysts' estimates of $2.06 in EPS. This is exceptional growth, especially after coming off a year of 80% growth in EPS from $0.75 to $1.36.

(Source: YCharts.com, Author's Table)

(Source: YCharts.com, Author's Table)

We can see in Kirkland Lake Gold's chart of annual EPS I've built below, earnings are at an all-time high and remain in a stable and powerful uptrend. This is extremely rare for the sector, as most gold companies still have their earnings in downtrends.

(Source: YCharts.com, Author's Table)

(Source: YCharts.com, Author's Table)

Based on Kirkland Lake Gold's robust fundamentals, it is likely that new highs are ahead for the stock in the long-term picture. Earnings growth is one of the best determinants of share price growth and the earnings trend is still alive and well. The issue I see short-term and why I don't believe there's any need to rush to start new positions here is that the technical picture is showing a few red flags which I've outlined above.

I'm sure there will be lots of critics that will say there's no way that Kirkland Lake Gold will trade below $30.00 and that it's silly to wait to buy, but this is exactly why I'm exercising patient to buy. We heard the same thing from the Apple bulls when it was over $220.00 per share, and that there's no way that Warren would let it go below $200.00. When the consensus is that a stock is going to double and that this is the last chance to buy, the majority is usually wrong. Recently, we had many commenters suggesting the stock was worth $70.00 - $100.00 per share, and this type of talk is what you see at short-term tops. Is $70.00 per share possible long-term on a 3-5 year horizon? Sure, anything is possible if the company continues to make more discoveries. But when investors start talking about price targets 200% above current levels, it's not a time I'm inclined to buy 10% dips in the stock. Usually, a deeper correction will ensue when this level of exuberance materializes.

In summary, I see no reason to rush in and buy shares of Kirkland Lake Gold here. The fundamentals remain robust, but the technicals suggest caution for the time being. A cocktail of distribution, a parabolic uptrend, a character change in price action and overwhelming bullishness can be a nasty one short-term for traders and investors. This does not mean Kirkland Lake Gold has to decline further, it does not mean we are going to crash, but I feel that the best course of action here is patience before buying back in. As always, I am not perfect, and I could be wrong, but I trade based on experience and how things have played out in the past in the majority of cases. From my own experience in these situations, rushing back in to buy is often a mistake. For the time being, I see the stock as a hold if long from much lower, but do not see any need to commit new money at these levels.

If you liked this article, please consider following me for future updates!

Disclosure: I am/we are long GLD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Taylor Dart and get email alerts