Kiss of Life for Gold / Commodities / Gold and Silver 2021

The narrow trading range in stocks continues, and theshallow sideways correction will eventually resolve itself with another upleg.The signs are countless, and the riskier part of the credit market spectrumagrees. As money flows from the Tresury markets, and sizable cash balances aresitting on many a balance sheet, there is plenty of fuel to power the S&P500 advance.

With volatility in the tame low 20s and the put/callratio again moving down, the bears‘ prospects are bleak. As I wrote last week,their time is running out, and a new stock market upleg approaches. It‘s thebond market that‘s under pressure, with both investment grade corporate bondsand long-dated Treasuries suffering in the accelerated decline.

Gold is the most affected, as the sensitivity of itsreaction to the rising long-tern yields, has picked up very noticeably. Howlong before these draw both the Fed‘s attention and action – what will we learn from Powell‘s testimony on Tue and Wed? And when will themuch awaited stimulus finally arrive, and force repricing beyond the metalsmarkets?

Before that, gold remains on razor‘s edge, while silverleads and platinum flies for all the green hydrogen promise. The dollar hasgiven back on Thu and Fri what it gained two days before, and remains in itsbear market. Not even rising yields were able to generate much demand for theworld reserve currency. Its lower prices stand to help gold thanks to thehistorically prevailing negative correlation, counterbalancing the Treasuryyields pressure.

Plenty of action that‘s bound to decide the coming weeks‘shape in the precious metals. And not only there as oil experienced 2 days oflossess in a row – practically unheard of in 2021 so far. On Saturday, I‘veadded a new section to my site, Latest Highlight, for easierorientation in the milestone calls and timeless pieces beyond the S&P 500and gold. Enjoy!

Let‘s get right into the charts (all courtesy of www.stockcharts.com).

S&P 500 Outlook

The weekly indicators suggest that a reversal is stillnot likely. There is no conviction behind the weekly decline, and signs arestill pointing to a sideways consolidation underway.

The daily chart reflects the relatively uneventfultrading – we‘re in a phase of bullish base building before powering off to newhighs. See how little the daily indicators have retreated from their extendedreadings, and the barely noticeable price decline associated.

S&P 500 Internals

All the three market breadth indicators show improvedreadings, and my eyes are on new highs new lows throwing theirweight behind the prior two indicators‘ advance. The overall impression is oneof balance.

The value to growth (VTV:QQQ) ratio shows that tech (XLKETF) has fallen a bit out out of step recently – we‘re undergoing anothermicrorotation into value stocks. The stock market leadership is thusbroadening, confirming the findings from the advance-decline line (andadvance-decline volume) examination.

Credit Markets

One chart to illustrate the bond market pressures – highyield corporate bonds are holding gained ground while investment gradecorporate bonds and long-dated Treasuries are plunging like there is notomorrow. With each of their rebound attempt sold, the dislocations areincreasing – a great testament to the euphoric stage of the stock marketadvance.

Gold and Treasuries

Gold price action isn‘t as bearish as it might seem basedon last week‘s moves. Yes, the readiness to decline in sympathy with risingyields, is diconcerting, but the yellow metal stopped practically at the lateNov lows, and refused to decline further. Low prices attracted buying interest,and due to the overwhelmingly negative sentiment for the week ahead, the yellowmetal may surprise on the upside. Time for the bulls to prove themselves as thetone of coming weeks‘ trading in gold is in the balance.

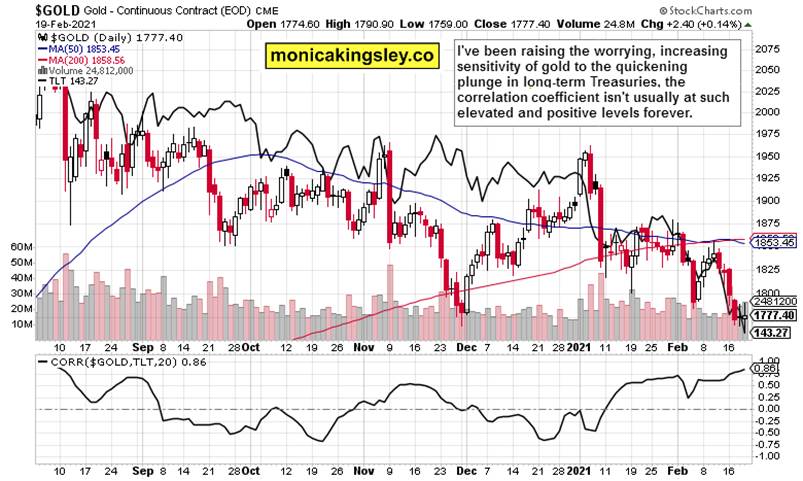

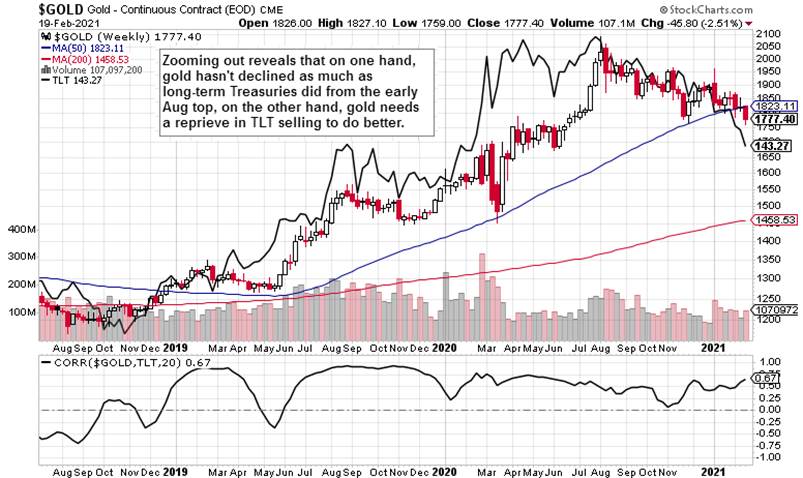

The daily chart‘s correlation coefficient has movedinto strongly positive territory in 2021, illustrating the headwinds goldfaces. Despite the prevailing wisdom, such strongly positive correlation isn‘tthe rule over extended periods of time. That‘s the message of the daily chart –but let‘s step back and see the bigger picture similarly tothe way I did on Friday witht the $HUI:$GOLD ratio.

Not an encouraging sight at the moment. The tightness ofmutual relationship is there, and given the decreased focus on timing (onecandle representing one week) coupled with the correlation coefficient beingcalculated again over a 20 period sample, the week just over shows thatregardless of the post-Nov resilience, gold is clearly getting under morepressure.

Gold and Dollar

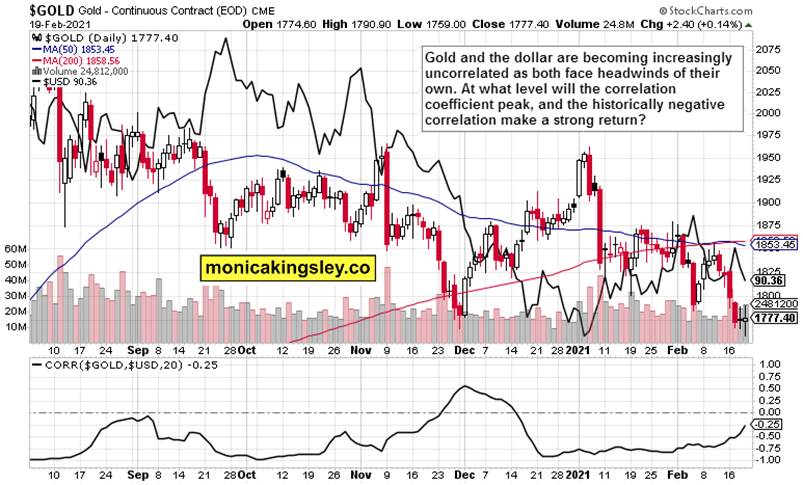

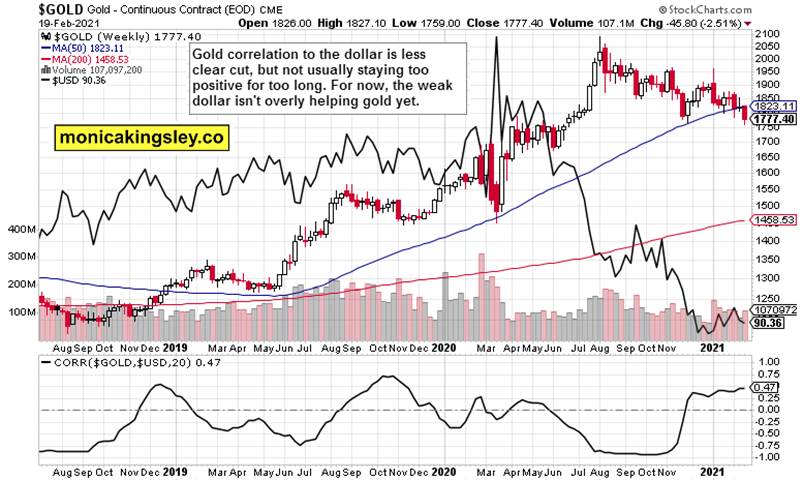

Let‘s do the same what I did about long-term Treasuriesand gold, also about the dollar and gold. Their historically negativecorrelation is receding at the moment as the two face their own challenges. Thekey question is when and from what level would the fiat currency and itsnemesis return to trading in the opposite directions. Such a time is highlylikely to be conducive to higher gold prices.

On the weekly chart, the negative correlation periods arewinning out in length and frequency. Certainly given the less sensitivetimining component through weekly candlesticks and 20-period calculation, thecurrent strength and level of positive correlation is rather an exception andnot a rule. Combining this chart‘s positive correlation between the two withthe daily chart‘s negative yet rising readings, highlights in my view apotential for seeing an upset in the momentary relationship.

In other words, the gold decline over the past now almost7 months going hand in hand with mostly sliding dollar, would turn into highergold prices accompanied by lower dollar values. How much higher gold prices,that depends on the long-term Treasuries market – that‘s the one playing thedecisive role, not the dollar at the moment.

Gold, Silver and Miners

Silver is doing fine, platinum very well, while goldstruggles and needs to prove itself. That‘s the essence of the long silver short gold trade idea –the silver to gold ratio attests to that.

Quoting from Friday‘s analysis:

(…) The dynamics favoring silver are unquestionable –starting from varied and growing industrial applications, strengtheningmanufacturing and economy recovery, poor outlook in silver above groundstockpile and recycling, to the white metal being also a monetary metal. Silveris bound to score better gains than gold, marred by the Bitcoin allure, would.

Final chart of today‘s extensive analysis is about thetwo miners to gold ratios, and the divergencies they show. The ETF-based one(GDX:GLD) is sitting at support marked by both the late Nov and late Jan lows,while $HUI:$GOLD is probing to break below its late Jan lows, and these werealready lower than the respective late Nov lows.

Both ratios are sending a mixed picture, in line with thetheme of my latest reports – gold is on razor‘s edge, and the technical pictureis mixed given its latest weakness. That‘s the short run – I expect that oncethe Fed‘s hand is twisted enough in TLT and TLH, and speculation on yield curve control initiationrises, the focus in the precious metals would shift to inflation and its dynamics I‘vedescribed both on Wed and Fri.

Summary

The sellers in stocks aren‘t getting far these days, andsignals remain aligned behind the S&P 500 advance to reassert itself.Neither the Russell 2000, nor emerging markets are flashing divergencies, andthe path of least resistance in stocks remains higher.

Gold‘s short-term conundrum continues - positivefundamentals that are going to turn even more so in the near future, yet thekey charts show the king of metals under pressure, with long-term Treasuryyields arguably holding the key to gold‘s short-term future. The decouplingevents seen earlier this month, got a harsh reality check in the week justover. Yet, that‘s not a knock-out blow – the medium- and long-term outlookremains bright, and too many market players have rushed to the short side inthe short run too.

Thank you for having read today‘s free analysis, which isavailable in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, whichfeatures real-time trade calls and intraday updates for both Stock TradingSignals and Gold Trading Signals.

Thank you,

MonicaKingsley

Stock Trading Signals

Gold Trading Signals

www.monicakingsley.co

mk@monicakingsley.co

* * * * *

All essays, research andinformation represent analyses and opinions of Monica Kingsley that are basedon available and latest data. Despite careful research and best efforts, it mayprove wrong and be subject to change with or without notice. Monica Kingsleydoes not guarantee the accuracy or thoroughness of the data or informationreported. Her content serves educational purposes and should not be relied uponas advice or construed as providing recommendations of any kind. Futures,stocks and options are financial instruments not suitable for every investor.Please be advised that you invest at your own risk. Monica Kingsley is not aRegistered Securities Advisor. By reading her writings, you agree that she willnot be held responsible or liable for any decisions you make. Investing,trading and speculating in financial markets may involve high risk of loss.Monica Kingsley may have a short or long position in any securities, includingthose mentioned in her writings, and may make additional purchases and/or salesof those securities without notice.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.