Laggards No Longer, Gold Stocks Are Now Leaders

Gold miners are in a relative strength positions versus the S&P 500.

This rare occurrence reflects intermediate-term investment demand.

Gold stock internal momentum suggests higher prices are ahead.

After months of lagging the gold price, as well as the S&P 500 Index (SPX), gold mining stocks have come into their own this summer. The gold miners are now among the market's top-performing groups, as witnessed by the impressive performance of the PHLX Gold/Silver Index (XAU). In today's report we'll discuss some reasons why gold stocks are poised to remain in the bulls' hands in the coming months and continue outperforming most major sectors. We'll also discuss the improved prospects for higher gold prices later this summer in the wake of the latest XAU rally.

Despite remaining near a yearly high, the market for physical gold isn't without its headwinds. Investors across the financial market spectrum have been faced with a potentially dire reality in recent days. The realization that a Fed rate cut may not be forthcoming later this month is an increasing worry, thanks to a string of impressive U.S. economic numbers. The rationale behind this worry is that if the Fed doesn't cut interest rates, non-yielding gold will stand to lose out due to the competition from bonds.

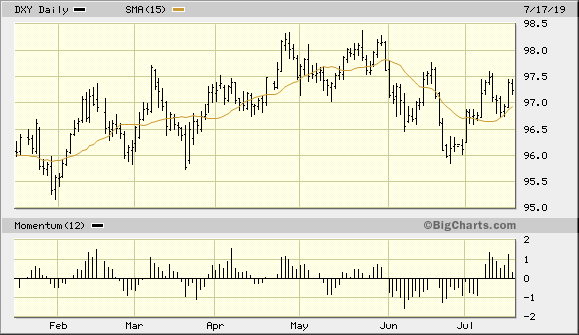

There is also the very real threat of a stronger dollar. Since the metal is priced in dollars, a stronger U.S. currency would serve as a potential obstacle to a sustained gold rally. Shown here is the latest U.S. Dollar Index (DXY), which has been firming up lately and threatening a move higher. A breakout to a new high in the greenback would likely keep gold stuck in its lateral holding pattern while the market continues to build enough strength for its next sustained move higher.

Source: BigCharts

Yet gold's upward trend is driven by more than just currency considerations. Gold's "fear factor" is the primary motive force behind its strength this summer, as I've argued in past reports. And there are plenty of worries to keep gold prices buoyant in the coming months in spite of a strong dollar.

Among the latest worries are continues fears over the U.S.-China trade war, as well as lingering concerns over the economic health of the European Union in the form of the recent U.S.-EU tariff threat. Military and economic tensions between the U.S. and Iran this summer also have investors worried. Clearly then, there is no shortage of things for investors to worry about and this bodes well for the gold "fear trade."

Fears pertaining to the future of U.S. equity market are another reason why gold has been in high demand. Many retail and institutional investors alike remains convinced that a major stock market decline is imminent, and many participants are waiting for the other "shoe" to drop after December's market plunge. The widespread concern over a possible stock market correction has arguably been one of the biggest supports for gold's "fear factor" in recent weeks. I would argue that the persistent dread of another plunge in the SPX which has largely served to increase gold's safe-haven demand and keep the metal's price pushing slowly toward multi-year highs.

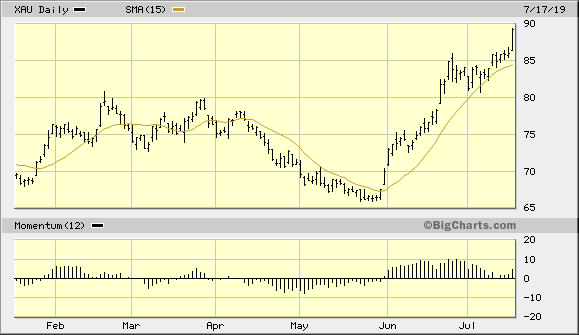

Along with boosting the gold price outlook, fear is also one of the big drivers behind the recent surge in the gold mining stocks. With the PHLX Gold/Silver Index having hit a new yearly high on July 17, it's clear that investors are buying gold stocks to leverage the fear trade in physical gold. The XAU, which is the benchmark for U.S.-listed precious metal mining stocks, has gained nearly 30% since the end of May. That's the best short-term performance for the mining shares in many years. I would argue that this strong performance also reflects the high demand that exists among individuals for gold stocks as portfolio anchors, rather than for purely short-term trading purposes.

Source: BigCharts

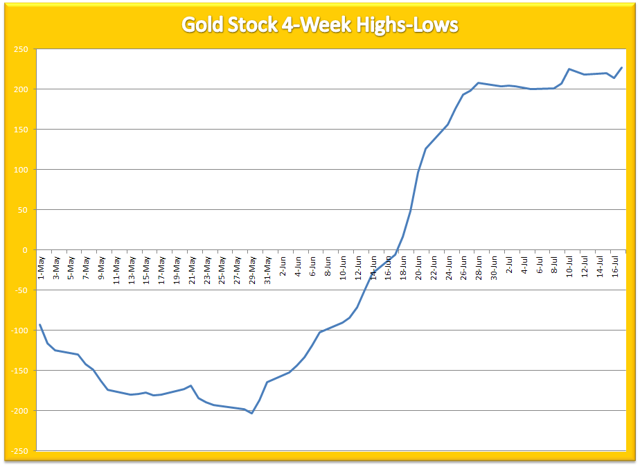

This bullish performance for the gold stocks isn't likely to end anytime soon, either. The internal momentum structure of the 50 most actively traded mining stocks continues to support rising prices. Shown below is the 4-week rate of change (momentum) for the new highs and lows of the actively traded gold stocks. As I've argued in recent reports, as long as this indicator is rising the near-term path of least resistance for gold stocks remains up. And with investors still very much worried about the global economic outlook, the demand for both gold and the companies that mine it will continue.

Source: NYSE

It should also be noted that gold stocks are not only outperforming the physical metal right now, but also the benchmark S&P 500. This is shown in the following ratio comparison of the XAU and the SPX. It's quite remarkable to consider that the XAU is in a relative strength position versus the SPX and has been for some weeks now. This doesn't often happen on a sustained basis, but when it does you can rest assured it speaks to the profundity of gold's "fear factor." Relative strength in the gold stocks also argues in favor of holding gold from the standpoint of an intermediate-term (3-6 month) investment time frame. Source: StockCharts

Source: StockCharts

With fears over the global economic and geopolitical outlook still very much alive, investors can expect gold's "fear trade" to remain intact this summer. Even if investors' worst fears fail to come to pass, memories of last year's scary stock market decline are still fresh and will keep the flight-to-safety impulse toward gold for months to come. Gold mining stocks should also continue to see increased demand based on these lingering fears. In view of the factors discussed here, investors are justified in maintaining longer-term investment positions in gold and gold ETFs.

On a strategic note, I'm currently long gold via the VanEck Vectors Gold Miners ETF (GDX). For this ETF I'm using the $24.50 level as a stop-loss on an intraday basis. Participants who haven't done so should also book some profit in GDX after its impressive run of the last few weeks.

Disclosure: I am/we are long GDX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts