Large Drop in Stocks, Big Rally in Gold and Silver / Commodities / Gold & Silver 2019

Theweek ahead, looks treacherous for the stock market, but should be a boon forgold, silver and share mining stocks. The cycles, waves and astro aspects arecoming together nicely for a possible quick 6% drop on the S&P 500.

Theweek ahead, looks treacherous for the stock market, but should be a boon forgold, silver and share mining stocks. The cycles, waves and astro aspects arecoming together nicely for a possible quick 6% drop on the S&P 500.

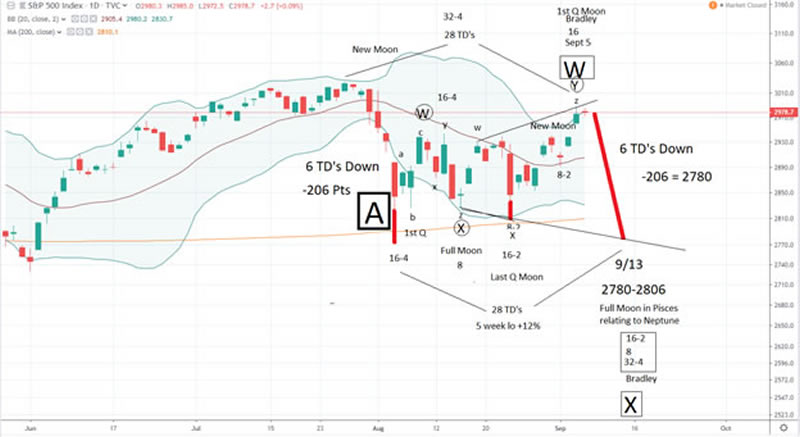

TheSPX chart below shows the 16 TD top on Sept 5, along with a first quarter moonand Bradley turn. We are going into the 5/35 week cycle low in a 4 year cyclelow from late 2015 due Monday-Friday (9/9-13). These usually go lower than the previous 10 week low that occurred onAug 5. I don’t believe we go much below 2780 as an extreme target, perhaps asmuch as 42 points below the August 5 low of 2822.

Theastro biggie of the week, has the Sun square Jupiter while forming a negativeaspect along with Mars to the Jupiter/Neptune Square all week. It looks to getcrazier as the week wears on. We also have Sun trine Saturn, Venus trine Pluto,Mercury opposite Neptune and Mars trine Saturn this weekend. These signatures along with the previousaspects I mentioned look exhaustive and ready to drop the stock market.

Sun/Marsconjunctions (Sept 2) warn us of an impending 8-20% drop just ahead (I believethe big one will be Oct 15-Nov 4). The current pattern can support a 6% dropand still be within the bear flag pattern. These patterns often times form a downward sloping bear flag.

Thecycles are running a 32-4 TD top to top and bottom to bottom. 28 TD’s work within the framework shown onthe chart below. It is basically a 5-6week cycle.

Chartsof GDX and silver explain why I believe a blow off top will likely happen thisweek. Gold is in an upwardly skewed,counter trend rally. The precious metals complex is telling us by GDX and silverthat this rally is doomed, for now….

Goldcould drop 20% plus and the other trading vehicles like silver and the minerseven more. The cycle bottom is due inFebruary. I believe we see a huge rallynext year from a bear market bottom.

Goldis in a strange running correction of sorts, but is due to fall backnonetheless!

BradGudgeon

Editorof The BluStar Market Timer

The BluStar Market Timer was rated #1in the world by Timer Trac in 2014, competing with over 1600 market timers.This occurred despite what the author considered a very difficult year for him.Brad Gudgeon, editor and author of the BluStar Market Timer, is a marketveteran of over 30 years. The website is www.blustarmarkettimer.info To view the details more clearly, you may visit our freechart look atwww.blustarmarkettimer.com

Copyright 2019, BluStar Market Timer. All rights reserved.

Disclaimer: The aboveinformation is not intended as investment advice. Market timers can and do make mistakes. The above analysis is believed to bereliable, but we cannot be responsible for losses should they occur as a resultof using this information. This articleis intended for educational purposes only. Past performance is never aguarantee of future performance.

BradGudgeon Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.