Last Train Out for Gold, Silver and Platinum Bulls? / Commodities / Gold & Silver 2019

The people who are prepared are going to reap rewards such asthey have never dreamed. We're going to have the biggest transfer of wealth inhistory – from the fools – to those who are prepared. – Bob Moriarty

The people who are prepared are going to reap rewards such asthey have never dreamed. We're going to have the biggest transfer of wealth inhistory – from the fools – to those who are prepared. – Bob Moriarty

The run upof the last few months to $1,565 gold and $19silver has stalled out into a relatively high-level correction, giving backless than might be expected after such a spirited rise.

Many people are focusing on the downside, without askingthemselves, "What's the relative reward?"

Even if you only believe the upside case to be around $2,000,that's still a potential 5x:1 reward compared to perceived risk.

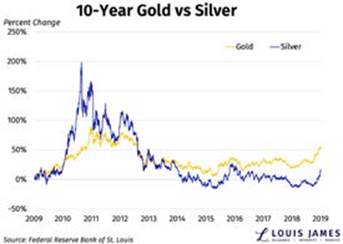

Whatever gold's potential gain, silver's will almost certainlybe considerably greater, as has historically been the case.

In the 1970's bull run, my biggestholding was silver bullion. The stagflation theme made it the go-to asset. Ishistory about to repeat? I think so.

Note the excellent overallperformance of silver against gold during the 1970s. Singapore dealers aresuddenly reporting that investors are buying more silver than gold. My simpleadvice to investors in the West is: Join them and buy silver bullion now!– Stewart Thomson, Graceland Updates

Silver's bullish (and highly unusual) upwardstair-stepping behavior.

Keepit Simple and Straightforward…

On the above chart above we can see that silver tends tobe quite volatile on the upside – and as recent trading sessions havedemonstrated – on the downside too!

This is why you should be leery of adding leverage or margin.Just stick with tubes of physical trade rounds, and/or bars fromreputable dealers.

Could I be wrong? Of course. Risk and reward go hand in hand.Remember, without risk, there would be no profit potential either. (Thoughnegative interest bonds are attempting to disprove this thesis!)

"Platinumdeclining into support."

Check your premise. How big is your picture? How much and forhow long are you willing to wait? Does any other current investment theme offersuch asymmetric potential?

Though platinum is a smaller market, it holds acertain allure. Largely an industrial metal, the questionable supply profile,coming mostly from South Africa, Zimbabwe and Russia, makes it an interestingspeculation.

Until a few years ago, this metal (known as "littlesilver" by early Spanish Conquistadors who tossed it back into a stream to"grow up"), has usually sold for several hundred dollars/ounce morethan gold.

Now at almost six hundred dollars less, the profit potential inplatinum could be substantial, if it can regain its normal relationship.

Throwing the Bones. In ancient cultures, animal boneswere heated and tossed onto a mat, looking for "patterns" to predictthe future. Today, Elliott microWavers, Japanese Candlestickers and otherprecious metals' "bone throwers" seek to divine data from charts andgraphs.

In fact, we use some of those tools ourselves. But occasionally,a massively profitable opportunity arises when a sector has reached a certain"tenor" that a bone toss can't tease out.

Where the best efforts at interpreting the questions Mr. Marketposes cannot be answered until later. Where maybe this time it is different.Where those who don't hold anything at all – regardless of the current price –run the risk of being left completely behind.

It's not easy to "buy the correction." Youcan either take a position and accept information risk or wait until later anddeal with price risk. Stu Thomson nails it when he says,

Weare all cowards on price weakness. Those who admit it, who bet against it makemoney. Those who hide it and lie about it, lose money. End of story.

Don't forget that during a correction, most news is negative.You'll be dealing with the crowd's uncertainty.

You'll start doubting yourself, waiting for even lower prices,and more than likely fail to carry out the most critical step – acting on whatyou've already decided.

Maybe you didn't buy gold at $1,100, or $1,250 or $1,350.Perhaps you kept waiting for the arrival of a well-known analyst's call of$700. (Whose tune has now changed to predicting $1,800!). What to do now?

At certain times in history owning money is the best available"investment" idea, because all other investment classes have becomeso corrupted and distorted that having money is the only sensible choice. Weare at such a point today, which means people who are the best informed, chooseto place a portion of their wealth into the precious metals. DavidMorgan

Confusing linear with exponential. Markets spendmost of the time trading in a linear, predictable manner – usually incongestion; occasionally in an up or down trend run.

Over 90 percent of the time, Bollinger Bands contain pricemovement within two standard deviations above or below the mid line. But oncein awhile an outlier – stronger and more durable than the markets expect – iscapable of driving the price exponentially in one direction.

This is where really big money can be made... or missed. If youwait for it to become obvious, these exceptional gains can reduce a speculatorto the status of... a spectator.

The Gold story, while showing more of the same, is also shiftingemphasis. It is making all-time highs in most of the world's majorcurrencies. Central banks bought a record 651 tonnes in 2018 – a 75% increasefrom the previous year, and the highest level of net purchases since 1971 whenPresident Nixon closed the gold window.

Additions by China, Russia, India and Turkey remain robust. Butin recent months, a larger percentage of the world's gold refining, whichroutes through Switzerland on its way to Asia, is being siphoned off to theU.K. Germany, and France.

This shift is a strong indicator that the crucial "missinglink" – a metaphorical spark which can ignite the supply-demand powderkeg, destroying the market's delicate balance – may soon be lit.

Add the fear of missing out by North Americans as it becomesobvious that the last train is leaving the station, and in short order a demandcontagion could spread across the entire precious metals' space.

It would be wise rather soon to decide if you want toparticipate...or just watch and wish you had.

David Smith isSenior Analyst for TheMorganReport.com and a regular contributor to MoneyMetals.com aswell as the LODE Cryptographic Silver Monetary System Project. He hasinvestigated precious metals’ mines and exploration sites in Argentina, Chile,Peru, Mexico, Bolivia, China, Canada and the U.S. He shares resource sectorobservations withr eaders, the media and North American investment conferenceattendees.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.