Latin America's mining industry remains optimistic - report

Codelco's Chuquicamata copper mine, Chile. (Image courtesy of Codelco)

While miners, analysts and media worldwide remain focus on the difficulties the sector is facing and the uncertain outlook for a turnaround in the near term, those in Latin America has managed to remain optimistic, a new report shows.

According to a study by international law firm Dentons, in association with the Mining and Investment in Latin America 2015 conference, most companies based or with operations in the area continue to explore, develop and operate projects in the face of these difficulties.

The survey, carried out among mining companies and financiers active in Mexico, Central and South America, indicates that 66% of those interviewed are either somewhat or very optimistic that there will be increased investment in the mining sector over the next 12 months.

Most of the participants believe that while private equity would be the main source of investment in the mining sector, consolidation will also play a key role. In fact, more than half of the actors surveyed expect more mergers and acquisitions and slightly fewer pointed to an increase in strategic investments.

"While extra fortitude and creativity is required in the current environment, there appears to be an underlying belief in the mining industry that market conditions will turn, even if no one knows when," said Alan Hutchison, partner in Dentons' mining group.

Courtesy of: EY's Peru's mining & metals investment guide 2015/2016. (Click to expand)

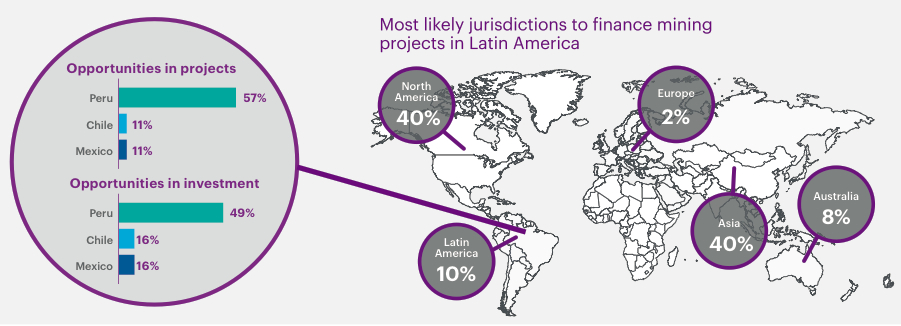

In terms of where the money will come from, the interviewees believe North America and Asia will be the most likely jurisdictions to finance Latin American mining projects.

The study reveals that Peru continues to be considered a hot spot, as roughly half of respondents think it offers the most investment opportunities, while slightly more than half think the South American nation has the most project opportunities.

However, when asked which country they though would attract the most mining investment over the next 12-18 months, nearly a third of respondents pointed at Chile. This, despite only a few thought the copper-rich country offered the most investment or project opportunities in mining.

"That may be a product of Chile's longstanding position as one of, if not the most, highly regarded jurisdictions within Latin America for mining investment," the study notes.

In terms of what are the main challenges they see for the sector at the moment, it was no surprise to see that respondents chose metal prices over all others. It was, however, a bit unexpected to see that corporate social responsibility (CSR) issues did not rank higher, especially given the emphasis on Peru, where billions of dollars worth of projects have been stalled by CSR issues recently.

As miners everywhere, Denton's survey respondents are watching closely any information related to changes in the current economic climate, as they believe that is what will have the biggest influence on the mining industry over the next 12 months.

Source: November 2015 survey by Dentons and the Mining and Investment in Latin America 2015 conference.