Leagold Mining (TSX: LMC, OTCQX: LMCNF): Mid-Tier Latin America Gold Producer, Four Gold Mines and Two Development Projects in Mexico and Brazil; Interview with Meghan Brown, Vice President of Investor Relations

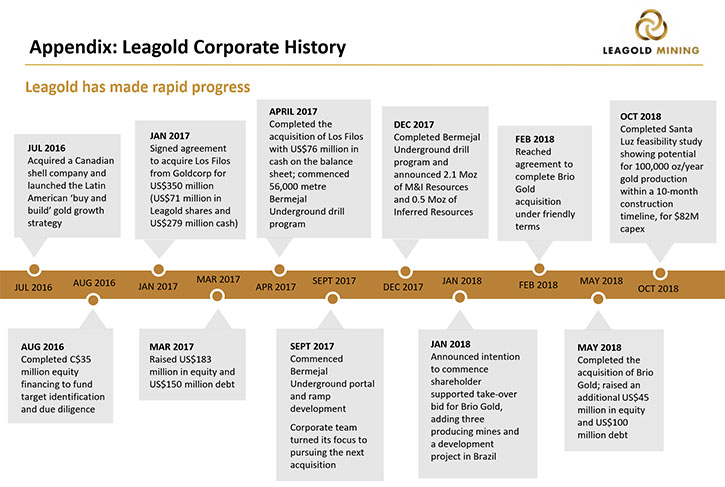

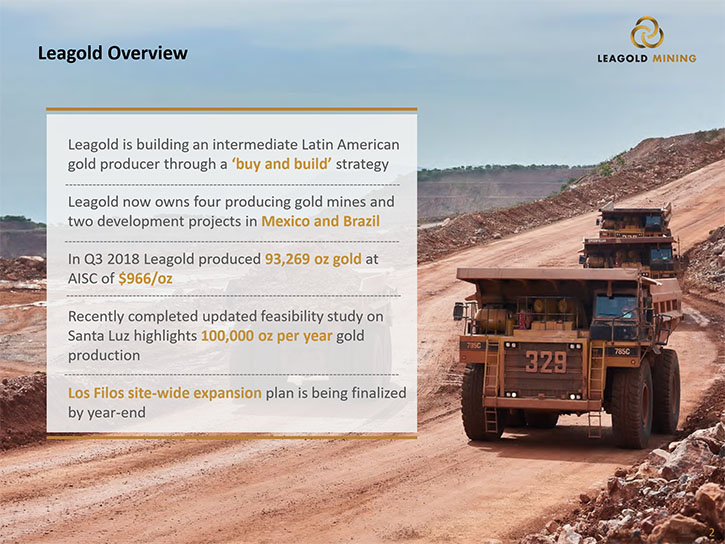

Leagold Mining (TSX: LMC, OTCQX: LMCNF) is a mid-tier gold producer, with a focus on Latin America. Leagold owns four gold mines and two development projects in Mexico and Brazil. We learned from Meghan Brown, Vice President of Investor Relations at Leagold Mining, that their four mines, in total, produced 93,000 ounces of gold in the third quarter for revenue of $111 million and net income of $15 million, which is five cents per share. The company is very well established, with a solid growth trajectory, in a very short period of time, of just a little bit over two years, and with the pipeline of development assets, within its portfolio.  Leagold Mining, Los Filos Gold MineDr. Allen Alper:This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Meghan Brown, Vice President of Investor Relations, Leagold Mining. Meghan, could you give our readers/investors an overview of your company?Meghan Brown:Thanks, Dr. Alper. Leagold was formed a little over two years ago by the former Chairman and former CEO of Endeavor Mining. As you probably know, Endeavor Mining is a Company that built up a portfolio of assets in West Africa. On formation of this company in 2016, Frank and Neil decided to replicate the Endeavor Mining model basically, but this time to do it in South America.They reassembled a few key members of Endeavor Mining's original team. That team, actually, had more extensive experience in Latin America than they ever did in West Africa. This jurisdiction really was a good fit and made sense. They bought a shell in the summer of 2016, and raised $35 million to get things started. In the fall of 2016, Leagold entered into the auction process to acquire Los Filos, which is about a 200,000 ounce per year gold mine in the Guerrero state of Mexico.Los Filos had been put up for sale by Goldcorp. They had declared it to be a non-core asset for a number of reasons. We, Leagold, were the successful bidder. We closed the transaction in the spring of 2017. The purchase price was $350 million, $280 million of that was cash and the remaining $70 million was in Leagold stock, which immediately established Goldcorp as our single largest shareholder. They took a seat on our Board, and they have retained a seat on our Board of Directors since then.They've been diluted down over the past couple of years, so they're no longer our largest shareholder. They retain their Board seat, and they still have a 12.5% interest in Leagold. They are a very important strategic partner for us. It took about six months after we acquired Los Filos to make some changes to the organization and to the reporting structure. After that was complete and after we established it as a stand-alone business unit of Leagold, at about this time last year, we turned our attention back to growth. The strategy, as I said, from the very beginning was focused on Latin America. That hasn't changed.

Leagold Mining, Los Filos Gold MineDr. Allen Alper:This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Meghan Brown, Vice President of Investor Relations, Leagold Mining. Meghan, could you give our readers/investors an overview of your company?Meghan Brown:Thanks, Dr. Alper. Leagold was formed a little over two years ago by the former Chairman and former CEO of Endeavor Mining. As you probably know, Endeavor Mining is a Company that built up a portfolio of assets in West Africa. On formation of this company in 2016, Frank and Neil decided to replicate the Endeavor Mining model basically, but this time to do it in South America.They reassembled a few key members of Endeavor Mining's original team. That team, actually, had more extensive experience in Latin America than they ever did in West Africa. This jurisdiction really was a good fit and made sense. They bought a shell in the summer of 2016, and raised $35 million to get things started. In the fall of 2016, Leagold entered into the auction process to acquire Los Filos, which is about a 200,000 ounce per year gold mine in the Guerrero state of Mexico.Los Filos had been put up for sale by Goldcorp. They had declared it to be a non-core asset for a number of reasons. We, Leagold, were the successful bidder. We closed the transaction in the spring of 2017. The purchase price was $350 million, $280 million of that was cash and the remaining $70 million was in Leagold stock, which immediately established Goldcorp as our single largest shareholder. They took a seat on our Board, and they have retained a seat on our Board of Directors since then.They've been diluted down over the past couple of years, so they're no longer our largest shareholder. They retain their Board seat, and they still have a 12.5% interest in Leagold. They are a very important strategic partner for us. It took about six months after we acquired Los Filos to make some changes to the organization and to the reporting structure. After that was complete and after we established it as a stand-alone business unit of Leagold, at about this time last year, we turned our attention back to growth. The strategy, as I said, from the very beginning was focused on Latin America. That hasn't changed.  Our objective is to build up a portfolio of assets in Latin America, including Mexico. We're looking for gold projects. We're looking for around 100,000 ounce per year minimum basis. We're looking for projects that are already in construction and production or have a very near timeline to production.When we turned our attention back to growth, at this time last year, we spent a number of months looking at many, many projects across South America. In February, we made an offer to acquire Brio Gold, which was a Canadian company based in Toronto that was a spin-out of Yamana. Brio Gold owns three mines in Brazil, plus a near-term development project that has the potential to become our fourth mine in Brazil.

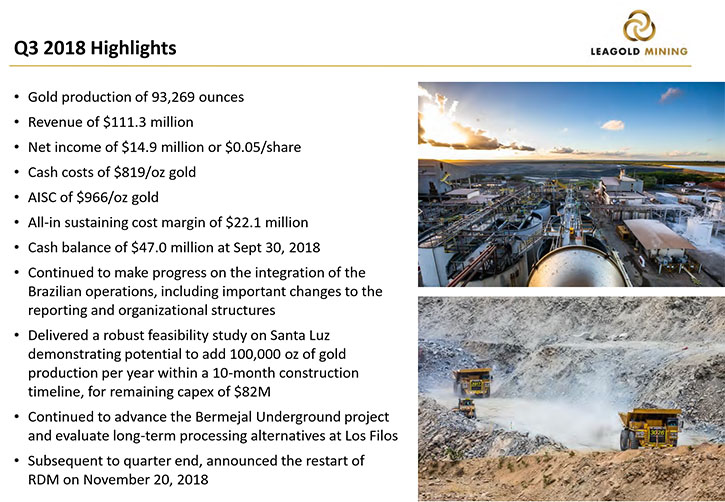

Our objective is to build up a portfolio of assets in Latin America, including Mexico. We're looking for gold projects. We're looking for around 100,000 ounce per year minimum basis. We're looking for projects that are already in construction and production or have a very near timeline to production.When we turned our attention back to growth, at this time last year, we spent a number of months looking at many, many projects across South America. In February, we made an offer to acquire Brio Gold, which was a Canadian company based in Toronto that was a spin-out of Yamana. Brio Gold owns three mines in Brazil, plus a near-term development project that has the potential to become our fourth mine in Brazil.  We closed the acquisition of these three operating mines and development project in May. We've been making some important changes to the reporting and organizational structures in country since that time. Things are starting to come together quite nicely. Just this week, we announced third quarter earnings. Our four mines, in total, produced 93,000 ounces of gold in the quarter, for revenue of $111 million and net income of $15 million, which is five cents per share.The company is very well established, with a solid growth trajectory in a very short period of time, of just a little bit over two years. Our objective is to build a solid mid-year, intermediate gold producer in Latin America. We're well on our way toward doing that. That's an overview of who we are.

We closed the acquisition of these three operating mines and development project in May. We've been making some important changes to the reporting and organizational structures in country since that time. Things are starting to come together quite nicely. Just this week, we announced third quarter earnings. Our four mines, in total, produced 93,000 ounces of gold in the quarter, for revenue of $111 million and net income of $15 million, which is five cents per share.The company is very well established, with a solid growth trajectory in a very short period of time, of just a little bit over two years. Our objective is to build a solid mid-year, intermediate gold producer in Latin America. We're well on our way toward doing that. That's an overview of who we are. Dr. Allen Alper:That's amazing progress that your management team has made in a very, very short time. They really know what they're doing. Their philosophy is to buy and build, is that correct?Meghan Brown:Exactly. You've read the material. Thank you. We called it buy and build. Meaning we want to buy operating assets, with the capacity to be built out. Los Filos, for example, is an operating mine that we bought, on which we saw the potential to build an extension, in terms of adding a second underground mine there. In Brazil, we have three operating mines. We have a fourth project, which has a capacity, once it's fully built, to become our fourth mine in Brazil for a very modest capital expenditure of $82 million. It's a mine that was formerly in production, but was shut down by a previous owner due to metallurgical problems. We have a feasibility study now that demonstrates it could add a 100,000 ounces of gold per year, for up to an 11 year mine life, for a modest capital expenditure of$82 million and a very short construction timeline of just 10 months.This is a project that we already own. It's within our project pipeline. We don't need to go out and buy anything else, in order to get this into production. We just need to make a decision, raise the money, and start the build.Dr. Allen Alper:That's sounds great. That's a great strategy, and your company's been executing it very well. That's excellent. It pays to have experienced, knowledgeable people running the shells. That's excellent.Meghan Brown:Thank you.Dr. Allen Alper:Could you tell me a little bit more about the team and your background?

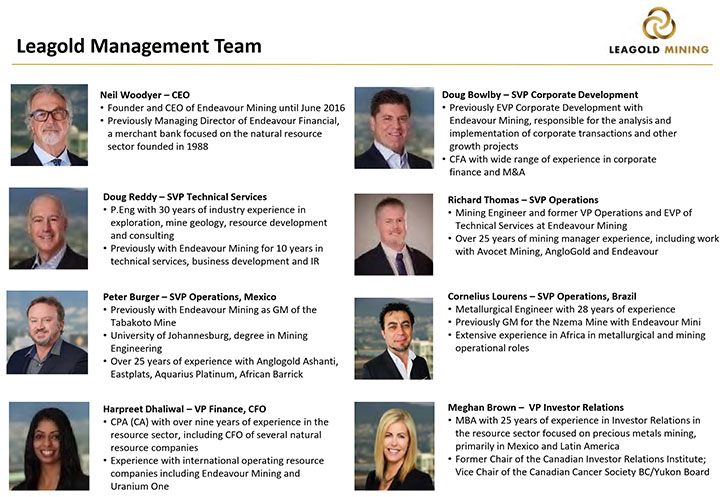

Dr. Allen Alper:That's amazing progress that your management team has made in a very, very short time. They really know what they're doing. Their philosophy is to buy and build, is that correct?Meghan Brown:Exactly. You've read the material. Thank you. We called it buy and build. Meaning we want to buy operating assets, with the capacity to be built out. Los Filos, for example, is an operating mine that we bought, on which we saw the potential to build an extension, in terms of adding a second underground mine there. In Brazil, we have three operating mines. We have a fourth project, which has a capacity, once it's fully built, to become our fourth mine in Brazil for a very modest capital expenditure of $82 million. It's a mine that was formerly in production, but was shut down by a previous owner due to metallurgical problems. We have a feasibility study now that demonstrates it could add a 100,000 ounces of gold per year, for up to an 11 year mine life, for a modest capital expenditure of$82 million and a very short construction timeline of just 10 months.This is a project that we already own. It's within our project pipeline. We don't need to go out and buy anything else, in order to get this into production. We just need to make a decision, raise the money, and start the build.Dr. Allen Alper:That's sounds great. That's a great strategy, and your company's been executing it very well. That's excellent. It pays to have experienced, knowledgeable people running the shells. That's excellent.Meghan Brown:Thank you.Dr. Allen Alper:Could you tell me a little bit more about the team and your background? Meghan Brown:Sure. In our Vancouver office, our corporate office, we have about 12 people. About half of them have been together since the formation of Endeavor Mining. In fact, some of them even pre-date that and were working with Neil at Endeavor Financial. Doug Bowlby, for example, he's our Senior Vice President of Corporate Development, he and Neil have been working together for over two decades. Doug Reddy has been with the group for not quite that long, but a number of years, including Endeavor Mining. The other half of us are new to the group. As I say, it's only a two-year-old company. It's a mix of people, with some pretty impressive experience in the industry. We have some very solid senior leaders on the executive team.My personal background, I've been working in mining for about 20 years. I've worked for large cap, mega cap, mid cap, small cap, micro cap, and everywhere in between. I started my career working for a company in Alberta called Suncor, which is actually an oil and gas company. They run the largest open pit mines in the world, in the oil sands in Northern Alberta. Although it's an oil and gas company, there is a significant mining component to what Suncor does. That's really where I cut my teeth in this industry.

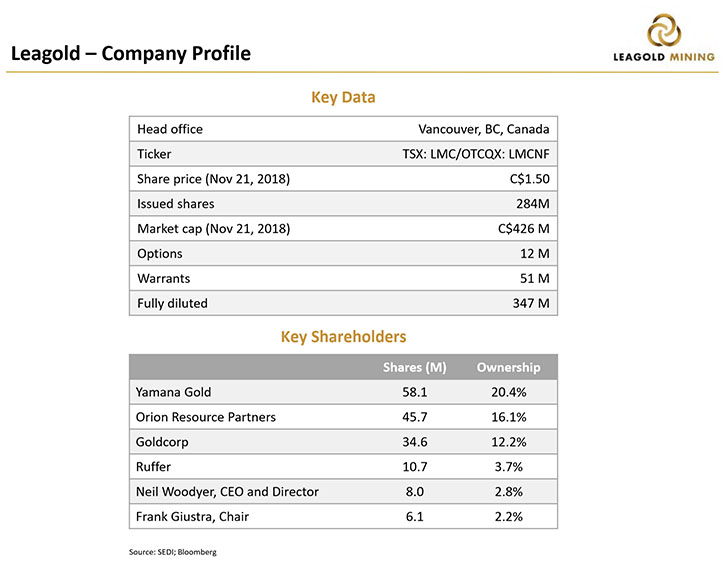

Meghan Brown:Sure. In our Vancouver office, our corporate office, we have about 12 people. About half of them have been together since the formation of Endeavor Mining. In fact, some of them even pre-date that and were working with Neil at Endeavor Financial. Doug Bowlby, for example, he's our Senior Vice President of Corporate Development, he and Neil have been working together for over two decades. Doug Reddy has been with the group for not quite that long, but a number of years, including Endeavor Mining. The other half of us are new to the group. As I say, it's only a two-year-old company. It's a mix of people, with some pretty impressive experience in the industry. We have some very solid senior leaders on the executive team.My personal background, I've been working in mining for about 20 years. I've worked for large cap, mega cap, mid cap, small cap, micro cap, and everywhere in between. I started my career working for a company in Alberta called Suncor, which is actually an oil and gas company. They run the largest open pit mines in the world, in the oil sands in Northern Alberta. Although it's an oil and gas company, there is a significant mining component to what Suncor does. That's really where I cut my teeth in this industry. After six-and-a-half years with Suncor, I moved back to Vancouver, and I joined the investor relations team at Placer Dome. I was with Placer Dome right up until the end, when it was taken over by Barrick in 2006, I believe. Since that time I've worked for a number of different companies, all in mining, gold mining, copper mining, silver mining. Most recently, I was four-and-a-half years with Endeavor Silver, which interestingly is not related in any way to Endeavor Mining. It's a Mexican silver producer, and so I have a bit of experience working in Mexico. I've also worked in other parts of South America and Latin America, as well, including Columbia and Chile.The team, yeah, it all came together fairly quickly. I've been here about a year-and-a-half. I would describe it as a very highly functioning, energetic, very talented, and motivated group here in Vancouver. We're running four mines from the Vancouver office, but our business model is really, very decentralized. We've pushed the accountabilities for many functions that are often done at head office like IT, Payroll, and HR. We've push all of those accountability functions down to the mines because we really would like each mine to be operating as an independent business unit. This allows us to keep a very lean team at the corporate level. Each mine General Manager is held accountable, not just for the operations, but for the financial performance of the business unit.Dr. Allen Alper:That sounds like a very great operating strategy, give responsibilities to the people running the mine. They have light P&L responsibilities, so that's very important. I like that idea.Meghan Brown:Thank you.Dr. Allen Alper:Could you tell us a little bit more about your share and capital structure?Meghan Brown:We have 284 million shares outstanding. With options and warrants, it adds up to about 347 million, fully diluted. At current prices, none of the options or warrants are in the money. They're all underwater, so really it's 284 million at the moment. The stock trades under the symbol LMC, basically Leagold Mining Corporation, on the TSX. That is our main exchange. It does trade, as well, on the OTCQX in the US. We don't see a lot of volume in the US. One of the things we are looking to do is to take on a New York listing. We're looking at that. We believe that will be helpful in terms of improving liquidity. The stock is still fairly thinly traded, due to the fact that it's largely held in some large institutional blocks.

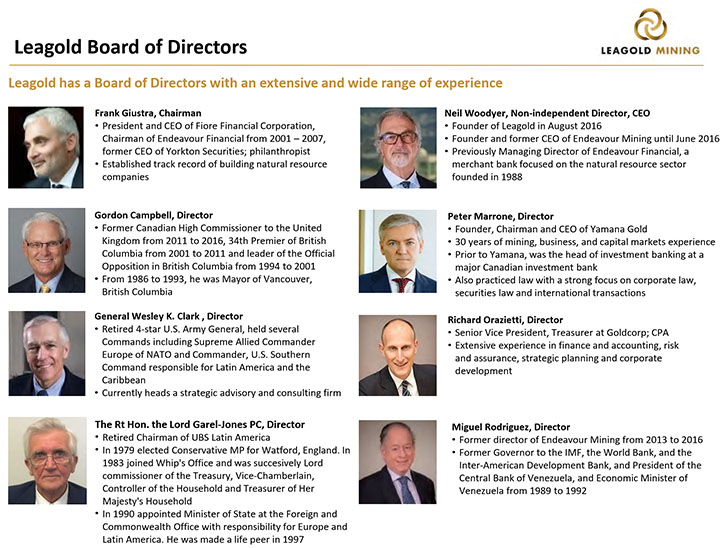

After six-and-a-half years with Suncor, I moved back to Vancouver, and I joined the investor relations team at Placer Dome. I was with Placer Dome right up until the end, when it was taken over by Barrick in 2006, I believe. Since that time I've worked for a number of different companies, all in mining, gold mining, copper mining, silver mining. Most recently, I was four-and-a-half years with Endeavor Silver, which interestingly is not related in any way to Endeavor Mining. It's a Mexican silver producer, and so I have a bit of experience working in Mexico. I've also worked in other parts of South America and Latin America, as well, including Columbia and Chile.The team, yeah, it all came together fairly quickly. I've been here about a year-and-a-half. I would describe it as a very highly functioning, energetic, very talented, and motivated group here in Vancouver. We're running four mines from the Vancouver office, but our business model is really, very decentralized. We've pushed the accountabilities for many functions that are often done at head office like IT, Payroll, and HR. We've push all of those accountability functions down to the mines because we really would like each mine to be operating as an independent business unit. This allows us to keep a very lean team at the corporate level. Each mine General Manager is held accountable, not just for the operations, but for the financial performance of the business unit.Dr. Allen Alper:That sounds like a very great operating strategy, give responsibilities to the people running the mine. They have light P&L responsibilities, so that's very important. I like that idea.Meghan Brown:Thank you.Dr. Allen Alper:Could you tell us a little bit more about your share and capital structure?Meghan Brown:We have 284 million shares outstanding. With options and warrants, it adds up to about 347 million, fully diluted. At current prices, none of the options or warrants are in the money. They're all underwater, so really it's 284 million at the moment. The stock trades under the symbol LMC, basically Leagold Mining Corporation, on the TSX. That is our main exchange. It does trade, as well, on the OTCQX in the US. We don't see a lot of volume in the US. One of the things we are looking to do is to take on a New York listing. We're looking at that. We believe that will be helpful in terms of improving liquidity. The stock is still fairly thinly traded, due to the fact that it's largely held in some large institutional blocks. We'd like to see trading liquidity volumes improve. There are a number of important indexes, in which we have not yet been included. Although we meet the market cap thresholds, we're not meeting the daily trading volume thresholds, though that's something we're working on. The two largest insider owners are our Chairman, Frank Giustra, and our CEO, Neil Woodyer. Frank owns about 6.8 million shares, and Neil owns about 8.0 million shares. They both have a lot of their own money invested, and they're highly motivated for a positive outcome. I think you can say that their interests are clearly aligned with shareholders.Dr. Allen Alper:That's great. It's good to see management have skin in the game. That's really great.Meghan Brown:I would agree with that. It really does motivate the team in a very meaningful way, when there are personal investments made at that level.Dr. Allen Alper:That's excellent. What are the primary reasons our high-net-worth readers/investors should consider investing in Leagold Mining?Meghan Brown:Well, right now I think there's a very interesting opportunity for an entry point, considering the performance of the shares in recent weeks. When we did our financing in 2017, it was done at $2.75. The stock today is trading at about $1.50. It's come down significantly, in spite of the fact that we've done a tremendous amount of work, and we've built up a portfolio of four producing assets.

We'd like to see trading liquidity volumes improve. There are a number of important indexes, in which we have not yet been included. Although we meet the market cap thresholds, we're not meeting the daily trading volume thresholds, though that's something we're working on. The two largest insider owners are our Chairman, Frank Giustra, and our CEO, Neil Woodyer. Frank owns about 6.8 million shares, and Neil owns about 8.0 million shares. They both have a lot of their own money invested, and they're highly motivated for a positive outcome. I think you can say that their interests are clearly aligned with shareholders.Dr. Allen Alper:That's great. It's good to see management have skin in the game. That's really great.Meghan Brown:I would agree with that. It really does motivate the team in a very meaningful way, when there are personal investments made at that level.Dr. Allen Alper:That's excellent. What are the primary reasons our high-net-worth readers/investors should consider investing in Leagold Mining?Meghan Brown:Well, right now I think there's a very interesting opportunity for an entry point, considering the performance of the shares in recent weeks. When we did our financing in 2017, it was done at $2.75. The stock today is trading at about $1.50. It's come down significantly, in spite of the fact that we've done a tremendous amount of work, and we've built up a portfolio of four producing assets.  The share price is most likely a reflection of the general disinterest in gold equities right now. Across the sector, many, many companies are reaching 52 week lows right now. We're not alone in that regard. One thing we do get credit for among the analyst community is this pipeline of development assets that already exist within our portfolio. In other words, we don't have to go out and buy anything to keep increasing production.In addition to the development project in Brazil that I described, which is called Santa Luz, we also have some meaningful upside at Los Filos in Mexico, in the form of extending a second underground mine and potentially adding a processing plant to improve recoveries. There are technical studies underway right now, looking at the development and expansion opportunities at Los Filos. Those studies will be complete by the end of 2018, so in the next six weeks or so.Once we have those studies complete, we'll be looking at financing and funding alternatives, the sequencing of projects to try and understand what the optimal scenarios are, determining the best fit, in terms of which project takes priority, how it gets built, and what the timeline is. We have opportunities within our portfolio that represent material upside to the existing production pipeline.Dr. Allen Alper:That sounds like very, very excellent reasons for our high-net-worth readers/investors to consider investing in Leagold Mining. Is there anything else you'd like to add?Meghan Brown:Well, I think you touched on the fact that we have a management team and a Board of Directors with a significant track record, so very well-known and well respected individuals supporting this company. That goes a long way, especially in a tough market. We have very good institutional support. In addition to Goldcorp with 12.5%, Yamana Gold is a 20% shareholder. They also have a seat on the Board. Those are two of Canada's most well respected mining companies. We think that their support is quite meaningful, as we continue to grow this company. I think that's important for consideration.Dr. Allen Alper:It's great to have backing and support of two major respected companies, so that's excellent. It show they have confidence in your company, your team, and your strategy that's being well executed.Meghan Brown:Thank you. And thank you for interviewing Leagold Mining for Metals News.Dr. Allen Alper:We'll publish your press releases as they come out so our readers/investors can follow your excellent progress.https://leagold.com/Meghan Brown, VP - Investor Relations+1-604-398-4525mbrown@leagold.com

The share price is most likely a reflection of the general disinterest in gold equities right now. Across the sector, many, many companies are reaching 52 week lows right now. We're not alone in that regard. One thing we do get credit for among the analyst community is this pipeline of development assets that already exist within our portfolio. In other words, we don't have to go out and buy anything to keep increasing production.In addition to the development project in Brazil that I described, which is called Santa Luz, we also have some meaningful upside at Los Filos in Mexico, in the form of extending a second underground mine and potentially adding a processing plant to improve recoveries. There are technical studies underway right now, looking at the development and expansion opportunities at Los Filos. Those studies will be complete by the end of 2018, so in the next six weeks or so.Once we have those studies complete, we'll be looking at financing and funding alternatives, the sequencing of projects to try and understand what the optimal scenarios are, determining the best fit, in terms of which project takes priority, how it gets built, and what the timeline is. We have opportunities within our portfolio that represent material upside to the existing production pipeline.Dr. Allen Alper:That sounds like very, very excellent reasons for our high-net-worth readers/investors to consider investing in Leagold Mining. Is there anything else you'd like to add?Meghan Brown:Well, I think you touched on the fact that we have a management team and a Board of Directors with a significant track record, so very well-known and well respected individuals supporting this company. That goes a long way, especially in a tough market. We have very good institutional support. In addition to Goldcorp with 12.5%, Yamana Gold is a 20% shareholder. They also have a seat on the Board. Those are two of Canada's most well respected mining companies. We think that their support is quite meaningful, as we continue to grow this company. I think that's important for consideration.Dr. Allen Alper:It's great to have backing and support of two major respected companies, so that's excellent. It show they have confidence in your company, your team, and your strategy that's being well executed.Meghan Brown:Thank you. And thank you for interviewing Leagold Mining for Metals News.Dr. Allen Alper:We'll publish your press releases as they come out so our readers/investors can follow your excellent progress.https://leagold.com/Meghan Brown, VP - Investor Relations+1-604-398-4525mbrown@leagold.com