Lithium demand from battery makers to almost double by 2027

The outlook for lithium continues to shine, with demand from companies that produce batteries to power electric cars, laptops and other high-tech devices, expected to increase more than thirtyfold by 2027, a new study shows.

While the next nine years will drain less than 1% of the reserves in the ground, battery makers will need more lithium to support their production, which will boost demand for the key metal almost 16% to reach 1 million tonnes, according to Roskill's 15th edition market outlook report.

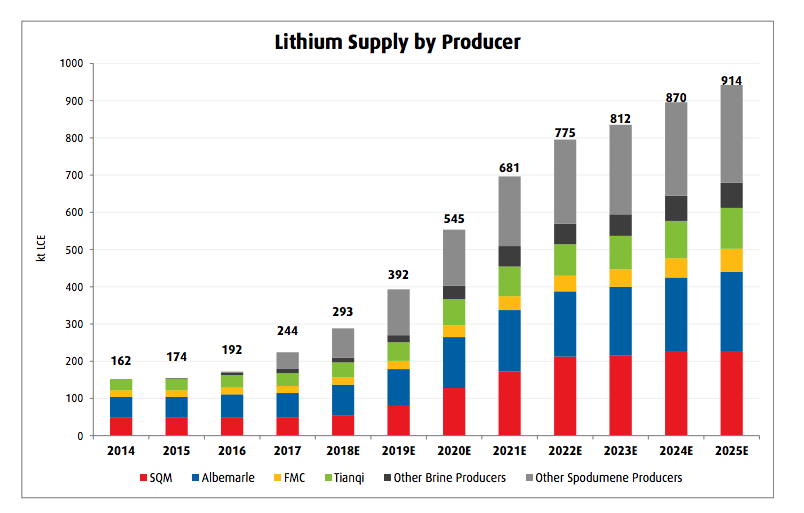

Expected supply, however, is far from the astronomical figure forecast by the research firm, with Canada's Bank of Montreal expecting between 80,000 and 91,500 tonnes of lithium coming from mines by 2025. And BMO's numbers include recently up-sized expansion plans by the market leaders, Chile's SQM, China's Tianqi Lithium, Albemarle and FMC, as well as Nemaska Lithium's plans to build a spodumene mine in northwestern Quebec, Canada.

Wave of much-needed spodumene based supply coming online. (Source: BMO Capital Markets, companies reports.)

Roskill estimates that demand from lithium-ion battery manufacturers will grow from 46% last year to 83% by 2027. Use of lithium hydroxide, in turn, is also forecast to become more prevalent, increasing from 25% of lithium compounds used in rechargeable batteries in 2021 to 55% by 2027.

The analysts expect the market for battery-grade lithium compounds to remain tight, however, as installing new battery grade capacity has proven complex and forecast demand growth is greatest for these products.

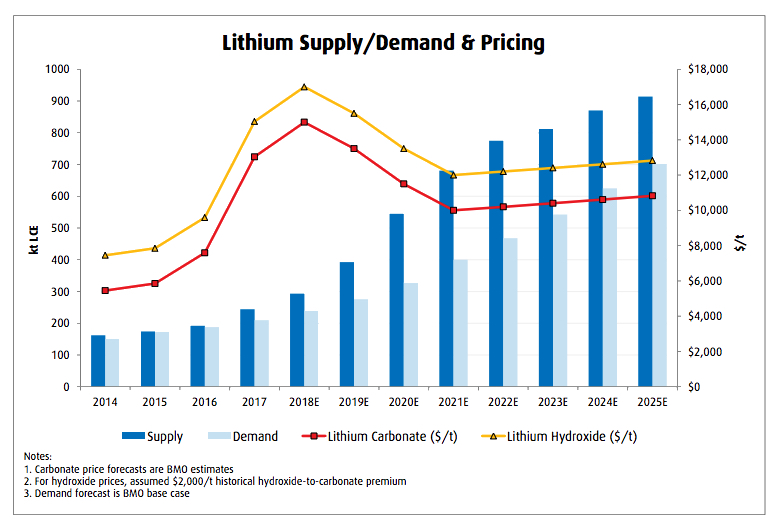

Source: BMO Capital Markets.

In terms of lithium prices, they are expected to peak in 2018, as greater supply availability of mined and refined lithium will enter the market in coming years, causing prices to briefly fall back in 2019, with a floor of $11,000/t battery grade lithium carbonate, Roskill says.

Beyond 2021, the research firm expects lithium prices to rise above 2018 levels again, as continued demand growth for battery grade lithium compounds will apply greater demand-side pressure on prices.