Looking for Precious Metals Key Triggers / Commodities / Gold & Silver 2020

The question on everyone’s mind is:when is it a good time to buy some gold or silver after they bottom? The answerto that question is simple: when key triggers are met. Count-trend rallies ingold or silver don’t mean that they have enough energy and momentum to keepclimbing. Miners also don’t have enough strength to lead the way in a freshclimb upwards for the PMs, so everything we see now only speaks of correctiveaction.

Gold moved higher yesterday (Dec 8),while silver and mining stocks went in the opposite direction. It seems thatthe latter moved in tune with the trend, while the move in the former wasrather accidental.

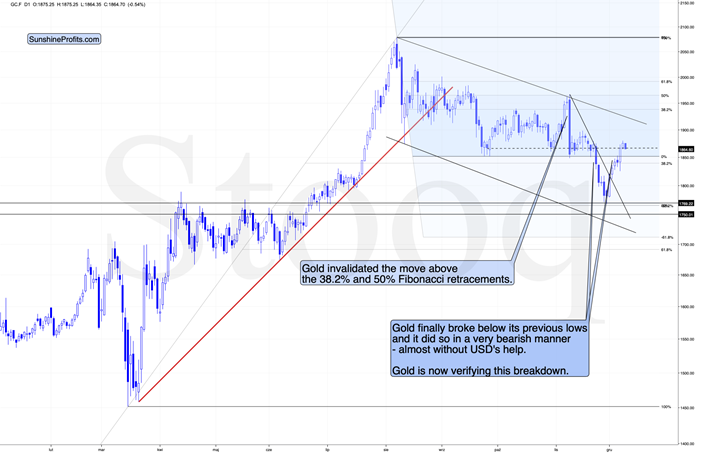

Why? Because gold already invalidatedyesterday’s daily rally at the moment of writing these words (in the overnighttrading). Yes, the closing prices matter the most, but if gold was really afteran important breakout, it wouldn’t have wiped out the previous day’s entirerally just several hours after the closing bell.

I previously wrote that it had been quitepossible for gold to rally up to its September lows, and the low in goldfutures in terms of the closing prices was $1,866.30. Monday’sclosing price for gold futures had been exactly $1,866, and yesterday, goldclosed at $1874.90. At the moment of writing these words, it’s trading at$1,864.60.

So, did anything particularly bullishhappen on the gold market yesterday? Not really.

But can gold move even higher from here?As discouraging (or encouraging, depending on one’s perspective) as this answermay be, it’s a “yes”. The US Dollar Index is currently trading at about 90.8,and its downside target is at about 90, so there is room for another short-termslide. Such a slide would be likely to trigger a rally in the yellow metal. Howhigh could the rally go during this final part of the counter-trend correctiveupswing?

Perhaps to the mid-November high of about$1,900. Even though gold might theoretically rally all the way up to theearly-November high, I don’t see this as being likely.

Meanwhile, silver formed a tiny reversalyesterday and it’s moving lower today.

Silver reversed after touching thedeclining resistance line, which is also the upper border of the trianglepattern. Did we just see a top in silver? That’s quite likely, but not certain.I wouldn’t be surprised if silver took one final attempt to break higher andrally and topped close to the early November high. After all, silver is knownfor its fake breakouts .

Moreover, please note that silver has atriangle-vertex-based reversal point in the final part of the month, whichcould imply that this is where silver forms a final, or temporary bottom. Thiscould have implications also for the rest of the precious metals sector, as itsparts tend to move together in the short and medium term.

Given the bearish post-Thanksgiving seasonality in the case of PMs and the tendency for them to form local bottoms in themiddle or second half of December, it seems likely that the above is likely tobe some kind of bottom.

Mining stocks moved 0.41% loweryesterday, despite a higher close in gold futures and the GLD ETF . The general stock market moved slightly higher yesterday, so it wasn’t thereason behind miners’ weakness. This lack of strength confirms the points that Imade yesterday and further validates the bearish picture:

What we see in the PMs is just acorrection, not the start of a new, powerful upleg. If it was, miners wouldhave been leading the way higher. We currently see the opposite.

Over a weekago, I wrote that miners could move to the previous lows and by moving to them,they could verify them as resistance . The previous – October – low is at$36.01 in intraday terms and at $36.52 in terms of the daily closing prices.Yesterday, miners closed at $36.50.

So, while gold closed at its Septemberlow (in terms of the daily closing prices), gold miners closed at their Octoberlow.

If the USD Index declines one more timebefore bottoming, and gold rallies, miners could also move temporarily higher.How high could they move? I think that the mid-November high of about $38 (intraday high: $38.35, dailyclose: $38.01) would provide the kind of strong resistance that miners mightnot be able to breach.

Still, this upside is based on two bigIFs.

The first “if” is if the USD Indexdeclines to 90 or slightly lower – it’s extremely oversold, and the CoTreports confirm it.

The second “if” is if the precious metalssector really reacts to USD’s decline with a visible rally. In the past fewweeks, gold shrugged off quite a few USDX declines. And miners shrugged offeven more positive news.

Consequently, it seems that trying totake a profit from the possible, but not very likely, immediate-term upswing isnot the best idea from the risk to reward point of view.

Thank you for reading our free analysistoday. Please note that the following is just a small fraction of today’s all-encompassingGold & Silver Trading Alert. The latter includes multiple premium detailssuch as the downside target for gold that could be reached in the next few weeks.

Thankyou for reading the above free analysis. It’s part of today’s extensive Gold& Silver Trading Alert. We encourage you to sign up for our free goldnewsletter – as soon as you do, you'll get 7 days of free access to our premiumdaily Gold & Silver Trading Alerts and you can read the full version of theabove analysis right away. Signup for our free gold newsletter today!

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.