Lyft Options Hot After KeyBanc Note

LYFT calls are attractively priced

LYFT calls are attractively priced

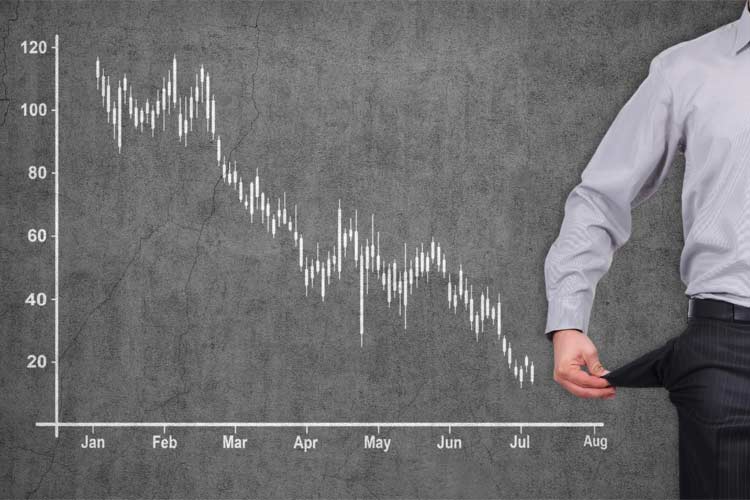

The shares of Lyft Inc (NASDAQ:LYFT) are down 4.1% to trade at $45.97 today, after it received a bear note from KeyBanc. While reiterating a "sector weight" rating, analyst Andy Hargreaves posed data that suggested the ride-sharing app's customer growth was fading, and could continue to "slow materially" unless Lyft can broaden its use cases. Also weighing heavy is a ruling out of New York City, in which a judge favored with Lyft rival, Uber Technologies (UBER), in that the city could not cap the amount of time its drivers maneuver the city without a passenger in the vehicle.

Options traders have responded to the news in kind, already over 61,000 contracts have changed hands, and call volume in the 97th percentile of its annual range. Weekly calls are leading the charge, with the 1/3 46- and 48-strikes the most popular. New positions are being opened here, while the weekly 12/27 47-strike put is also popular.

This preference for calls is nothing new. According to data from the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the security has a 10-day call/put volume ratio of 4.22. However, short interest increased by 12% in the two most recent reporting periods, and now accounts for almost 9% of LYFT's total available float. Thus, its possible some of these calls could be shorts seeking an options hedge against any additional upside.

Whatever the motive, now is the time to target Lyft options, based on the equity's Schaeffer's Volatility Index (SVI) of 37%, which ranks in the third percentile of its annual range.

Today's drop racks LYFT's deficit up to 38% for the year. Resistance has emerged at the shares' 100-day moving average, a trendline that has yet to be toppled on a closing basis since the company went public back in May.