MainStreetBets on Silver and Wins / Commodities / Gold and Silver 2021

Peter Krauth, editor of Silver Stock Investor, explains why he believes silver's movements this past week were just a small taste of its opening act.

TEMPORARILY OUT OF STOCK.

That's the message most hopeful physical silver buyers have been getting since the last days of January. Odds are bullion dealers going to have a tough time keeping any silver in stock.

Everyone is buying, and no one is selling the physical metal. Dealers are asking for 35% premiums…and that's if you can get your hands on any silver at all.

And yet I remember well, less than a year ago in mid-March, when the world started a major lockdown in response to the Covid-19 pandemic. Gold and silver bullion dealers were nearly completely sold out within days. In some cases, silver premiums reached historic highs, near 100% of spot prices.

In the recent #silversqueeze hype, silver traded at an 8-year high, as demand was exploding. Silver's given back $2 since its $29 peak on Feb. 1. But it's still up 20% since late November, and has gained 125% since its March lows.

And silver stocks have been surging. It's all related to the now infamous WallStreetBets calls to action, the latest of which targeted silver. It was enough to cause the Comex to raise silver margins by 18% after just two up days.

But silver's story is still in its early days. Dramatically higher silver prices are still squarely ahead.

Here's What Really Happened to Silver

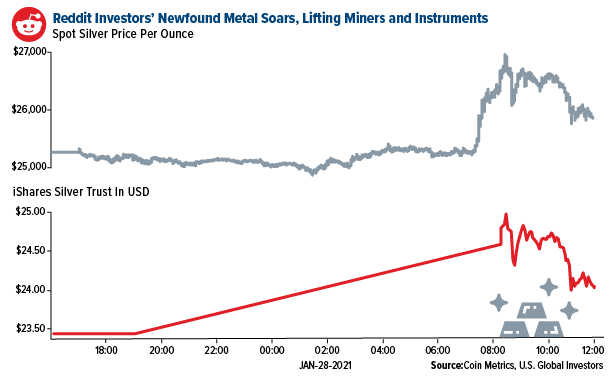

A Reddit subgroup called WallStreetBets sent out a call-to-action to buy silver on January 28. Retail investors piled in en masse and kept doing so on Friday, Jan. 29 and Monday, Feb. 1. By Sunday, January 31, most bullion dealers were outright sold out. By Monday, February 1, silver was up nearly 8% from the Friday close.

Silver had gained almost 20% in just three trading days.

Silver had soared to an 8-year high. Silver stocks were ripping higher, and many were seeing their trading volumes explode anywhere from 6-10 times normal levels.

The Global X Silver Miners ETF (NYSE:SIL) went from $40 to $49 in just three days. The ETFMG Prime Junior Silver Miners ETF (NYSE:SILJ) went from $13.60 to $17.80 in that same time.

On Friday alone (Jan. 29), the iShares Silver Trust (NYSE:SLV), the world's largest silver-backed exchange traded fund, added nearly $1 billion of inflows.

Some of this move will turn out to be a short-term speculative buying frenzy. But what this whole saga has done is to introduce a massive new following to the silver space.

More importantly, I believe silver still remains fundamentally cheap.

Silver Supply and Demand Drivers

Huge forces are going to keep pushing silver higher for years to come.

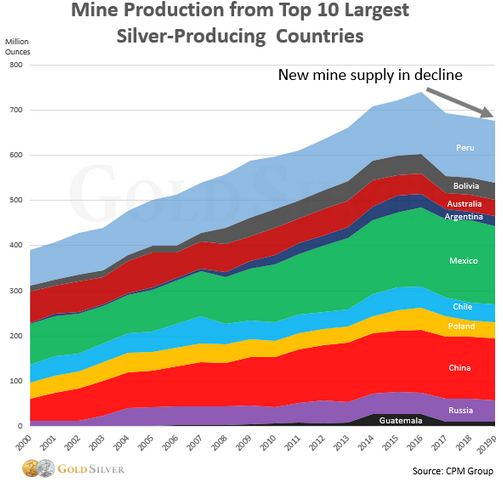

Supply has been falling consistently for the last five years.

Not one of the top 10 silver producing countries has escaped this trend. Several consecutive years of low prices have led to underinvestment and underexploration. Output has dropped along with reserves.

And with 70% of mined silver is a by-product of mining other metals, those miners are not motivated to produce more even when silver rises: it's too small a portion of their revenues.

All this is happening while multiple demand forces are building.

Vehicle demand for silver is soaring. Whereas internal combustion engines need 15–28 grams of silver, EVs need double that amount at 25–50 grams per vehicle. Globally, EV sales are projected rise dramatically. The Silver Institute projects a 50% rise in automotive silver demand, from 60M oz currently to over 90M oz in just five years.

Meanwhile, the solar sector is also likely to boost silver demand. It currently represents 100M oz of silver annually. And although efficiencies have been leading to lower silver consumption per solar panel, in my view expanding volumes will more than make up for that.

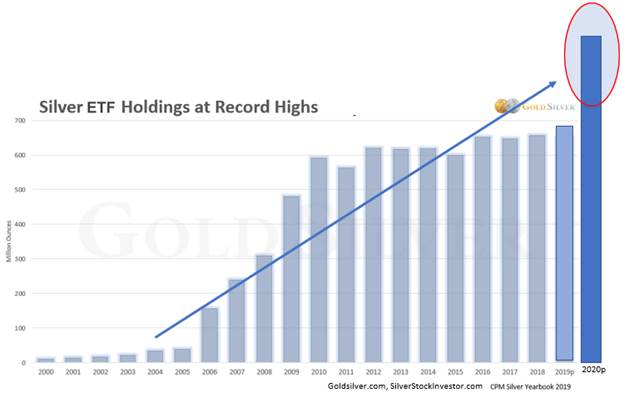

However, I believe the wild card will be investment demand for silver. Even without the dramatic, explosive action in silver markets over the last week, investment demand has been gradually increasing over the last five years. 2019 saw an impressive increase of 12% over 2018. But 2020 was an absolute standout, with a 16% increase over 2019. None of this happened with any hype.

That translates into global silver ETF holdings now in the 1 billion ounce range.

Consider that these total holdings are the equivalent of a whole year's silver supply: mine production and recycling.

And yet silver remains stunningly cheap, especially relative to gold.

The gold-silver ratio has reversed in a dramatic way from its all-time high last March at 125, and has just broken below support at 70. I believe it's heading towards 55 or even 50. Silver remains cheap on a fundamental basis, a relative basis and an historical basis.

In the Silver Stock Investor newsletter, I provide my outlook on which silver stocks offer the best prospects as this bull market progresses. I recently added three companies to the portfolio, which I believe have exceptional potential to double or better in the next 12 months.

In the end, this pullback is just par for the course, especially in silver. The way I see it, all it does is give us more time and another opportunity to keep accumulating silver and silver miners at discount prices.

The mania stage still lies ahead. This past week was just a small taste of the opening act.

Stay long silver.

--Peter Krauth

Peter Krauth is a former portfolio adviser and a 20-year veteran of the resource market, with special expertise in precious metals, mining and energy stocks. He is editor of two newsletters to help investors profit from metal market opportunities: Silver Stock Investor, www.silverstockinvestor.com and Gold Resource Investor, www.goldresourceinvestor.com. In those letters Peter writes about what he is buying and selling; he takes no pay from companies for coverage. Peter has contributed numerous articles to Kitco.com, BNN Bloomberg, the Financial Post, Seeking Alpha, Streetwise Reports, Investing.com, TalkMarkets and Barchart, and he holds a Master of Business Administration from McGill University.

Disclosure: 1) Peter Krauth: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector. 2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.5) From time to time, Streetwise Reports and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.