Major Revaluation of Gold Shares Coming

Barry Dawes of Martin Place Securities takes a look at the current price of gold and shares three gold stocks.

Barry Dawes of Martin Place Securities takes a look at the current price of gold and shares three gold stocks.

It seems that gold didn't want to wait until September for this breakout.

The series of 1-2, 1-2, 1-2 steps (two more minor steps already in August) is leading to that wave 3 take off.

This breakout should lead to a major takeoff. The next stop is US$2800.

Friday's US$51 rise is a good indicator of more to come. Up US$100 intraday this week? The top of this channel comes in at around US$2800 in 2024 and that could be achieved quite quickly

Note the break out from US$2089 to US$2400 is $300. That would give the measured move to US$2800. The next higher parallel channel could come in at that US$3300 level for 2024/25.

This breakout will soon be followed by a VERY strong market for gold stocks. The Gann students have been pointing to 2023 being the 60-year cycle lows for both gold and U.S. stocks, so this new bull market has a very long way to go.

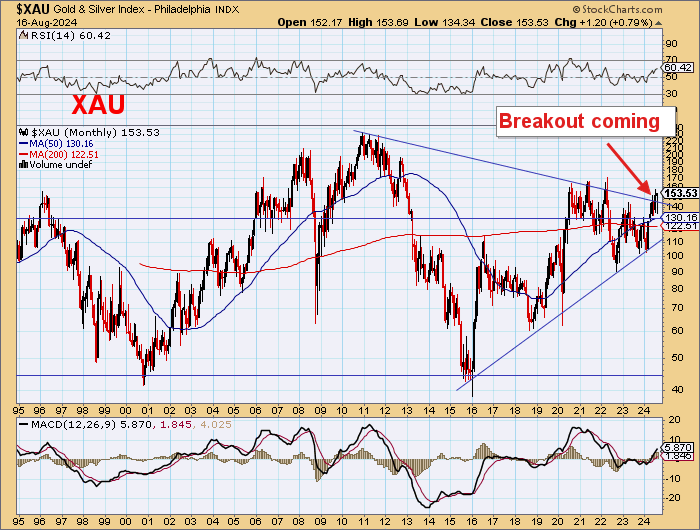

You will recall this long-term graphic for Nth American gold stocks. 52 years of bear market of goldstocks versus gold here. 50 years of a bull market ahead.

The major comment here is:

Hyperbullish gold miners for a generation.Miners will increase 40x from 2024 levels.Equally applicable here on ASX. From @StocksFormula:

The XAU had a 2.48% move on Friday to the top of its box.

That 13-year downtrend is being broken.

You should understand the importance of this breakout.

All those 1-2, 1-2, 1-2s are building up very nicely on the bigger picture as well. Wave 3 of WAVE 3!

The great acceleration is coming in gold stocks.

Gold stocks versus gold:

Should move from 0.60 to 0.225 = 275% vs a strong gold priceThe big rerating will come through higher earnings

Gold stocks versus S&P500:

Massive outperformance is coming as gold earnings pick up.Gold stocks will go from pariahs to market darlings!

Earnings drive share prices.

Stocks

Newmont Corp. (NEM:NYSE) reported US$834m Q2 earnings on US$2347/oz, up 32% in March Qtr (US$2090/oz) and up 213% in June Qtr 2023 (US$1965/oz).

At US$2500 on 1.6m oz/qtr, this is a further US$240m gross revenue addition.

Barrick Gold Corp. (ABX:TSX; GOLD:NYSE) reported US$557m Q2 earnings on US$2344/oz, up 67% on March Qtr (US$2075/oz) and up 66% on June Qtr 2023 (US$1972/oz).

At US$2500 on 0.95m oz/qtr, this is a further US$140m gross revenue addition.

Agnico Eagle Mines Ltd.'s (AEM:TSX; AEM:NYSE) US$535m Q2 earnings on US$2342/oz, up 42% on March Qtr (US$2070/oz) and up 67% on June Qtr 2023 (US$1975/oz).

At US$2500 on 0.9m oz/qtr, this is a further US$135m gross revenue addition.

Head the markets, not the commentators.

| Want to be the first to know about interestingGold investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Barrick Gold Corp. and Agnico Eagle Mines Ltd.Barry Dawes: I, my entities, and managed portfolios may hold ALL of the mentioned stocks. The position may change at any time. I determined which companies would be included in this article based on my research and understanding of the sector.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.