Marathon Gold: Hold

Marathon Gold continues to build a large base but is now beginning to hang out in the top half of that base.

The fundamentals for the stock continue to improve, with more exceptional drill results out of Leprechaun last week.

I believe the time for trading the stock has passed, and it's much wiser to hold onto the majority of one's position.

With the mining indexes (NYSEARCA:GDX) finally waking up after a two-year slumber, Marathon Gold (OTCQX:MGDPF) has found itself in the best position it has ever been in. The stock has a healthy treasury with over $20 million in cash, it's got a gold price that's boosting its project economics, and it's arguably the top takeover target in the space among open-pit style deposits. The even better news is that this is all occurring when there is a dearth of truly world-class deposits out there. Avnel, Integra, Richmont, Mariana, Atlantic, NewCastle, and Kaminak are all gone, and that's left almost no truly stand-out deposits remaining within premier jurisdictions. While a recent article suggested taking profits and carried a bearish stance on Marathon, I believe the days for swing trading the stock are behind us. Profit-taking made complete sense in a range-bound gold (GLD) market where juniors were getting no credit for their resources. However, in an environment where gold is trying to reset its bull market, M&A activity is likely to pick up, and this should put a floor under Marathon. For this reason, I believe it's wiser to hold onto the majority of one's position unless this thesis suddenly changes.

My prior articles have focused mostly on Marathon's fundamentals, but this article will focus on the technical picture, which is just as important. For the past year and a half, Marathon has had superior fundamentals to nearly all of its peers but was being out-shined by Atlantic Gold (OTCPK:SPVEF) which had the trifecta of a new producing asset, a perfect technical picture, and an exceptional deposit. This is why I favored Atlantic Gold in early Q2 to all other juniors, and it was the only junior name I disclosed a position in. Fortunately, for Marathon shareholders, the top dog has now been taken over, and by default, Marathon has moved into the top spot. In addition, the technical picture is improving significantly for Marathon, which has changed the stock from one to sell into rallies, to a name worth holding. We can examine the technical picture in more detail below:

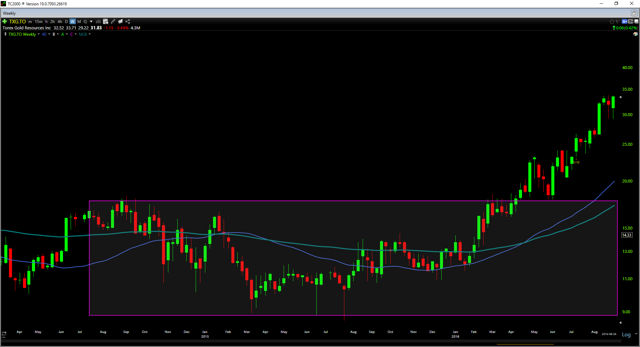

As we can see from the weekly chart of Marathon Gold I've shown, the stock is carving out a massive weekly base but is beginning to hang out near the top half of that base. This base is comparable to others I've played in the sector like Kaminak Gold (OTCPK:KMKGF) in 2016, Torex Gold (OTCPK:TORXF) in 2016, and most recently, Atlantic Gold in Q2 2019. In nearly all of these examples, we can see that the 40-week moving average (blue line) was beginning to trade above the intermediate moving average, signifying that they were starting new up-trends after consolidation periods. Additionally, two of those three previous examples led to takeovers within the next twelve months.

(Source: TC2000.com)

(Source: TC2000.com)

(Source: TC2000.com)

(Source: TC2000.com)

Typically, when we get these types of base formations, they are indicative of institutional accumulation if they are finally beginning to see a reduction in the wide swings of the share price. The reason for this is that stronger institutional hands have an interest in the stock, and their typical holding period is nine months to twelve years, not nine days to two months like many swing traders. This transition to a higher quality shareholder base often reduces the volatility as there are fewer shares up for grabs, and new shareholders are forced to pay up. Also, those swing traders that are used to selling out their position into spikes find they are unable to get back in the stock easily, and therefore, they narrow their limits from where they previously bought. Before I put you to sleep with all this technical jargon, I'll hurry up and get to my point. If Marathon can finally break out of this base, it will be a very bullish development for the stock. The base currently measures dimensions of about $0.60, and therefore, a conservative measured move would be up to the CAD $1.70 level if we get confirmation of a breakout. For this to occur, the stock would need a weekly close above CAD $1.30.

(Source: TC2000.com)

The other good news that's coupled with this is that suitors interested in the company will finally be faced with a minor sense of urgency, which they do not previously have. While any interested parties can mull over the idea of a takeover and run their calculations until they're blue in the face while the stock is going sideways, it becomes more expensive to do this when a stock breaks out. The reason for this is that the stock now has a tailwind behind it, and the acquisition is getting more expensive each month assuming the breakout is for real. We saw an example of this with Kaminak as Goldcorp (NYSE:GG) finally threw in the towel and paid up for their Coffee Project after the stock had gained over 60% from its base breakout. We also saw something similar with the Atlantic Gold takeover last quarter, but fortunately St. Barbara was wiser than Goldcorp and didn't want around to pay up for the stock well above its base.

Based on this new development that Marathon looks like it has a good shot at breaking out before year-end, it has become riskier to sell out one's position on rallies in the hopes of buying back in much lower. For this reason, I see the best course of action as holding, or only trading a small portion of one's position. As long as Marathon holds above the CAD $0.96 level on a weekly close, the bulls are in complete control of all the relevant time-frames. While pullbacks are entirely possible, I would expect strong buying to come in near the $1.00 level.

So, are there any new ground developments worth touching on before closing? Let's take a look:

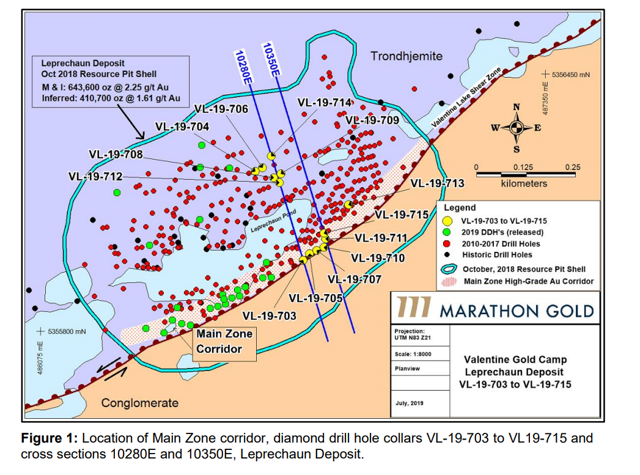

(Source: Company Website)

While things have been pretty quiet on the exploration front this quarter, last week, Marathon put out outstanding results from their southeastern-most Leprechaun deposit. Not only did grades come in at nearly two times average resource grades on the highlight hole, but they were also over a considerable thickness. The current average grade of the Leprechaun deposit is 2.25 grams per tonne, and highlight hole VL-19-711 intersected 74 meters of 4.24 grams per tonne gold. The second most impressive hole in the release was VL-19-703 with 19 meters of 10.03 grams per tonne gold, with a deeper intercept of 31 meters of 3.59 grams per tonne gold. It's rare to see these types of intercepts at a bulk tonnage deposit, and it's reminiscent of Romarco's Haile Project which OceanaGold (OTCPK:OCANF) paid an arm and a leg for ($850~ M CAD). The high-grade zone within the Leprechaun deposit now extends to a 480-meter strike length, up from only 300 meters earlier this year. This added strike in the high-grade zone at Leprechaun should help to increase grades for the updated resource estimate, from an already high level of 1.90+ grams per tonne average for the deposit.

In addition, it's worth noting that Marathon Gold's project economics have improved vastly since their PEA as they used a conservative gold price of $1,250/oz, 10% below current spot prices. Using a gold price of $1,350/oz which is below current prices, the after-tax NPV improves from $432 M to $616 M, and the internal rate of return jumps from 30% to 36%.

Marathon Gold continues to be my top takeover target in the junior space in the open-pit category, with Osisko Mining (OTCPK:OBNNF) being one of my top 2 takeover targets in the 'underground' category. The recent technical improvements in Marathon Gold make the stock more attractive, and I wholeheartedly disagree with the most recent article suggesting a bearish stance on the stock. While pullbacks are entirely possible and nothing is certain, I don't see any real value in trying to sell out one's position into spikes in the hopes of repurchasing it 10-15% lower if gold may be transitioning to a new bull market. There's no question this was a fruitful strategy in the past, but I see it as riskier given that the new floor for the stock is likely to lie between CAD $0.99 and CAD $1.03.

Disclosure: I am/we are long OBNNF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Taylor Dart and get email alerts