Market uncertainty pulls Canadian Mining Eye index down in Q3

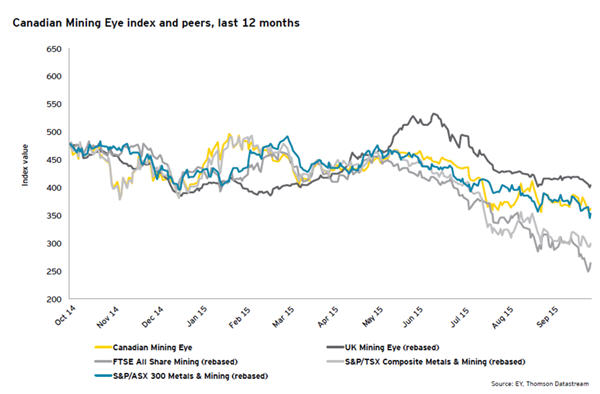

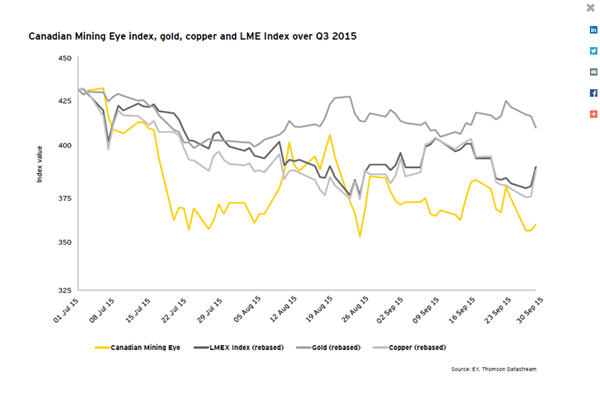

The Canadian Mining Eye index declined 17% during Q3 2015, compared to a 4% gain in Q2 2015. The Canadian Mining Eye index underperformed the S&P/TSX Composite index which slipped 9% during the quarter. The London Metal Exchange index (LMEX) declined 9% over the quarter.The S&P/TSX Composite Metals and Mining index witnessed a significant plunge of 26% due to extremely bearish sentiment during the quarter. Stock prices remained volatile, mirroring the movement in gold prices. Canadian mining equities continue to face downward pressure due to a fall in metal prices, weak macro-economic backdrop and weak Chinese demand. Canadian companies in this sector continue to focus on their core businesses by disposing of non-core assets and managing costs. Some companies showed steady progress developing their planned projects.

Majors experienced a fall of 26% in Q3 2015, compared to a 4% decline in Q2 2015, indicating weak investor confidence on a global macroeconomic outlook. Companies with a focus on margin protection continue to manage costs effectively while looking to improve productivity. With the US dollar strengthening against the Canadian dollar (7% in 3Q 2015), Canadian miners are expected to benefit as commodities are traded in US dollars whereas production costs are incurred in Canadian dollars. Companies remained cautious about their capital spending and focused on rigorous cost control measures and productivity improvements.

Majors experienced a fall of 26% in Q3 2015, compared to a 4% decline in Q2 2015, indicating weak investor confidence on a global macroeconomic outlook. Companies with a focus on margin protection continue to manage costs effectively while looking to improve productivity. With the US dollar strengthening against the Canadian dollar (7% in 3Q 2015), Canadian miners are expected to benefit as commodities are traded in US dollars whereas production costs are incurred in Canadian dollars. Companies remained cautious about their capital spending and focused on rigorous cost control measures and productivity improvements.

The UK Mining Eye performed marginally better than the Canadian Mining Eye, losing 15% during Q3, and the FTSE Miners Index which fell 32% during Q3.Gold prices decreased further by 5% in Q3 2015 after a 2% decline in Q2 2015. Gold started weak in the beginning of the quarter and, although it recovered slightly in the middle, it continued to decline at the end of the quarter. Gold prices remained volatile during the quarter, impacted by the uncertainty in the market. Gold was hit by lower imports by India, dropping 52% in September after a surge to meet festival demand in August. Between the price surge in anticipation of further stimulus in Europe, the US Federal Reserve decision to defer increase in borrowing rates and China's yuan devaluation, the bearish sentiment continued to put pressure on the yellow metal over the quarter. Despite the current slight uplift, gold prices can be expected to remain volatile on the back of speculation that the Federal Reserve will increase interest rates sometime in the future

The UK Mining Eye performed marginally better than the Canadian Mining Eye, losing 15% during Q3, and the FTSE Miners Index which fell 32% during Q3.Gold prices decreased further by 5% in Q3 2015 after a 2% decline in Q2 2015. Gold started weak in the beginning of the quarter and, although it recovered slightly in the middle, it continued to decline at the end of the quarter. Gold prices remained volatile during the quarter, impacted by the uncertainty in the market. Gold was hit by lower imports by India, dropping 52% in September after a surge to meet festival demand in August. Between the price surge in anticipation of further stimulus in Europe, the US Federal Reserve decision to defer increase in borrowing rates and China's yuan devaluation, the bearish sentiment continued to put pressure on the yellow metal over the quarter. Despite the current slight uplift, gold prices can be expected to remain volatile on the back of speculation that the Federal Reserve will increase interest rates sometime in the future

The slide in base metals continued in Q3 2015 as a result of an economic slowdown and a decline in the manufacturing activities in China. In response to China's slowing demand and concerns over metal financing inventories, copper tumbled 10% during the quarter on the London Metal Exchange (LME), the largest drop since 1Q 2014. Nickel and Lead were down 13% and 5% respectively on the LME over Q3 2015, while Zinc slipped 16%. In the face of lower prices, some companies suspended operations and focused on cost cutting. Glencore, the world's largest miner and trader of zinc, suspended its zinc mine production in Australia and Peru, while also reducing production across its various operations.

Mergers and acquisitions

Momentum in M&A increased significantly in Q3 2015 as a result of several high-value M&A and financing deals. A number of companies accessed financing through asset disposals, equity or stream financing arrangements, as evident in such cases as Barrick, North American Palladium and New Gold. In contrast to earlier quarters, there were many high value deals announced.

Barrick Gold announced that it entered into an agreement to sell its 50% stake in its Chile-based Zaldivar copper mine to Antofagasta on July 30, 2015, for a total consideration of US$1,005 million in cash, which consists of US$980 million upon closing, and five annual payments of US$5 million per year starting in 2016. Under the transaction, Antofagasta will take over as operator of the mine and a JV will be formed with equal representation of Barrick and Antofagasta on its board. Zaldivar produced 222 million lbs at cash cost of US$1.79/lb and EBITDA of US$260 million in 2014. The mine carries a P&P reserve of 5.56bn lbs copper at an estimated life of approximately 14 years with additional upside potential through exploration, so it appears Antofagasta is taking a longer term view. Production guidance of 230-250 lbs in 2015 at a current spot price of US$2.42/lb implies an EV/EBITDA multiple of 13.3x for the deal. The transaction is expected to close in late 2015. This transaction took Barrick to c.60% (~US$1.85 billion) of its net debt reduction target of US$3.0 billion for 2015, including disposals of Cowal (US$550 million) and Porgera (US$298 million) earlier in the year. Also, it added a partner with wide experience in Chile. After this deal announcement, Barrick entered in a US$610 million gold and silver streaming agreement with Royal Gold on August 05, 2015, for production linked to Barrick's 60% interest in the Pueblo Vjejo mine. Following its efforts to reduce debt, Barrick announced on October 14, 2015 that it would purchase its US$850 million outstanding loan notes. 1, 2, 3, 4

OceanaGold announced acquisition of Romarco Minerals for a total consideration of CDN$856 million on July 30, 2015. OceanaGold offered 0.241 shares for each Romarco Minerals share with a consideration of CDN$0.68 per share, representing a premium of 72.7% on the closing price as of July 29, 2015. The offer price represented a premium of 71.8% to the 30-day volume-weighted average price (VWAP) of each company's respective shares. After the completion of the transaction, existing OceanaGold and Romarco shareholders will own approximately 51% and 49% respectively of the combined entity. This combined entity will be a low-cost intermediate gold producer, diversified across New Zealand, Philippines and USA, and producing over 540kozpa starting in 2017, with a top quartile AISC of