Market volatility means cash is king for mining and metals companies

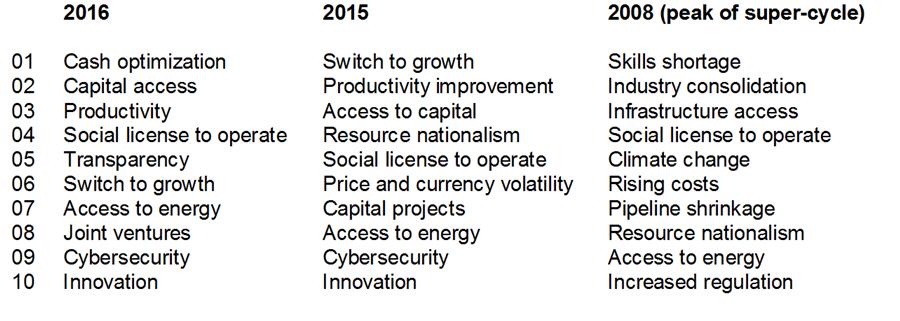

Capital considerations dominate the top three business risks in the mining and metals sector, according to EY's Top 10 business risks facing mining and metals 2016-2017 report.

"Much like our global counterparts, Canadian mining and metals companies are facing challenges amid prolonged volatility in the sector," says Bruce Sprague, EY's Canadian Mining & Metals Leader. "Companies who proactively mitigate risks with a well-managed and cost-effective end-to-end value chain, will be best positioned for growth."

Cash optimization replaces "switch to growth" - which fell from first to sixth position - as the top risk in the 2016-2017 report. The switch comes as mining and metals companies increase their focus on cash to maintain strong balance sheets and plan for longer-term profitability.

Capital access moves to second in risks rankingThe last couple years have seen a sharp decline in loan finance to the sector. In 2015, capital raised was down by 10% year-over-year. Securing funding and credit terms has been particularly challenging as traditional forms of debt and equity aren't readily available in today's market. Globally, debt markets are expected to improve more rapidly than equity markets. In Canada, equity markets are expected to remain subdued, with the potential risk of shareholder dilution due to placements or rights issues brought on by companies facing financial distress.

"Unless the commodity pricing environment improves, we expect the cost of capital to remain elevated," says Sprague. "As companies plan for the future, sourcing alternative finance options and raising capital is crucial."

Productivity remains top operational challengeProductivity declined significantly during the sector boom as companies adopted a "volume-at- any-cost" mindset. This approach resulted in a singular focus on the mine and created an integration gap between the mine and production plant, maintenance and supply chain.

"Mining and metals is one of the few sectors that has actually fallen behind on productivity," warns Sprague. "The upside of that, however, is there are great opportunities to learn from other sectors who have increased output through innovative process improvements."

Innovation remains in the top ten risks for 2016-2017.

Sprague adds: "Innovation is central for the industry and will be a key factor in solving issues around productivity. It's about disrupting the industry, engaging in digital tools and finding efficient ways to do everyday tasks."

While adopting process models and embracing digital, Sprague says companies need to effectively manage liquidity, while focusing on long-term profitability. These key enablers will help address and mitigate sector risks and help companies position themselves for continued growth.

EY's top 10 business risks in mining and metals, 2016-2017 are:

To read the full report, visit: http://www.ey.com/gl/en/industries/mining-metals/business-risks-in-mining-and-metals.

About EYEY is a global leader in assurance, tax, transaction and advisory services. The insights and quality services we deliver help build trust and confidence in the capital markets and in economies the world over. We develop outstanding leaders who team to deliver on our promises to all of our stakeholders. In so doing, we play a critical role in building a better working world for our people, for our clients and for our communities.