Markets register a sequential sell signal

In his February 22nd Howe Street broadcast, Bob Hoye from ChartsandMarkets.com reveals that based on his firm's historical pattern recognition metrics, major stock markets are registering a sequential sell signal.

Excitement in markets could signal a top is near

Meanwhile, gold stocks may be in the early stages of what could be a cyclical bull market.

In light of the major sell-off markets experienced late last year and the subsequent rebound, Hoye has been tracking the broad market to see if it fits within historical experience. Key questions he has been asking:

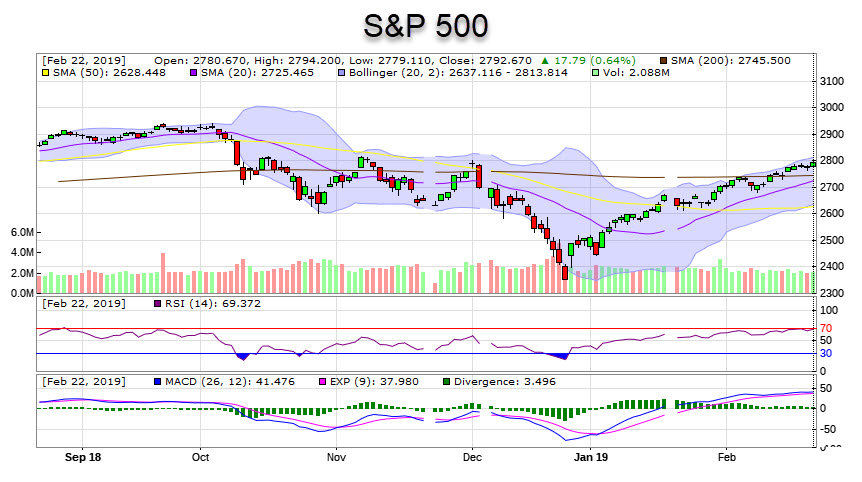

Is the market up at the right time?Are there signs of speculation based on sentiment, momentum and specific patterns?The answer to both questions is yes. Of all the factors he is watching, market price momentum and patterns are key. Hoye explains that daily and weekly RSIs are measures of momentum that reveal how much excitement is present in markets, either on the upside or downside. In addition, he looks at patterns based on the ups and downs over a number of trailing week where you can end up with a sequential sell signal near the tops and at bottoms you can get the opposite, a sequential buy.

We now have a sequential sell. It may take a number of weeks for this to top and complete. But, the main things is you have momentum, sentiment patterns, a number of things, saying it's exciting enough where one should be taking some money off the table.

He points out that in terms of the broad market, selling the rallies is the opposite of the idea that prevailed during all the years of the big bull market which was to buy the dips.

Meanwhile, Hoye likes the precious metals group now. However, he cautions that he wouldn't chase rallies as he believes it is going to take more work and time before you a solid bull market.

One could buy a little on each of the dips, the opposite to the big stock market where an intermediate type trader would want to be selling the rallies such as now

Looking at history, he recalls that each of the 5 previous great bubbles was followed by a long contraction when the real price of gold went up. But, the pattern was for the real price of industrial commodities to likely go down in the post bubble world.

That brings Hoye to crude oil. He expects the current crude strength to continue until around March, and that oil stocks should benefit as well. However, he warns against getting too comfortable with the rally which he characterizes as a "trading position".

Hoye suggests that with the US being the key oil producer now, OPEC and the Middle East doesn't matter as much as it did in the past.

Even if there are, and there will continue to be political disasters in the Middle East, it will have less influence on crude prices.

Instead, Hoye believes that investors should now be focusing on the realities of a post bubble world. For those looking for direction, he suggests that history is a wonderful guide.