Martin Rapaport: Synthetic Ethics

RAPAPORT...Synthetic diamonds are a fundamental threat to the naturaldiamond industry. They are not just a competitive product like gems, pearls, orgold jewelry. They are a replacement product. Their marketers shout out: Don't buynatural diamonds, buy synthetic diamonds because synthetic diamonds are moreethical. They are cheaper. They build up synthetic diamonds by tearing downnatural diamonds.The natural diamond trade is confused and afraid. Ourdiamond distribution system is under relentless attack as retailers are forcedto match lower prices from online sellers who operate at lower costs.Furthermore, suppliers are using the internet to sell direct to consumers,cutting out retailers. Competition is fierce, profit margins are low and peopleare leaving the industry. The problem is not just distribution. Natural diamondsthemselves are under direct attack. Synthetic sellers are mounting marketingand public-relations campaigns to convince consumers that natural diamonds arebad. They claim natural diamonds deface the earth and force child labor. Thereputation of our diamonds and trade are being destroyed in the mind of theconsumer. Identity crisisOur trade is having an identity crisis. Are synthetics moreethical? Are they a good product? Should we sell synthetics? If we sellsynthetics, what does that say about us and our natural diamonds? The synthetic marketing campaigns are just the tip of theiceberg. What's really going on is an attempt to steal the identity of naturaldiamonds and hijack the reason people buy diamonds. Synthetics sellers are notsaying "Buy synthetics because they are more beautiful, sparkly, or well cut."They are saying "Buy synthetics because they are the same as natural diamondsbut with better ethics and lower prices." They are getting under our skin bytrying to capture the idea and promise of natural diamonds. Synthetics are parasites living off the marketing messagethat naturally scarce diamonds are the ultimate gift of love and commitment.Synthetics are trying to steal the Diamond Dream. They don't have their ownmessage. Synthetics are not more ethical.[1]They don't contribute to sustainable economic development in developingcountries. And most importantly they don't hold value. Synthetic pricesSynthetic sellers make a strong argument that syntheticdiamonds are "exactly the same"[2]as natural diamonds. But that's not true. Synthetic diamonds have no naturallimitation of supply. They can be cranked out in unlimited quantities and will bemanufactured as long as there is profit. Given a competitive market, thequantity and supply of synthetic diamonds manufactured will increase untilthere is very little price difference between the cost of manufacturing and thesales price. The wholesale B2B price of synthetics is limited to manufacturingcosts plus a small distribution profit. The cost of manufacturing synthetic diamonds is continuouslydecreasing (it currently stands at $300 to $500 per carat). Technologicaladvances in synthetic processing are being driven by governments and companiesseeking to develop a broad range of futuristic synthetic diamond technologiesthat have nothing to do with jewelry. These include synthetic diamond chips forquantum computers, high-powered CO2 lasers, and even biological applicationsfunded by the US Department of Defense.[3]Extended funding for these advances will create new technology that willfurther reduce the cost of creating synthetics. Think Moore's law on steroids. There are also the tens of thousands of High Pressure-HighTemperature (HPHT) machines in China shifting production from creatingsynthetic diamond abrasives to synthetic gem rough. And let's not forget aboutwhat happened to synthetic emeralds, rubies and sapphires: Their prices plummetedas unlimited production increased supply. For all the above reasons, it is reasonable and rational topredict that synthetic diamond prices will decline significantly over the nextfew years. In fact, according to some reports, prices for 1-carat syntheticshave fallen over 20% in just the last quarter. In contrast, the supply of natural diamonds - particularlylarge expensive diamonds - is limited by their natural occurrence. You can'tjust crank them out. Natural diamond prices are based on scarcity and that iswhy their price per carat increases with size and quality. The scarcersomething is the more valuable it is. Synthetic valuesJewelers considering the sale of synthetic diamondengagement rings should consider the ramifications of what happens when thecustomer comes back in a few years and finds out that her $30,000 diamond isnow worth $3,000 or $300. What will you say? What will you do? Do you thinkthat customer will ever trust you again? Do you think the customer will everagain buy any diamond, synthetic or natural, from you or anyone else again? Consumers are not being told of the sinking value of theirsynthetic diamonds. Jewelers are presenting the diamonds as a discounted itemcompared to natural diamonds even though they are not comparable when it comesto value retention. These jewelers and jewelry companies are misleadingconsumers who think they are buying a diamond that will retain value the way anatural diamond does. An entire generation of millennials is being "ethically"ripped off. Sadly, we have an industry that is cashing in on thereputation of natural diamonds. We are destroying the long-term reputation ofdiamonds as a store of value for short-term synthetic profits. It's shocking tosee so many in our industry willing to take consumers for a ride withoutdisclosing the likely price decline of expensive synthetic diamonds. The diamond dreamSo what is the diamond dream? Why do people buy diamonds?What is the promise of diamonds? Let's talk diamond engagement rings. When a man gives awoman a diamond,[4]there is more going on than the physical exchange of a commodity. Similarly,when a couple has a committed relationship, there is more going on than aone-night Tinder experience. We seek to transcend our physical connection byincorporating high-level emotions into a spiritual relationship. We seek tomake love, not just have sex. The diamond engagement ring is an emotional andspiritual gift that transcends the physical diamond as it communicates thecommitment of love forever. The universally symbolic gift of a diamondengagement ring is similar to a wedding ring, which is "worth" much more thanits weight in gold. The value of the wedding ring incorporates the emotionaland spiritual investment of the couple. So, too, the diamond engagement ring. For many young women, the diamond dream is that one day shewill fall in love. The perfect man will come along, ask her to marry him andgive her a diamond ring to seal that love. The dream starts at a young age -maybe 10 or 12 - and continues throughout her life. Even after she getsmarried, she will look at the ring every day, remembering the love itrepresents. The foundation of diamond demand is the engagement ring. Aman does not give an engagement ring to a woman just because it sparkles. He isgiving her much more than the physical product. He is giving her his promise tobe there for her, for the rest of her life. The value of valuesThe natural diamondtrade does itself a disservice by promoting diamonds based on price. If themost important thing about the diamond is price then why doesn't the man justgive the woman cash? Many in the trade do not know how to sell the emotionalpower of the diamond so they just sell price discounting. It is likely thatthese companies will lose market share to synthetic diamond sellers. The woman receiving the diamond does not just want price -she wants value. She does not want a commodity transaction; she wants herrelationship with her lover to be more than transactional. She wants her man togive her something valuable because she projects the value of the diamond ontoherself. She wants to think, "He loves me sooo much, he spent sooo much on me."Sure, she wants the biggest and best diamond she can get for their money, butmost importantly she wants him to show her he loves her by buying her somethingexpensive. Something that has no utility other than to make her feel good andconfident about his love for her. The Achilles heel of synthetic diamonds is that they don'thave the ability to store value. Yet an important part of the diamond dream isthe idea that the gift she is receiving is valuable and will stay valuableforever. That is what she is thinking and that is what she is expecting. Thefact that no one is telling her the value of her synthetic diamond willdeteriorate is a great injustice. The diamond dream is about the promise of real love, basedon real emotions, based on a real diamond that maintains real value. Thediamond dream is not about cool technology, celebrating a transactionalrelationship, or a synthetic diamond that has no long-term value. There is nosuch thing as a synthetic diamond dream. Synthetic profitsOur research shows that retailers can make higher profitmargins selling synthetic diamonds.Click on the tables to enlarge.

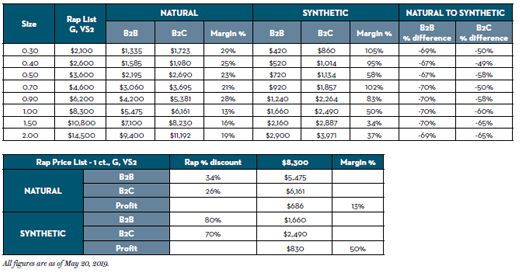

RAPAPORT...Synthetic diamonds are a fundamental threat to the naturaldiamond industry. They are not just a competitive product like gems, pearls, orgold jewelry. They are a replacement product. Their marketers shout out: Don't buynatural diamonds, buy synthetic diamonds because synthetic diamonds are moreethical. They are cheaper. They build up synthetic diamonds by tearing downnatural diamonds.The natural diamond trade is confused and afraid. Ourdiamond distribution system is under relentless attack as retailers are forcedto match lower prices from online sellers who operate at lower costs.Furthermore, suppliers are using the internet to sell direct to consumers,cutting out retailers. Competition is fierce, profit margins are low and peopleare leaving the industry. The problem is not just distribution. Natural diamondsthemselves are under direct attack. Synthetic sellers are mounting marketingand public-relations campaigns to convince consumers that natural diamonds arebad. They claim natural diamonds deface the earth and force child labor. Thereputation of our diamonds and trade are being destroyed in the mind of theconsumer. Identity crisisOur trade is having an identity crisis. Are synthetics moreethical? Are they a good product? Should we sell synthetics? If we sellsynthetics, what does that say about us and our natural diamonds? The synthetic marketing campaigns are just the tip of theiceberg. What's really going on is an attempt to steal the identity of naturaldiamonds and hijack the reason people buy diamonds. Synthetics sellers are notsaying "Buy synthetics because they are more beautiful, sparkly, or well cut."They are saying "Buy synthetics because they are the same as natural diamondsbut with better ethics and lower prices." They are getting under our skin bytrying to capture the idea and promise of natural diamonds. Synthetics are parasites living off the marketing messagethat naturally scarce diamonds are the ultimate gift of love and commitment.Synthetics are trying to steal the Diamond Dream. They don't have their ownmessage. Synthetics are not more ethical.[1]They don't contribute to sustainable economic development in developingcountries. And most importantly they don't hold value. Synthetic pricesSynthetic sellers make a strong argument that syntheticdiamonds are "exactly the same"[2]as natural diamonds. But that's not true. Synthetic diamonds have no naturallimitation of supply. They can be cranked out in unlimited quantities and will bemanufactured as long as there is profit. Given a competitive market, thequantity and supply of synthetic diamonds manufactured will increase untilthere is very little price difference between the cost of manufacturing and thesales price. The wholesale B2B price of synthetics is limited to manufacturingcosts plus a small distribution profit. The cost of manufacturing synthetic diamonds is continuouslydecreasing (it currently stands at $300 to $500 per carat). Technologicaladvances in synthetic processing are being driven by governments and companiesseeking to develop a broad range of futuristic synthetic diamond technologiesthat have nothing to do with jewelry. These include synthetic diamond chips forquantum computers, high-powered CO2 lasers, and even biological applicationsfunded by the US Department of Defense.[3]Extended funding for these advances will create new technology that willfurther reduce the cost of creating synthetics. Think Moore's law on steroids. There are also the tens of thousands of High Pressure-HighTemperature (HPHT) machines in China shifting production from creatingsynthetic diamond abrasives to synthetic gem rough. And let's not forget aboutwhat happened to synthetic emeralds, rubies and sapphires: Their prices plummetedas unlimited production increased supply. For all the above reasons, it is reasonable and rational topredict that synthetic diamond prices will decline significantly over the nextfew years. In fact, according to some reports, prices for 1-carat syntheticshave fallen over 20% in just the last quarter. In contrast, the supply of natural diamonds - particularlylarge expensive diamonds - is limited by their natural occurrence. You can'tjust crank them out. Natural diamond prices are based on scarcity and that iswhy their price per carat increases with size and quality. The scarcersomething is the more valuable it is. Synthetic valuesJewelers considering the sale of synthetic diamondengagement rings should consider the ramifications of what happens when thecustomer comes back in a few years and finds out that her $30,000 diamond isnow worth $3,000 or $300. What will you say? What will you do? Do you thinkthat customer will ever trust you again? Do you think the customer will everagain buy any diamond, synthetic or natural, from you or anyone else again? Consumers are not being told of the sinking value of theirsynthetic diamonds. Jewelers are presenting the diamonds as a discounted itemcompared to natural diamonds even though they are not comparable when it comesto value retention. These jewelers and jewelry companies are misleadingconsumers who think they are buying a diamond that will retain value the way anatural diamond does. An entire generation of millennials is being "ethically"ripped off. Sadly, we have an industry that is cashing in on thereputation of natural diamonds. We are destroying the long-term reputation ofdiamonds as a store of value for short-term synthetic profits. It's shocking tosee so many in our industry willing to take consumers for a ride withoutdisclosing the likely price decline of expensive synthetic diamonds. The diamond dreamSo what is the diamond dream? Why do people buy diamonds?What is the promise of diamonds? Let's talk diamond engagement rings. When a man gives awoman a diamond,[4]there is more going on than the physical exchange of a commodity. Similarly,when a couple has a committed relationship, there is more going on than aone-night Tinder experience. We seek to transcend our physical connection byincorporating high-level emotions into a spiritual relationship. We seek tomake love, not just have sex. The diamond engagement ring is an emotional andspiritual gift that transcends the physical diamond as it communicates thecommitment of love forever. The universally symbolic gift of a diamondengagement ring is similar to a wedding ring, which is "worth" much more thanits weight in gold. The value of the wedding ring incorporates the emotionaland spiritual investment of the couple. So, too, the diamond engagement ring. For many young women, the diamond dream is that one day shewill fall in love. The perfect man will come along, ask her to marry him andgive her a diamond ring to seal that love. The dream starts at a young age -maybe 10 or 12 - and continues throughout her life. Even after she getsmarried, she will look at the ring every day, remembering the love itrepresents. The foundation of diamond demand is the engagement ring. Aman does not give an engagement ring to a woman just because it sparkles. He isgiving her much more than the physical product. He is giving her his promise tobe there for her, for the rest of her life. The value of valuesThe natural diamondtrade does itself a disservice by promoting diamonds based on price. If themost important thing about the diamond is price then why doesn't the man justgive the woman cash? Many in the trade do not know how to sell the emotionalpower of the diamond so they just sell price discounting. It is likely thatthese companies will lose market share to synthetic diamond sellers. The woman receiving the diamond does not just want price -she wants value. She does not want a commodity transaction; she wants herrelationship with her lover to be more than transactional. She wants her man togive her something valuable because she projects the value of the diamond ontoherself. She wants to think, "He loves me sooo much, he spent sooo much on me."Sure, she wants the biggest and best diamond she can get for their money, butmost importantly she wants him to show her he loves her by buying her somethingexpensive. Something that has no utility other than to make her feel good andconfident about his love for her. The Achilles heel of synthetic diamonds is that they don'thave the ability to store value. Yet an important part of the diamond dream isthe idea that the gift she is receiving is valuable and will stay valuableforever. That is what she is thinking and that is what she is expecting. Thefact that no one is telling her the value of her synthetic diamond willdeteriorate is a great injustice. The diamond dream is about the promise of real love, basedon real emotions, based on a real diamond that maintains real value. Thediamond dream is not about cool technology, celebrating a transactionalrelationship, or a synthetic diamond that has no long-term value. There is nosuch thing as a synthetic diamond dream. Synthetic profitsOur research shows that retailers can make higher profitmargins selling synthetic diamonds.Click on the tables to enlarge. The first table presents wholesale (B2B) and retail (B2C) prices fornatural and synthetic diamonds. The second table provides an analysis of how theRapaport list is being used for natural and synthetic diamonds using theexample of fine-cut 1-carat, G-color, VS2-clarity, triple-Ex diamonds. The gross profit margin based on internet B2B to B2C pricesfor a 1-carat, G, VS2 synthetic diamond is 50% versus only 13% for a naturaldiamond. The difference in profit margins is significantly higher for smallersizes. For example, a 0.30-carat synthetic diamond shows a gross profit marginof 105% versus 29% for natural diamonds. Not only are synthetic diamonds muchcheaper to source (-69% B2B price) and easier to sell (-50% B2C price) they arealso much more profitable for the retailer. From a price and profit perspectivesynthetics diamonds are killing natural diamonds. One reason for this is that retailers are not passing on thelower B2B cost of synthetics to consumers. They price synthetics in comparisonto naturals, making consumers think they are getting a good deal. One keyquestion is if such a high markup will be sustainable once B2C competitionexpands and B2B prices come down. Another question is if brick-and-mortarretailers can gain significantly increased margins for natural diamonds basedon their ability to provide added-value services that differentiate the valueproposition of natural diamonds. Given the current pricing and profit structure it's hard forretailers to ignore the short-term attractiveness of synthetic diamonds.Consider, however, where all of this going. There will be significant declinesin the B2B prices as new technology and increased supply impact the market.Competition, particularly internet competition, will be driving down B2C pricesand the profitability of synthetics. Synthetic diamonds will be sold in adownward-moving market with continued price competition. Undoubtedly, short-term temptations will encourage many retailersto sell expensive synthetic diamonds. What will they say to their customerswhen synthetic diamonds go the way of synthetic emeralds, rubies and sapphires?All of us in the diamond trade face an ethical challenge: short-term profitsversus long-term integrity. Leonardo DiCaprio is a great actor and the Titanicwas a great ship. But ask yourself, should you be going down with Leonardo'sTitanic? Synthetic melee and fashion jewelrySo far, our analysis has been limited to expensiveengagement rings and the diamond dream. But what about synthetic melee and themarket for inexpensive fashion jewelry? Our primary concern that expensive synthetic diamond pricesare unsustainable is not a factor when it comes to inexpensive fashion jewelry.De Beers has set a B2C price of $800 per carat for synthetic polished diamondsin sizes up to 1 carat. Assuming rough production costs are about $300 percarat, there is a limited pricing downside considering the diamonds must becut, polished, marketed and delivered to consumers. Furthermore, even if meleeprices do fall significantly, consumers don't care if the price of theirinexpensive fashion jewelry goes down. We are not talking about an emotionalinvestment in a $5,000-plus engagement ring. While the high-end jewelry and watch brands will continue tolimit their purchases to top-quality natural diamond melee, the market formedium to low-quality natural melee will come under continuous pressure.Competition from synthetic melee will increase as synthetic prices continuouslydecline due to technological innovation and increased rough production fromChinese HPHT manufacturers. Absent aggressive DPA marketing, consumers probablywon't care if their fashion jewelry contains synthetic or natural diamonds.It's the look that counts. Ultimately, if synthetic diamonds become extremely cheap, wemay see differentiated demand for natural melee. In the meantime, the fight forthe differentiation of low-quality natural melee appears to be lost. There isno marketing support for natural melee. On the contrary, marketers including DeBeers are supporting synthetic melee and sizes up to 1 carat in fashionjewelry. Given the lack of differentiation marketing and the extremedifficulties associated with continuous testing for natural melee ininexpensive jewelry, it is likely that natural and synthetic melee markets willmerge. Mixed parcels of synthetic and natural diamonds will become the norm. Ifconsumers don't care, why should retailers or dealers? High-end jewelryusing melee for halo, micro-pav?(C) or other settings will have to implementcareful supply chain controls if they wish to ensure natural diamondconsistency in their products. In general, we expect increasing supply chaincontrol for high-end jewelry. One area that may benefit from the confusion isthe melee market for recycled diamonds, which is expected to do well in lightof the increasing emphasis on ethical jewelry sourcing by synthetic suppliers. RecommendationsIt is important to recognize the US Federal Trade Commission's(FTC) policy that consumers are best served with a wide offering of productsand services. Hence, it makes sense for the FTC to legitimize the sale ofsynthetic diamonds to consumers on the condition that there is full disclosureregarding the nature of the product. Unfortunately the FTC and our industry trade organizations[5]fail to require proper full disclosure regarding synthetic diamonds. 1. Consumers must be informedthat "lab-grown diamond prices are subject to significant risk of lower pricesdue to the fact that they can be produced in unlimited quantities. Lab-growndiamond prices may diverge significantly from natural diamond prices which arebased on natural scarcity related to the size and quality of the diamonds." 2. Since the FTC has establishedthat synthetic diamonds and natural diamonds are "diamonds," both types shouldbe treated the same when it comes to treatments. There is no justification forexempting synthetic diamonds from treatment disclosure. Once a syntheticdiamond emerges from its HPHT crucible or CVD device, any further treatmentsmust be disclosed. "Treated lab-created diamond" should be an acceptabledescription. It is fundamentally unfair to require natural diamond disclosureof treatment while exempting synthetic diamonds. 3. The FTC should investigateclaims by synthetic diamond companies "guaranteeing the value of your diamond."Such guarantees only provide credit toward the purchase of other syntheticdiamonds. They do not guarantee the value or price paid for the diamonds.Furthermore, statements by Leonardo DiCaprio and others that refer to syntheticdiamonds as "real diamonds" should be removed from websites. 4. While the Diamond ProducersAssociation (DPA) is to be congratulated for its landmark study of "The Socioeconomicand Environmental Impact of Large-Scale Diamond Mining,"[6]it must aggressively defend the market for large natural diamonds, particularlyengagement rings. It should be highlighting the value-retention differencebetween natural and synthetic diamonds. Consumers need to know that syntheticdiamonds do not retain value due to their unlimited supply. 5. Industry tradeorganizations must address the issue of melee diamonds that cannot be testeddue to their small size, color, tint or low value. Mixed parcels of syntheticand natural diamonds or untested parcels must be recognized as such and tradedwith full disclosure. 6. The diamond trade must makeadditional efforts to eliminate "questionable diamonds" from the supply chain.Synthetic diamond producers are breathing down our necks with claims aboutunacceptable sourcing. Reliance on the Kimberley Process to ensure thelegitimacy of diamonds is no longer sufficient or acceptable. New sourcecertification and provenance systems capable of ensuring an ethical supplychain must be encouraged and promptly implemented. Unethical companies andindividuals must be excluded from the legitimate diamond trade. ConclusionSynthetic diamonds are threatening the integrity of thenatural diamond trade by promoting the sale of expensive synthetic diamondswithout disclosing their inability to store value. Consumers are being misledabout the medium- and long-term value of their synthetic diamonds. Absent fulland fair disclosure it is likely that once consumers find out about the "valueretention problem" they will no longer be interested in buying any diamonds,including natural diamonds. As millennials finally come of marriageable age, we are indanger of losing an entire generation of diamond consumers due to our failureto differentiate our natural diamonds from synthetic diamonds based on valueretention and other factors. Better marketing focusing on the benefits ofnatural diamonds compared to synthetic diamonds is desperately needed. It looks like we have lost the battle for low-qualitynatural melee diamonds. The benefits of natural diamonds for inexpensivefashion jewelry are unclear. Extensive marketing efforts to brand and sellsynthetic diamond jewelry by Swarovski, Diamond Foundry and others are takingplace. Nothing similar is being done for natural diamonds. All of us in the diamond industry face an ethical dilemma:Should we or should we not sell synthetic diamonds? Even with full disclosureabout value retention, we will still have the problem of facing consumers whowill come back in a few years with worth-less synthetic diamonds. From the Rapaport perspective we question the ethics ofestablishing a synthetic diamond trading network on RapNet or publishing aRapaport price list for synthetics. We do not think it is right to create anenabling environment for products that will hurt consumers. So as to gain a better understanding of the trade's positionregarding synthetic diamonds, we will be holding a RapNet vote on syntheticdiamond issues before the Las Vegas show. Your comments and suggestions arealways welcome. To make comments or suggestions visit:library.rapaport.news/syntheticsFootnotes[1] Seethe report by Trucost ESG Analysis:a. Mined polished diamonds produce an average of 160kilograms of CO2 emissions per carat, while lab-grown diamonds produce 511kilograms - more than three times as much.b. The report includes additional information aboutthe ethical benefits provided by natural diamonds.[2]"Lab grown diamonds are exactly the same as mined diamonds." - New DawnDiamonds website (newdawndiamonds.com)[3]"Quantum-assisted Nano-imaging of Living Organism Is a First." darpa.mil/news-events/2013-05-02[4] Whileour comments here refer to a man and woman, we recognize that manyrelationships are same-sex or gender-fluid, or have non-traditional genderroles.[5] Industrytrade organizations include Jewelers of America (JA), the American Gem Society(AGS), the Diamond Dealers Club (DDC), the Diamond Manufacturers &Importers Association of America (DMIA), the World Federation of DiamondBourses (WFDB), the International Diamond Manufacturers Association (IDMA), andthe World Jewellery Confederation (CIBJO).[6] See the report here.Bibliography1. Federal TradeCommission letter tosynthetic producers,March 26, 2019 (hasredacted parts).2. Diamond ProducersAssociation(DPA) report "TheSocioeconomic andEnvironmental Impactof Large-Scale DiamondMining" and pressrelease, May 2, 2019.3. Special RapaportReport on SyntheticDiamonds, February2019.4. "Martin Rapaport onDe Beers' Synthetics,"July 4, 2018.5. Martin Rapaportarticle "Sinthetics,"December 4, 2013.6. Martin Rapaportarticle "Trust,"May 6, 2002.Image: Rough and polished diamonds. (Alrosa/Shutterstock)

The first table presents wholesale (B2B) and retail (B2C) prices fornatural and synthetic diamonds. The second table provides an analysis of how theRapaport list is being used for natural and synthetic diamonds using theexample of fine-cut 1-carat, G-color, VS2-clarity, triple-Ex diamonds. The gross profit margin based on internet B2B to B2C pricesfor a 1-carat, G, VS2 synthetic diamond is 50% versus only 13% for a naturaldiamond. The difference in profit margins is significantly higher for smallersizes. For example, a 0.30-carat synthetic diamond shows a gross profit marginof 105% versus 29% for natural diamonds. Not only are synthetic diamonds muchcheaper to source (-69% B2B price) and easier to sell (-50% B2C price) they arealso much more profitable for the retailer. From a price and profit perspectivesynthetics diamonds are killing natural diamonds. One reason for this is that retailers are not passing on thelower B2B cost of synthetics to consumers. They price synthetics in comparisonto naturals, making consumers think they are getting a good deal. One keyquestion is if such a high markup will be sustainable once B2C competitionexpands and B2B prices come down. Another question is if brick-and-mortarretailers can gain significantly increased margins for natural diamonds basedon their ability to provide added-value services that differentiate the valueproposition of natural diamonds. Given the current pricing and profit structure it's hard forretailers to ignore the short-term attractiveness of synthetic diamonds.Consider, however, where all of this going. There will be significant declinesin the B2B prices as new technology and increased supply impact the market.Competition, particularly internet competition, will be driving down B2C pricesand the profitability of synthetics. Synthetic diamonds will be sold in adownward-moving market with continued price competition. Undoubtedly, short-term temptations will encourage many retailersto sell expensive synthetic diamonds. What will they say to their customerswhen synthetic diamonds go the way of synthetic emeralds, rubies and sapphires?All of us in the diamond trade face an ethical challenge: short-term profitsversus long-term integrity. Leonardo DiCaprio is a great actor and the Titanicwas a great ship. But ask yourself, should you be going down with Leonardo'sTitanic? Synthetic melee and fashion jewelrySo far, our analysis has been limited to expensiveengagement rings and the diamond dream. But what about synthetic melee and themarket for inexpensive fashion jewelry? Our primary concern that expensive synthetic diamond pricesare unsustainable is not a factor when it comes to inexpensive fashion jewelry.De Beers has set a B2C price of $800 per carat for synthetic polished diamondsin sizes up to 1 carat. Assuming rough production costs are about $300 percarat, there is a limited pricing downside considering the diamonds must becut, polished, marketed and delivered to consumers. Furthermore, even if meleeprices do fall significantly, consumers don't care if the price of theirinexpensive fashion jewelry goes down. We are not talking about an emotionalinvestment in a $5,000-plus engagement ring. While the high-end jewelry and watch brands will continue tolimit their purchases to top-quality natural diamond melee, the market formedium to low-quality natural melee will come under continuous pressure.Competition from synthetic melee will increase as synthetic prices continuouslydecline due to technological innovation and increased rough production fromChinese HPHT manufacturers. Absent aggressive DPA marketing, consumers probablywon't care if their fashion jewelry contains synthetic or natural diamonds.It's the look that counts. Ultimately, if synthetic diamonds become extremely cheap, wemay see differentiated demand for natural melee. In the meantime, the fight forthe differentiation of low-quality natural melee appears to be lost. There isno marketing support for natural melee. On the contrary, marketers including DeBeers are supporting synthetic melee and sizes up to 1 carat in fashionjewelry. Given the lack of differentiation marketing and the extremedifficulties associated with continuous testing for natural melee ininexpensive jewelry, it is likely that natural and synthetic melee markets willmerge. Mixed parcels of synthetic and natural diamonds will become the norm. Ifconsumers don't care, why should retailers or dealers? High-end jewelryusing melee for halo, micro-pav?(C) or other settings will have to implementcareful supply chain controls if they wish to ensure natural diamondconsistency in their products. In general, we expect increasing supply chaincontrol for high-end jewelry. One area that may benefit from the confusion isthe melee market for recycled diamonds, which is expected to do well in lightof the increasing emphasis on ethical jewelry sourcing by synthetic suppliers. RecommendationsIt is important to recognize the US Federal Trade Commission's(FTC) policy that consumers are best served with a wide offering of productsand services. Hence, it makes sense for the FTC to legitimize the sale ofsynthetic diamonds to consumers on the condition that there is full disclosureregarding the nature of the product. Unfortunately the FTC and our industry trade organizations[5]fail to require proper full disclosure regarding synthetic diamonds. 1. Consumers must be informedthat "lab-grown diamond prices are subject to significant risk of lower pricesdue to the fact that they can be produced in unlimited quantities. Lab-growndiamond prices may diverge significantly from natural diamond prices which arebased on natural scarcity related to the size and quality of the diamonds." 2. Since the FTC has establishedthat synthetic diamonds and natural diamonds are "diamonds," both types shouldbe treated the same when it comes to treatments. There is no justification forexempting synthetic diamonds from treatment disclosure. Once a syntheticdiamond emerges from its HPHT crucible or CVD device, any further treatmentsmust be disclosed. "Treated lab-created diamond" should be an acceptabledescription. It is fundamentally unfair to require natural diamond disclosureof treatment while exempting synthetic diamonds. 3. The FTC should investigateclaims by synthetic diamond companies "guaranteeing the value of your diamond."Such guarantees only provide credit toward the purchase of other syntheticdiamonds. They do not guarantee the value or price paid for the diamonds.Furthermore, statements by Leonardo DiCaprio and others that refer to syntheticdiamonds as "real diamonds" should be removed from websites. 4. While the Diamond ProducersAssociation (DPA) is to be congratulated for its landmark study of "The Socioeconomicand Environmental Impact of Large-Scale Diamond Mining,"[6]it must aggressively defend the market for large natural diamonds, particularlyengagement rings. It should be highlighting the value-retention differencebetween natural and synthetic diamonds. Consumers need to know that syntheticdiamonds do not retain value due to their unlimited supply. 5. Industry tradeorganizations must address the issue of melee diamonds that cannot be testeddue to their small size, color, tint or low value. Mixed parcels of syntheticand natural diamonds or untested parcels must be recognized as such and tradedwith full disclosure. 6. The diamond trade must makeadditional efforts to eliminate "questionable diamonds" from the supply chain.Synthetic diamond producers are breathing down our necks with claims aboutunacceptable sourcing. Reliance on the Kimberley Process to ensure thelegitimacy of diamonds is no longer sufficient or acceptable. New sourcecertification and provenance systems capable of ensuring an ethical supplychain must be encouraged and promptly implemented. Unethical companies andindividuals must be excluded from the legitimate diamond trade. ConclusionSynthetic diamonds are threatening the integrity of thenatural diamond trade by promoting the sale of expensive synthetic diamondswithout disclosing their inability to store value. Consumers are being misledabout the medium- and long-term value of their synthetic diamonds. Absent fulland fair disclosure it is likely that once consumers find out about the "valueretention problem" they will no longer be interested in buying any diamonds,including natural diamonds. As millennials finally come of marriageable age, we are indanger of losing an entire generation of diamond consumers due to our failureto differentiate our natural diamonds from synthetic diamonds based on valueretention and other factors. Better marketing focusing on the benefits ofnatural diamonds compared to synthetic diamonds is desperately needed. It looks like we have lost the battle for low-qualitynatural melee diamonds. The benefits of natural diamonds for inexpensivefashion jewelry are unclear. Extensive marketing efforts to brand and sellsynthetic diamond jewelry by Swarovski, Diamond Foundry and others are takingplace. Nothing similar is being done for natural diamonds. All of us in the diamond industry face an ethical dilemma:Should we or should we not sell synthetic diamonds? Even with full disclosureabout value retention, we will still have the problem of facing consumers whowill come back in a few years with worth-less synthetic diamonds. From the Rapaport perspective we question the ethics ofestablishing a synthetic diamond trading network on RapNet or publishing aRapaport price list for synthetics. We do not think it is right to create anenabling environment for products that will hurt consumers. So as to gain a better understanding of the trade's positionregarding synthetic diamonds, we will be holding a RapNet vote on syntheticdiamond issues before the Las Vegas show. Your comments and suggestions arealways welcome. To make comments or suggestions visit:library.rapaport.news/syntheticsFootnotes[1] Seethe report by Trucost ESG Analysis:a. Mined polished diamonds produce an average of 160kilograms of CO2 emissions per carat, while lab-grown diamonds produce 511kilograms - more than three times as much.b. The report includes additional information aboutthe ethical benefits provided by natural diamonds.[2]"Lab grown diamonds are exactly the same as mined diamonds." - New DawnDiamonds website (newdawndiamonds.com)[3]"Quantum-assisted Nano-imaging of Living Organism Is a First." darpa.mil/news-events/2013-05-02[4] Whileour comments here refer to a man and woman, we recognize that manyrelationships are same-sex or gender-fluid, or have non-traditional genderroles.[5] Industrytrade organizations include Jewelers of America (JA), the American Gem Society(AGS), the Diamond Dealers Club (DDC), the Diamond Manufacturers &Importers Association of America (DMIA), the World Federation of DiamondBourses (WFDB), the International Diamond Manufacturers Association (IDMA), andthe World Jewellery Confederation (CIBJO).[6] See the report here.Bibliography1. Federal TradeCommission letter tosynthetic producers,March 26, 2019 (hasredacted parts).2. Diamond ProducersAssociation(DPA) report "TheSocioeconomic andEnvironmental Impactof Large-Scale DiamondMining" and pressrelease, May 2, 2019.3. Special RapaportReport on SyntheticDiamonds, February2019.4. "Martin Rapaport onDe Beers' Synthetics,"July 4, 2018.5. Martin Rapaportarticle "Sinthetics,"December 4, 2013.6. Martin Rapaportarticle "Trust,"May 6, 2002.Image: Rough and polished diamonds. (Alrosa/Shutterstock)