Melior Resources Inc. (TSXV: MLR): Completed the Restart Program on Time and on Budget at Goondicum Ilmenite Mine in Queensland Australia; Interview with Mark McCauley, Director and CEO

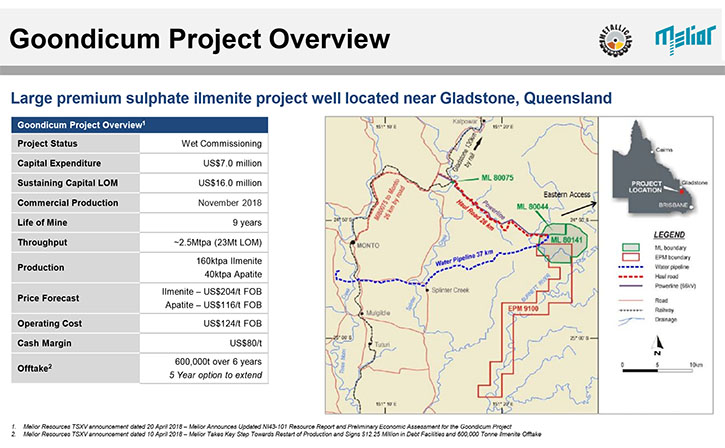

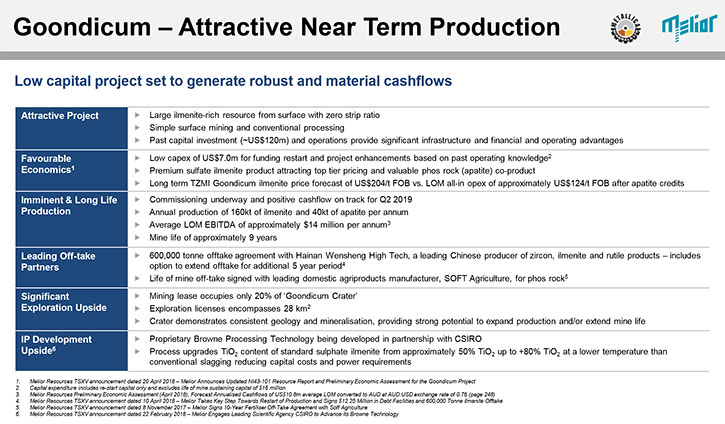

Melior Resources Inc. (TSXV: MLR) is the owner and operator of the Goondicum ilmenite mine, a past-producing ilmenite and apatite mine, strategically located in Queensland Australia. We learned from Mark McCauley, Director and CEO of Melior Resources, that they have completed the restart program at Goondicum on time and on budget. As of early November, they have moved from the construction phase into the commissioning phase and have started putting ore through the processing plant and commissioning the facility. According to Mr. McCauley, Goondicum is anticipated to be in full production middle of next year, and cash flow positive in the second quarter of 2019. The project will produce ilmenite for export to China, Japan, and Korea, and phosphate rock for a domestic agri-tech company in Australia. Melior Resources Inc.Dr. Allen Alper:This is Dr. Allen Alper, Editor in Chief of Metals News, talking with Mark McCauley who is Director and CEO of Melior Resources. I wonder, Mark, if you could give our readers/investors an overview of Melior Resources?Mark McCauley:Okay. Well, thanks for having me on this interview, Allen. With respect to Melior Resources, we are a TSXV listed company, market ticker MLR, and our primary asset is the Goondicum apatite and ilmenite mine in Queensland, Australia. We've owned that since 2014. That project had been in production previously, and it last operated in 2015, before we suspended production due to some very low ilmenite prices. However, in the last 18 months, both the ilmenite price and the phosphate rock price have increased significantly and the future forecast for both those commodities looks particularly robust, with good indications for prices to be sustained at levels that make Goondicum look very attractive. In the last six months, we have been completing a 7.5 million dollar restart program at Goondicum, and have just completed that program on time and on budget. The project has now moved from the construction phase into the commissioning phase and we have started putting ore through the processing plant and commissioning the facility. That's been a great step forward for Melior and Goondicum. We're all very excited about our progress to date and the future for Goondicum.

Melior Resources Inc.Dr. Allen Alper:This is Dr. Allen Alper, Editor in Chief of Metals News, talking with Mark McCauley who is Director and CEO of Melior Resources. I wonder, Mark, if you could give our readers/investors an overview of Melior Resources?Mark McCauley:Okay. Well, thanks for having me on this interview, Allen. With respect to Melior Resources, we are a TSXV listed company, market ticker MLR, and our primary asset is the Goondicum apatite and ilmenite mine in Queensland, Australia. We've owned that since 2014. That project had been in production previously, and it last operated in 2015, before we suspended production due to some very low ilmenite prices. However, in the last 18 months, both the ilmenite price and the phosphate rock price have increased significantly and the future forecast for both those commodities looks particularly robust, with good indications for prices to be sustained at levels that make Goondicum look very attractive. In the last six months, we have been completing a 7.5 million dollar restart program at Goondicum, and have just completed that program on time and on budget. The project has now moved from the construction phase into the commissioning phase and we have started putting ore through the processing plant and commissioning the facility. That's been a great step forward for Melior and Goondicum. We're all very excited about our progress to date and the future for Goondicum. Dr. Allen Alper:Well that sounds excellent. This is an exciting time for Melior and I'm sure all our readers/investors will be very interested in the results you'll be getting in the next quarter, as you bring the operation back into production.Mark McCauley:I think that's right.It will take us about six months to ramp up to full production, Allen, and so we've only just started that process. That process involves particularly focusing on operator training and we're off to a very good start and anticipate that to be a relatively smooth ramp up. We expect to be in full production middle of next year and cash flow positive in the second quarter of 2019.Dr. Allen Alper:That sounds exciting. That's great! Could you tell our readers/investors a little bit about the products you'll be retrieving and the markets they'll be going to?Mark McCauley:Yes, definitely.We have two products, ilmenite and phosphate rock. Our phosphate rock is a very clean phosphate rock. It has no cadmium or heavy metals in it. It runs at about 32% P2O5 content, which is quite high, and we sell all of that to a domestic agri-tech company in Australia. They use it to produce organic fertilizer, which we think is a great sector to be exposed to. Organic fertilizers are certainly a growing sector and becoming very popular in Australia. We sell that product on an on truck basis at the mine site in Australian dollars, and we have a ten year off-take agreement with that Australian domestic company. So that's in good shape.We export all of the ilmenite. That's a titanium dioxide mineral and is primarily used to extract the titanium dioxide to produce pigment, used in paints, inks, plastics. Titanium pigment is very good at diffracting or blocking light and giving paint its opaqueness and its brilliant colors. So, we export all our ilmenite to China, Japan, and Korea, primarily, although given that we have upgraded our product spec for our ilmenite in this restart, we have had inquiries from farther afield, including Europe and North America. A very important aspect of this restart is taking our ilmenite product from a previously second tier product, that was still good and the customers still liked to use, up to a top tier quality product.

Dr. Allen Alper:Well that sounds excellent. This is an exciting time for Melior and I'm sure all our readers/investors will be very interested in the results you'll be getting in the next quarter, as you bring the operation back into production.Mark McCauley:I think that's right.It will take us about six months to ramp up to full production, Allen, and so we've only just started that process. That process involves particularly focusing on operator training and we're off to a very good start and anticipate that to be a relatively smooth ramp up. We expect to be in full production middle of next year and cash flow positive in the second quarter of 2019.Dr. Allen Alper:That sounds exciting. That's great! Could you tell our readers/investors a little bit about the products you'll be retrieving and the markets they'll be going to?Mark McCauley:Yes, definitely.We have two products, ilmenite and phosphate rock. Our phosphate rock is a very clean phosphate rock. It has no cadmium or heavy metals in it. It runs at about 32% P2O5 content, which is quite high, and we sell all of that to a domestic agri-tech company in Australia. They use it to produce organic fertilizer, which we think is a great sector to be exposed to. Organic fertilizers are certainly a growing sector and becoming very popular in Australia. We sell that product on an on truck basis at the mine site in Australian dollars, and we have a ten year off-take agreement with that Australian domestic company. So that's in good shape.We export all of the ilmenite. That's a titanium dioxide mineral and is primarily used to extract the titanium dioxide to produce pigment, used in paints, inks, plastics. Titanium pigment is very good at diffracting or blocking light and giving paint its opaqueness and its brilliant colors. So, we export all our ilmenite to China, Japan, and Korea, primarily, although given that we have upgraded our product spec for our ilmenite in this restart, we have had inquiries from farther afield, including Europe and North America. A very important aspect of this restart is taking our ilmenite product from a previously second tier product, that was still good and the customers still liked to use, up to a top tier quality product.  We have added a circuit to the processing facility that takes the ilmenite from that second tier product up to a genuine, top tier product. Having the best product is a great place to be when you're selling industrial minerals. And we now have as good a product as anyone in the world. It has 50% TiO2, very low Fe2O3, so it's very reactive and we have very low impurities including chrome, very little radioactive elements and no phosphate.So, that's a big step forward on the marketing front. We have a six year off-take agreement, with a very reputable Chinese producer and they have prepaid us five million U.S. dollars, which we will repay over the next six years. They are a good quality customer and we're very pleased to have them as a partner. We also have a marketing agreement with one of the large Japanese trading firms to place our ilmenite product into Japan and Korea, and so there's a little bit of geographic diversity there between China, Japan, and Korea.

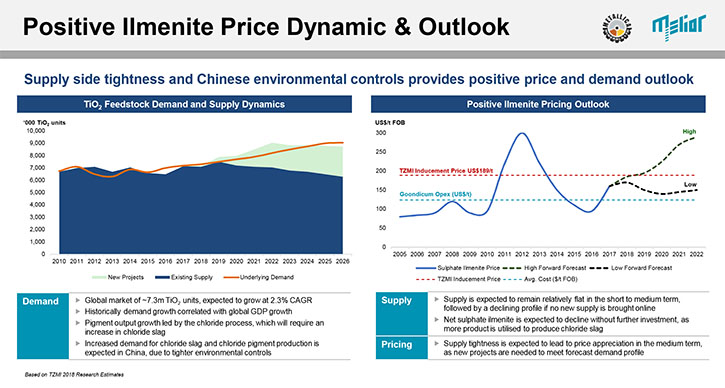

We have added a circuit to the processing facility that takes the ilmenite from that second tier product up to a genuine, top tier product. Having the best product is a great place to be when you're selling industrial minerals. And we now have as good a product as anyone in the world. It has 50% TiO2, very low Fe2O3, so it's very reactive and we have very low impurities including chrome, very little radioactive elements and no phosphate.So, that's a big step forward on the marketing front. We have a six year off-take agreement, with a very reputable Chinese producer and they have prepaid us five million U.S. dollars, which we will repay over the next six years. They are a good quality customer and we're very pleased to have them as a partner. We also have a marketing agreement with one of the large Japanese trading firms to place our ilmenite product into Japan and Korea, and so there's a little bit of geographic diversity there between China, Japan, and Korea. So, we think we're in good shape. I've just come back from Singapore where the annual TZMI conference was held and the mood there is quite buoyant and generally, people expect today's prices to hold up through 2019 and further into the future and that's a good case for Goondicum, with respect to pricing.Dr. Allen Alper:That sounds excellent. Could you tell our readers/investors a little bit about what kind of financial trend projections you see for developing in 2019?Mark McCauley:I'm a little constrained on what financial numbers I can talk about, but we recently did a preliminary economic assessment in early 2018 and that's on our website. That talks about the economics of this project and that generally aligns with our own internal management thinking. So, this project has a ten year mine life. By virtue of the very low amount that we've spent to get it back into operation, it will have a very high rate of return as far as the project is concerned. We do anticipate being cash positive in the second quarter of 2019. We operate on a June to June financial year, so for the financial year 2020, we anticipate hitting full production and getting the full benefit of that through a very healthy EBIT dollar figure and profitability figure.That will put the company in good stead and we'll use that cash primarily for debt repayment and to position ourselves for further merger and acquisition type investigations.Dr. Allen Alper:That sounds very good. Could you tell our readers/investors a little bit about yourself and your team and your board?Mark McCauley:Definitely.

So, we think we're in good shape. I've just come back from Singapore where the annual TZMI conference was held and the mood there is quite buoyant and generally, people expect today's prices to hold up through 2019 and further into the future and that's a good case for Goondicum, with respect to pricing.Dr. Allen Alper:That sounds excellent. Could you tell our readers/investors a little bit about what kind of financial trend projections you see for developing in 2019?Mark McCauley:I'm a little constrained on what financial numbers I can talk about, but we recently did a preliminary economic assessment in early 2018 and that's on our website. That talks about the economics of this project and that generally aligns with our own internal management thinking. So, this project has a ten year mine life. By virtue of the very low amount that we've spent to get it back into operation, it will have a very high rate of return as far as the project is concerned. We do anticipate being cash positive in the second quarter of 2019. We operate on a June to June financial year, so for the financial year 2020, we anticipate hitting full production and getting the full benefit of that through a very healthy EBIT dollar figure and profitability figure.That will put the company in good stead and we'll use that cash primarily for debt repayment and to position ourselves for further merger and acquisition type investigations.Dr. Allen Alper:That sounds very good. Could you tell our readers/investors a little bit about yourself and your team and your board?Mark McCauley:Definitely. I'm actually a mining engineer from a long time ago. Have been in the mining industry for 30 years, both in Australia and offshore. Have been involved in several commodities including coal, gold and mineral sands. I have previously done a variety of jobs including being CFO for a billion dollar ASX listed coal company that we took from a market capital of $35 million up to over a billion dollars in three years, and that was a very exciting time, and, in fact, I see real parallels with Goondicum and Melior Resources to what we did some time ago with a company called Felix Resources in the coal industry.My Board is a small, but very capable bunch of individuals. We have Martyn Buttenshaw, who is a Pala Investment adviser. Martyn is a mining engineer and has very broad experience across a breadth of background including finance, operations and marketing, so he's a strong, capable character. Martyn's the Chairman.

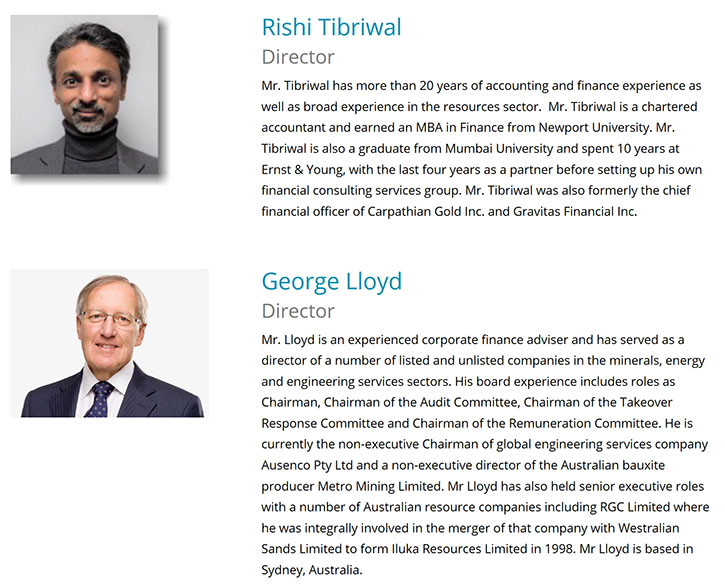

I'm actually a mining engineer from a long time ago. Have been in the mining industry for 30 years, both in Australia and offshore. Have been involved in several commodities including coal, gold and mineral sands. I have previously done a variety of jobs including being CFO for a billion dollar ASX listed coal company that we took from a market capital of $35 million up to over a billion dollars in three years, and that was a very exciting time, and, in fact, I see real parallels with Goondicum and Melior Resources to what we did some time ago with a company called Felix Resources in the coal industry.My Board is a small, but very capable bunch of individuals. We have Martyn Buttenshaw, who is a Pala Investment adviser. Martyn is a mining engineer and has very broad experience across a breadth of background including finance, operations and marketing, so he's a strong, capable character. Martyn's the Chairman. We have George Lloyd who has just joined our Board in the middle of 2018. I've worked with George for over 15 years. He's a very capable individual and has a long background in mineral sands and a breadth of experience in corporate advisory and the financial aspects of resources.Rishi Tibriwal has a financial background. Rishi's based in Toronto and is a very capable individual as well, so between those three non-executive directors and myself, I think we have a fairly lean, but very capable team of individuals, who are very committed to taking Melior forward and doing something pretty exciting with the company.

We have George Lloyd who has just joined our Board in the middle of 2018. I've worked with George for over 15 years. He's a very capable individual and has a long background in mineral sands and a breadth of experience in corporate advisory and the financial aspects of resources.Rishi Tibriwal has a financial background. Rishi's based in Toronto and is a very capable individual as well, so between those three non-executive directors and myself, I think we have a fairly lean, but very capable team of individuals, who are very committed to taking Melior forward and doing something pretty exciting with the company. Dr. Allen Alper:That sounds excellent. You have a very strong background and your Board members have excellent background and can give your great support in financing et cetera.Could you tell me a little bit more about your share and capital structure?Mark McCauley:Certainly. Melior has just under 29 million shares issued. We are currently trading at around 80 Canadian cents per share. That gives us a market capital of about $25 million, which, of course, we think is significantly undervalued, given the stage of our project and the pending cash generation and sustained production outlook for Goondicum.We do have a debt facility on the balance sheet and that's with Pala Investments. Pala is one of our major shareholders as well. Pala has 45% of the company and we currently have 12 million U.S. dollars in debt, which has a two year tenure with a 12 month extension option, so we have three years, effectively, to repay that U.S. $12 million and that's all been used to restart Goondicum and refinance previous debt that the company incurred, while the project was on care and maintenance. So, that's the capital structure.Dr. Allen Alper:Very good. Sounds like you're in good shape. What are the primary reasons our high-net-worth readers/investors should consider investing in Melior Resources?Mark McCauley:Well, there's quite a compelling case to put forward, Allen. We have just completed our construction program on time and on budget. So, that box has been ticked. A big de-risk effort has gone on there and we have just started putting ore through our facility and are building up into commissioning,which is all looking very positive. The share price has yet to react to that progress in our operational status. It's lagging somewhat, so now is a great opportunity to invest in Melior and take advantage of our imminent progress, over the next six months, as we ramp up through commissioning and move into positive cash generation. That's a big change, obviously, for Melior and will allow us to do a lot of other things with respect to further enhancement of Goondicum. We have some big plans there, for both expansion and for some installation of additional infrastructure to lower the cost of production at that project. There's plenty of additional value we can get out of Goondicum over the next 12 months and we'll look to accelerate those projects.

Dr. Allen Alper:That sounds excellent. You have a very strong background and your Board members have excellent background and can give your great support in financing et cetera.Could you tell me a little bit more about your share and capital structure?Mark McCauley:Certainly. Melior has just under 29 million shares issued. We are currently trading at around 80 Canadian cents per share. That gives us a market capital of about $25 million, which, of course, we think is significantly undervalued, given the stage of our project and the pending cash generation and sustained production outlook for Goondicum.We do have a debt facility on the balance sheet and that's with Pala Investments. Pala is one of our major shareholders as well. Pala has 45% of the company and we currently have 12 million U.S. dollars in debt, which has a two year tenure with a 12 month extension option, so we have three years, effectively, to repay that U.S. $12 million and that's all been used to restart Goondicum and refinance previous debt that the company incurred, while the project was on care and maintenance. So, that's the capital structure.Dr. Allen Alper:Very good. Sounds like you're in good shape. What are the primary reasons our high-net-worth readers/investors should consider investing in Melior Resources?Mark McCauley:Well, there's quite a compelling case to put forward, Allen. We have just completed our construction program on time and on budget. So, that box has been ticked. A big de-risk effort has gone on there and we have just started putting ore through our facility and are building up into commissioning,which is all looking very positive. The share price has yet to react to that progress in our operational status. It's lagging somewhat, so now is a great opportunity to invest in Melior and take advantage of our imminent progress, over the next six months, as we ramp up through commissioning and move into positive cash generation. That's a big change, obviously, for Melior and will allow us to do a lot of other things with respect to further enhancement of Goondicum. We have some big plans there, for both expansion and for some installation of additional infrastructure to lower the cost of production at that project. There's plenty of additional value we can get out of Goondicum over the next 12 months and we'll look to accelerate those projects. We will also look at other appropriate operating and development projects for the company to merge with or acquire. I have successfully done that several times before. That's a great way to get strong growth into a company, particularly if you have a great platform with an existing asset like Melior has.Dr. Allen Alper:That sounds like very strong reasons to consider investing in Melior. The timing seems to be really great. Is there anything else you'd like to add, Mark?Mark McCauley:No, I don't think so, Allen, I think that sums us up pretty well. We look forward to talking with you over the next six months as we continue to deliver on what we say we're going to do, as we have done in the last 12 months. Dr. Allen Alper:That sounds great! We'll publish your press releases as they come out so our readers/investors can follow your progress.http://www.meliorresources.com/Mark McCauleyChief Executive Officer+61 7 3233 6300info@meliorresources.com

We will also look at other appropriate operating and development projects for the company to merge with or acquire. I have successfully done that several times before. That's a great way to get strong growth into a company, particularly if you have a great platform with an existing asset like Melior has.Dr. Allen Alper:That sounds like very strong reasons to consider investing in Melior. The timing seems to be really great. Is there anything else you'd like to add, Mark?Mark McCauley:No, I don't think so, Allen, I think that sums us up pretty well. We look forward to talking with you over the next six months as we continue to deliver on what we say we're going to do, as we have done in the last 12 months. Dr. Allen Alper:That sounds great! We'll publish your press releases as they come out so our readers/investors can follow your progress.http://www.meliorresources.com/Mark McCauleyChief Executive Officer+61 7 3233 6300info@meliorresources.com