Mike Davies, CFO, GCM Mining Corp. (TSX: GCM, OTCQX: TPRFF) Discusses Being a Mid-Tier Gold Producer, with a Proven Track Record of Mine Building and Operating, in Latin America

We spoke with Mike Davies, who is CFO of GCM Mining Corp. (TSX: GCM, OTCQX: TPRFF), a mid-tier gold producer, with a proven track record of mine building and operating, in Latin America. In Colombia, the Company is the leading high-grade underground gold and silver producer, with several mines in operation at its Segovia Operations, which produced 206,389 ounces of gold in 2021. In Guyana, the Company is advancing its, fully funded, Toroparu Project, one of the largest undeveloped gold/copper projects in the Americas, which is expected to commence production of more than 200,000 ounces of gold, annually in 2024. GCM Mining pays a monthly dividend to its shareholders and has equity interests in Aris Gold Corporation (~44%; TSX: ARIS; Colombia - Marmato, Soto Norte; Canada - Juby), Denarius Metals Corp. (~29%; TSX-V: DSLV; Spain - Lomero-Poyatos and Colombia - Guia Antigua, Zancudo) and Western Atlas Resources Inc. (~26%; TSX-V: WA: Nunavut - Meadowbank). GCM Mining Corp.Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Mike Davies, who is CFO of GCM Mining. Mike, could you give our readers/investors an overview of your Company and what differentiates it from others? Mike Davies: To give you an update on the story of GCM Mining, we're a Company focused on growth, through diversification, while paying a monthly dividend to our shareholders. We have two cornerstone assets in the Company, our Segovia operations in Colombia, one of the leading high-grade gold projects in Colombia. We've produced over 200,000 ounces a year from Segovia and it's a very significant free cash flow generator for us.

GCM Mining Corp.Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Mike Davies, who is CFO of GCM Mining. Mike, could you give our readers/investors an overview of your Company and what differentiates it from others? Mike Davies: To give you an update on the story of GCM Mining, we're a Company focused on growth, through diversification, while paying a monthly dividend to our shareholders. We have two cornerstone assets in the Company, our Segovia operations in Colombia, one of the leading high-grade gold projects in Colombia. We've produced over 200,000 ounces a year from Segovia and it's a very significant free cash flow generator for us.  Last year we acquired the Toroparu Project in Guyana, one of the largest undeveloped gold/copper projects in Latin America. It's fully funded for us to move forward and develop, over the next two years, and we expect to be up and running, with more than 200,000 ounces a year of production, starting in 2024. We also have a couple of interesting equity investments, so I think overall what we have is a portfolio of some very large-scale projects.

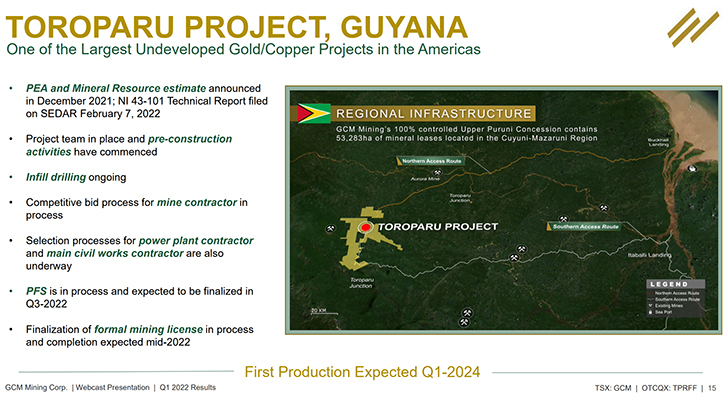

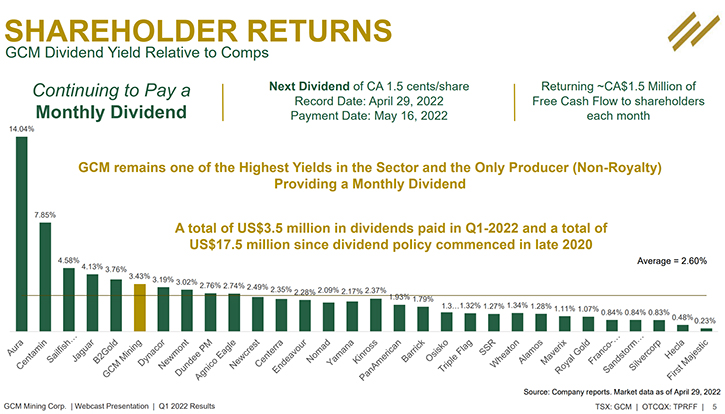

Last year we acquired the Toroparu Project in Guyana, one of the largest undeveloped gold/copper projects in Latin America. It's fully funded for us to move forward and develop, over the next two years, and we expect to be up and running, with more than 200,000 ounces a year of production, starting in 2024. We also have a couple of interesting equity investments, so I think overall what we have is a portfolio of some very large-scale projects.  We are still relatively undervalued, compared to peers, on a like for like basis. We offer a dividend, which at current prices is about a 4% yield and we pay monthly, which we think differentiates us. We think we offer a really terrific value proposition and certainly our Management Team has demonstrated, over the last number of years, a commitment to executing our strategy and meeting our guidance.Dr. Allen Alper: That sounds excellent. Could you tell us a little bit more about your key projects, your diversification and also the equity positions you have? Mike Davies: Let's just start with our cornerstone project in Colombia, the Segovia operations. It's a collection of mines, operating within a mining district, of which we own 100%. We own the land, the mineral rights and surface rights, at our Segovia operations in perpetuity. It's not a concession, but it's a private property that we own, which is a very unique characteristic of the project. The project dates back to the 1850s and over that period of time has produced more than 6 million ounces of gold. During the last 11 years that we've owned the project, we've produced a million and a half ounces of high-grade material. Our average historical grade is over 13 grams per tonne at the Segovia operations. That's one of the key facets of the project and it's open, as far as exploration goes. It not only has a long history behind it, but we think it has many years of prosperous future in front of it. The second project that we've added, as our expansion outside of Colombia to obtain some diversification, is the Toroparu project in Guyana. It's a large-scale, open pit resource, with some underground resources now captured in it for the first time, with an updated resource and PEA that we released last December. There are 8.4 million ounces of measured indicated gold on the project, and over 140 million tons of copper to be recovered over the mine life that we've set out for it in the PEA. From an exploration standpoint, it's open along strike as well as at depth. We released a PEA for the project last year in December, with some very attractive, high-quality economics for the project. We're currently infill drilling the resource and anticipate that we will be releasing the results of a pre-feasibility study by the end of July of this year. We've already gotten started on the project, with pre-construction activities and contractor selection processes and EPCM contractor selection processes, so we're getting a running start on the project. We really like Guyana as a new country in which to invest. It has a good rule of law, it's English speaking and it really is a new frontier.

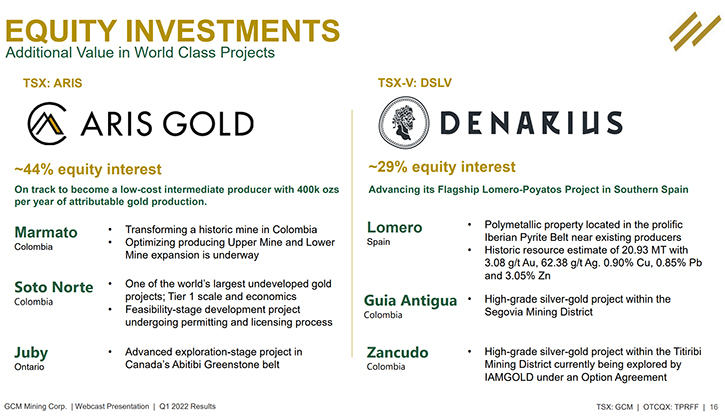

We are still relatively undervalued, compared to peers, on a like for like basis. We offer a dividend, which at current prices is about a 4% yield and we pay monthly, which we think differentiates us. We think we offer a really terrific value proposition and certainly our Management Team has demonstrated, over the last number of years, a commitment to executing our strategy and meeting our guidance.Dr. Allen Alper: That sounds excellent. Could you tell us a little bit more about your key projects, your diversification and also the equity positions you have? Mike Davies: Let's just start with our cornerstone project in Colombia, the Segovia operations. It's a collection of mines, operating within a mining district, of which we own 100%. We own the land, the mineral rights and surface rights, at our Segovia operations in perpetuity. It's not a concession, but it's a private property that we own, which is a very unique characteristic of the project. The project dates back to the 1850s and over that period of time has produced more than 6 million ounces of gold. During the last 11 years that we've owned the project, we've produced a million and a half ounces of high-grade material. Our average historical grade is over 13 grams per tonne at the Segovia operations. That's one of the key facets of the project and it's open, as far as exploration goes. It not only has a long history behind it, but we think it has many years of prosperous future in front of it. The second project that we've added, as our expansion outside of Colombia to obtain some diversification, is the Toroparu project in Guyana. It's a large-scale, open pit resource, with some underground resources now captured in it for the first time, with an updated resource and PEA that we released last December. There are 8.4 million ounces of measured indicated gold on the project, and over 140 million tons of copper to be recovered over the mine life that we've set out for it in the PEA. From an exploration standpoint, it's open along strike as well as at depth. We released a PEA for the project last year in December, with some very attractive, high-quality economics for the project. We're currently infill drilling the resource and anticipate that we will be releasing the results of a pre-feasibility study by the end of July of this year. We've already gotten started on the project, with pre-construction activities and contractor selection processes and EPCM contractor selection processes, so we're getting a running start on the project. We really like Guyana as a new country in which to invest. It has a good rule of law, it's English speaking and it really is a new frontier.  There is an emergence of a number of larger players, such as Barrick, in the country as well, so we know that it has some credibility, as far as a mining jurisdiction, by the names of other people that are flocking to Guyana, right now, to look at it as a new mining jurisdiction. We're fully funded for the project, we raised $300 million, through a senior note, last August. We have another $138 million of funding, to come from Wheaton Precious Metals, through a gold and silver stream that the previous owners had arranged, for the project, several years ago.With a $355 million upfront capital cost, we have more than the funding required to complete construction and expect to be in operation early 2024 and producing over 225,000 ounces of gold a year and a two-year payback on the project. Dr. Allen Alper: That's fantastic! That's excellent!Mike Davies: We have two significant equity investments. One is Aris Gold Corp., which is a TSX listed Company that came together in early 2021. It's the who's who of Canadian mining, the Company's led by Neil Woodyer of Endeavor Mining and Leagold fame, as the CEO of the Company. Ian Telfer is the Chairman of the Company. Frank Giustra, Peter Marrone and David Garofalo are all involved, Frank Giustra as an advisor to the Board and the others are members of the Board. So, a very qualified group of individuals, with tremendous mining background and they're looking to build the next relevant gold producer, a global gold producer. Marmato is the project that we owned. It spun out to Caldas Gold. Neil and his Team took over the Company and Management, and renamed it Aris Gold. We own 44% and they've recently added to their portfolio a 20% interest in the Soto Norte Project, one of the largest undeveloped global gold projects. It's a tier one project, with great economics and scale. So, they're starting to evolve their strategy, to build a much larger Company. Our other investment is in Denarius Metals Corp. Denarius is a junior that formed about a year ago, we own 29% of it. Denarius has really settled in on the Iberian Pyrite Belt, a very prolific area of massive sulfides. Denarius acquired the Lomero Project, which is a Polymetallic project that has some historic production and a really sizable historic resource, with 21 million tons of material, with copper, lead, zinc, gold and silver.

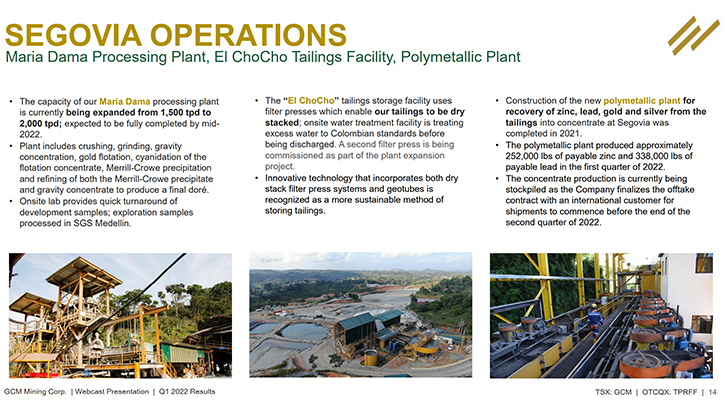

There is an emergence of a number of larger players, such as Barrick, in the country as well, so we know that it has some credibility, as far as a mining jurisdiction, by the names of other people that are flocking to Guyana, right now, to look at it as a new mining jurisdiction. We're fully funded for the project, we raised $300 million, through a senior note, last August. We have another $138 million of funding, to come from Wheaton Precious Metals, through a gold and silver stream that the previous owners had arranged, for the project, several years ago.With a $355 million upfront capital cost, we have more than the funding required to complete construction and expect to be in operation early 2024 and producing over 225,000 ounces of gold a year and a two-year payback on the project. Dr. Allen Alper: That's fantastic! That's excellent!Mike Davies: We have two significant equity investments. One is Aris Gold Corp., which is a TSX listed Company that came together in early 2021. It's the who's who of Canadian mining, the Company's led by Neil Woodyer of Endeavor Mining and Leagold fame, as the CEO of the Company. Ian Telfer is the Chairman of the Company. Frank Giustra, Peter Marrone and David Garofalo are all involved, Frank Giustra as an advisor to the Board and the others are members of the Board. So, a very qualified group of individuals, with tremendous mining background and they're looking to build the next relevant gold producer, a global gold producer. Marmato is the project that we owned. It spun out to Caldas Gold. Neil and his Team took over the Company and Management, and renamed it Aris Gold. We own 44% and they've recently added to their portfolio a 20% interest in the Soto Norte Project, one of the largest undeveloped global gold projects. It's a tier one project, with great economics and scale. So, they're starting to evolve their strategy, to build a much larger Company. Our other investment is in Denarius Metals Corp. Denarius is a junior that formed about a year ago, we own 29% of it. Denarius has really settled in on the Iberian Pyrite Belt, a very prolific area of massive sulfides. Denarius acquired the Lomero Project, which is a Polymetallic project that has some historic production and a really sizable historic resource, with 21 million tons of material, with copper, lead, zinc, gold and silver.  It has a significant resource there that the Company had raised money for drilling the resource, proving out the historic resource and, by about the third quarter of this year, will be publishing a PEA, charting the course of how they'll bring this tremendous polymetallic project into production. Four projects, which all give us exposure, not only to gold, but to the emerging metals in the base metals side and a great portfolio of assets, for us to create value for the shareholders. Dr. Allen Alper: Well, that's really excellent to have such high-quality projects and portfolio and investments. So that's excellent work. Could you tell our readers/investors your primary goals for this year? I know you have a great deal, not only of operations, but also exploration. So maybe you could tell us what you're doing with improving operations, your cash flow and exploration activities. Mike Davies: Thinking of each of the individual projects, each one is at a different stage and has different objectives, for this year, to move the strategy forward. When we look at Segovia, it's our key cash generating asset. It produced over 200,000 ounces last year. We're currently completing an expansion of the processing plant, taking us from 1,500 tonnes a day to 2,000 tonnes a day and we expect to have that completed by the middle of this year. Then we will be able to operate the plant, at between 85 and 95% of that new 2,000 tonne a day capacity, in the second half of the year. With that, we'll be expecting our guidance to be 210,000 to 225,000 ounces of gold this year. So, a step up in production, as a result of that expansion.The second major project we have at Segovia is the operation and the completion of expansion of a new Polymetallic recovery plant that we built in 2021. We got it up and running, in test mode, for the last couple of months of 2021 and now this year it's moved forward into commercial operation. We're processing about 100 tons a day right now of the tailings from the Segovia operation. These tailings include not only the remnant silver, that's not fully recovered, in our primary plant, but they also include heavy metals, both zinc and lead, in sufficient commercial quantities that we can make a nice return on the investment that we have in this new polymetallic plant, by producing zinc concentrate and lead concentrate. We've just recently finalized the business terms, with an international customer and we're documenting the offtake contract now. By June, we'll be able to start shipping the zinc and lead concentrates that we've been stockpiling for the last six months and start to realize the cash benefit from this project. But it's really a nice financial return. We expect it probably represents about an extra $30 an ounce of gold equivalent return to us. And it will also have the added benefit of further cleaning up the tailings, by taking out the heavy metals, that we deposit into our tailings storage facility. From an environmental standpoint, this is an enhancement of our project.

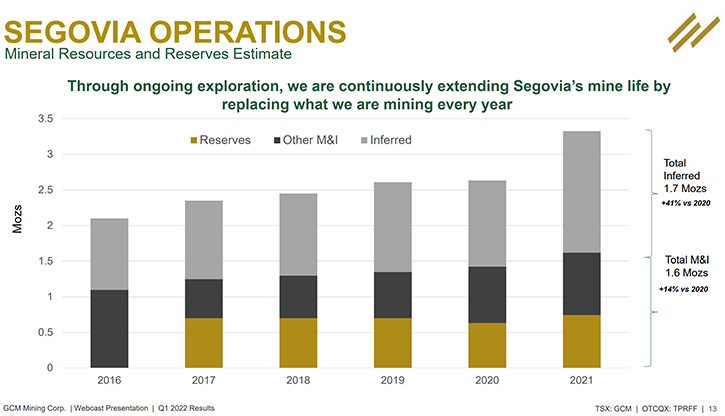

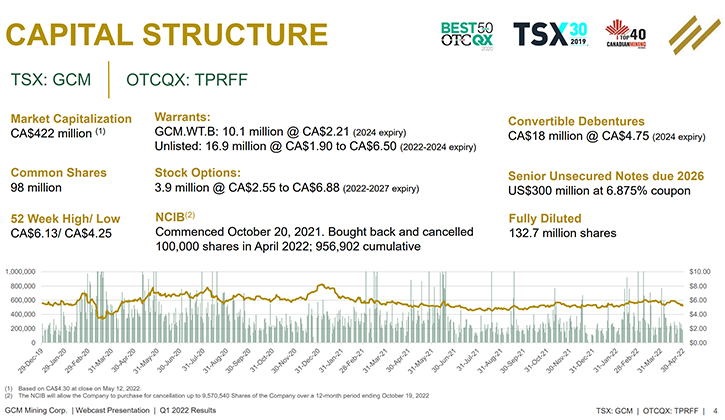

It has a significant resource there that the Company had raised money for drilling the resource, proving out the historic resource and, by about the third quarter of this year, will be publishing a PEA, charting the course of how they'll bring this tremendous polymetallic project into production. Four projects, which all give us exposure, not only to gold, but to the emerging metals in the base metals side and a great portfolio of assets, for us to create value for the shareholders. Dr. Allen Alper: Well, that's really excellent to have such high-quality projects and portfolio and investments. So that's excellent work. Could you tell our readers/investors your primary goals for this year? I know you have a great deal, not only of operations, but also exploration. So maybe you could tell us what you're doing with improving operations, your cash flow and exploration activities. Mike Davies: Thinking of each of the individual projects, each one is at a different stage and has different objectives, for this year, to move the strategy forward. When we look at Segovia, it's our key cash generating asset. It produced over 200,000 ounces last year. We're currently completing an expansion of the processing plant, taking us from 1,500 tonnes a day to 2,000 tonnes a day and we expect to have that completed by the middle of this year. Then we will be able to operate the plant, at between 85 and 95% of that new 2,000 tonne a day capacity, in the second half of the year. With that, we'll be expecting our guidance to be 210,000 to 225,000 ounces of gold this year. So, a step up in production, as a result of that expansion.The second major project we have at Segovia is the operation and the completion of expansion of a new Polymetallic recovery plant that we built in 2021. We got it up and running, in test mode, for the last couple of months of 2021 and now this year it's moved forward into commercial operation. We're processing about 100 tons a day right now of the tailings from the Segovia operation. These tailings include not only the remnant silver, that's not fully recovered, in our primary plant, but they also include heavy metals, both zinc and lead, in sufficient commercial quantities that we can make a nice return on the investment that we have in this new polymetallic plant, by producing zinc concentrate and lead concentrate. We've just recently finalized the business terms, with an international customer and we're documenting the offtake contract now. By June, we'll be able to start shipping the zinc and lead concentrates that we've been stockpiling for the last six months and start to realize the cash benefit from this project. But it's really a nice financial return. We expect it probably represents about an extra $30 an ounce of gold equivalent return to us. And it will also have the added benefit of further cleaning up the tailings, by taking out the heavy metals, that we deposit into our tailings storage facility. From an environmental standpoint, this is an enhancement of our project. GCM Mining has expanded the capacity of our tailings deposit by close to 60%.A third thing we're doing is Segovia is a continuation of what we've been doing the last few years. Last year was our biggest year yet of drilling, at Segovia. It's historically a very shallowly exploited title. Last year we did 97,000 meters of drilling, of which about 16,000 meters were in the brownfield areas of the title, where there's been previous mining activity documented and some small-scale miners working. At the moment, we've been drilling these high priority targets to identify the future expansion, for our mining operations. In addition to that, we did about another 83,000 of infill drilling and resource definition, drilling in our four primary operating mines in Segovia. We have another 91,000 meters planned for the coming year; we've done about 20,000 of that in the first quarter. The work last year led to a very significant increase, in both the resources as well as the mineral reserves for the project. We think that as we continue to put forward this kind of effort and drilling, we'll continue to build out a longer mine life on paper, which is something that our investors have been wanting to see.Segovia has quite an agenda for itself. It's free cash flowing. It's all-in sustaining costs, in the first quarter of 2022, were about $1,187 an ounce. Gold prices averaged about $1,860. We had 36% all-in sustaining cost margin. We generated about $11 million of free cash flow, in the first quarter of 2022. About half of that went to pay our dividends and pay our normal course issuer bid purchases. The balance of that went to the balance sheet, to add to our cash balance. So, a good result in the first quarter. When we look to Toroparu for this year. We were really focused on completing the PFS, which we've said we'll do by the end of July of this year. We're also currently working, with the local government agency, to finalize and formalize the mining license for the project, which we expect to have done also by July of this year. We've commenced pre-construction activities. Wheaton's on board for the financing. This is really the year for us to get started, in the second half of the year, on the construction of this project. We expect to be up and running, first production starting in the first quarter of 2024. It's really a big year for us in terms of projects.Our CEO, Lombardo Paredes, has been the driver behind the improvements and the evolution of our Segovia mining operations and certainly has built a very good Team, with in-country experience in Guyana, in order to bring forward this Toroparu Project, on a very quick schedule. Dr. Allen Alper: It's amazing how you have these diversified projects and you're improving your cash flow, your resources and getting ready for production, in a fantastic potential mine. So, it's amazing what you fellows are doing! Mike Davies: The markets can be, and certainly, as we've seen in the first part of this year, and very much so the last week, the markets can be very volatile. We've said, and we've been saying it for the last few years, especially during the modernization and mechanization of Segovia, the best thing for us to do in executing our strategy, is to just be smart about it and focus on what we can control, which is our cash, our costs and our execution. That's what I think has made us successful over the years. Our plate, we feel, at the moment is full. We have a lot on our plate. It's Segovia. We have a great Team running Segovia and now we have a really great Team leading the charge at Toroparu. Right now, those two projects have enough, that's what we'll focus on. We'll make sure that we deliver on Toroparu. There's a lot of uncertainty, in the market these days, about capital projects and inflation and supply chain impact on capital cost. We feel that we're managing that risk. You just have to focus on your execution and focus on your cost and allocate your cash, according to being prudent. Use some today, but keep some on the balance sheet, because you never know when something disruptive happens and you'll be glad to put some cash aside for the rainy day. Dr. Allen Alper: That sounds like an excellent approach. What I find so interesting, when I talk to your Team, they have not only been great in exploration and mining, but also your business decisions have been outstanding.Mike Davies: As a group, we each bring different skills, different experience. That's been good for challenging each other at times, on what's the right thing. But I think we have a group that, between Serafino Iacono, Lombardo Paredes and myself and Alessandro Cecchi, our VP Exploration, has been able to make some good decisions and stay focused on what really matters to deliver the strategy. I think we've also been very fortunate. I've worked with Serafino for 15 years. He just has such a good acumen, for finding very good quality assets, often assets that may be shunned by others, because maybe they're not the cleanest, from whatever legal or other conditions are around them. Segovia was mired in a liquidation, with the government, when Serafino acquired it. He found a way to deal with the concerns that the liquidator had. By dealing with that, we came out of it, with a nice, clean asset that just turned out to be a tremendous, high grade global gold project. We look at Toroparu, it had a good Management Team, but they were going at things a little bit slower, and it just needed a bit of a kick start and that's where we came in. When we look at Denarius, it's Lomero Project, a terrific asset in the Iberian Pyrite Belt, one that has some very significant gold quantities, in there, but also some pretty good copper grades and zinc and lead. It has over $8 billion of metal in the ground, based on the historic resource and it was mired in legal issues, because the previous owners had gone through a bunch of bankruptcy matters. It needed somebody, who could work through the red tape, with the liquidators there, to find a solution that appeased everybody's interests and come out of it with a nice, clean title to a project that now is going to turn out to be a prolific project, in the right jurisdiction and the Iberian Pyrite Belt. It's six kilometers away from MASTA property that just sold for $2 billion to Sandfire, and not far from Atalaya's project. I think we're fortunate enough to have some good sizable assets in great jurisdictions. And I think focusing on a few very good large-scale projects is better than having a lot of little, tiny projects. Dr. Allen Alper: I think that's a very good approach. That's excellent! Mike, could you tell us a little bit about your share and capital structure? Mike Davies: We currently have 98 million shares outstanding. We trade both on the TSX: GCM, as well as the OTCQX: TPRFF. We have options and warrants and some convertible debentures outstanding. So, on a fully diluted basis, we're about 137 million shares. We have a $300 million senior, unsecured note outstanding, due in 2026. At the end of March 2022, we had US$315 million in the bank, so our balance sheet is pretty strong, and we have $138 million of funds committed to come from Wheaton, under the stream that is not yet recorded on our balance sheet. That'll come during the capital project construction, at Toroparu, in various installments. We also have a normal course issuer bid in place, to buy back the 10% of our stock, from last October through the end of this October. That's about 9.6 million shares in total. We've currently bought back about a million shares under that program. When we come out of blackout the week starting May 16th, with the recent dip in the share price, we'll will be back in the market, buying up some shares to cancel some of our shares, using some of our excess cash flow that we have available to us. So prudent investment in ourselves, to take out our undervalued stock.

GCM Mining has expanded the capacity of our tailings deposit by close to 60%.A third thing we're doing is Segovia is a continuation of what we've been doing the last few years. Last year was our biggest year yet of drilling, at Segovia. It's historically a very shallowly exploited title. Last year we did 97,000 meters of drilling, of which about 16,000 meters were in the brownfield areas of the title, where there's been previous mining activity documented and some small-scale miners working. At the moment, we've been drilling these high priority targets to identify the future expansion, for our mining operations. In addition to that, we did about another 83,000 of infill drilling and resource definition, drilling in our four primary operating mines in Segovia. We have another 91,000 meters planned for the coming year; we've done about 20,000 of that in the first quarter. The work last year led to a very significant increase, in both the resources as well as the mineral reserves for the project. We think that as we continue to put forward this kind of effort and drilling, we'll continue to build out a longer mine life on paper, which is something that our investors have been wanting to see.Segovia has quite an agenda for itself. It's free cash flowing. It's all-in sustaining costs, in the first quarter of 2022, were about $1,187 an ounce. Gold prices averaged about $1,860. We had 36% all-in sustaining cost margin. We generated about $11 million of free cash flow, in the first quarter of 2022. About half of that went to pay our dividends and pay our normal course issuer bid purchases. The balance of that went to the balance sheet, to add to our cash balance. So, a good result in the first quarter. When we look to Toroparu for this year. We were really focused on completing the PFS, which we've said we'll do by the end of July of this year. We're also currently working, with the local government agency, to finalize and formalize the mining license for the project, which we expect to have done also by July of this year. We've commenced pre-construction activities. Wheaton's on board for the financing. This is really the year for us to get started, in the second half of the year, on the construction of this project. We expect to be up and running, first production starting in the first quarter of 2024. It's really a big year for us in terms of projects.Our CEO, Lombardo Paredes, has been the driver behind the improvements and the evolution of our Segovia mining operations and certainly has built a very good Team, with in-country experience in Guyana, in order to bring forward this Toroparu Project, on a very quick schedule. Dr. Allen Alper: It's amazing how you have these diversified projects and you're improving your cash flow, your resources and getting ready for production, in a fantastic potential mine. So, it's amazing what you fellows are doing! Mike Davies: The markets can be, and certainly, as we've seen in the first part of this year, and very much so the last week, the markets can be very volatile. We've said, and we've been saying it for the last few years, especially during the modernization and mechanization of Segovia, the best thing for us to do in executing our strategy, is to just be smart about it and focus on what we can control, which is our cash, our costs and our execution. That's what I think has made us successful over the years. Our plate, we feel, at the moment is full. We have a lot on our plate. It's Segovia. We have a great Team running Segovia and now we have a really great Team leading the charge at Toroparu. Right now, those two projects have enough, that's what we'll focus on. We'll make sure that we deliver on Toroparu. There's a lot of uncertainty, in the market these days, about capital projects and inflation and supply chain impact on capital cost. We feel that we're managing that risk. You just have to focus on your execution and focus on your cost and allocate your cash, according to being prudent. Use some today, but keep some on the balance sheet, because you never know when something disruptive happens and you'll be glad to put some cash aside for the rainy day. Dr. Allen Alper: That sounds like an excellent approach. What I find so interesting, when I talk to your Team, they have not only been great in exploration and mining, but also your business decisions have been outstanding.Mike Davies: As a group, we each bring different skills, different experience. That's been good for challenging each other at times, on what's the right thing. But I think we have a group that, between Serafino Iacono, Lombardo Paredes and myself and Alessandro Cecchi, our VP Exploration, has been able to make some good decisions and stay focused on what really matters to deliver the strategy. I think we've also been very fortunate. I've worked with Serafino for 15 years. He just has such a good acumen, for finding very good quality assets, often assets that may be shunned by others, because maybe they're not the cleanest, from whatever legal or other conditions are around them. Segovia was mired in a liquidation, with the government, when Serafino acquired it. He found a way to deal with the concerns that the liquidator had. By dealing with that, we came out of it, with a nice, clean asset that just turned out to be a tremendous, high grade global gold project. We look at Toroparu, it had a good Management Team, but they were going at things a little bit slower, and it just needed a bit of a kick start and that's where we came in. When we look at Denarius, it's Lomero Project, a terrific asset in the Iberian Pyrite Belt, one that has some very significant gold quantities, in there, but also some pretty good copper grades and zinc and lead. It has over $8 billion of metal in the ground, based on the historic resource and it was mired in legal issues, because the previous owners had gone through a bunch of bankruptcy matters. It needed somebody, who could work through the red tape, with the liquidators there, to find a solution that appeased everybody's interests and come out of it with a nice, clean title to a project that now is going to turn out to be a prolific project, in the right jurisdiction and the Iberian Pyrite Belt. It's six kilometers away from MASTA property that just sold for $2 billion to Sandfire, and not far from Atalaya's project. I think we're fortunate enough to have some good sizable assets in great jurisdictions. And I think focusing on a few very good large-scale projects is better than having a lot of little, tiny projects. Dr. Allen Alper: I think that's a very good approach. That's excellent! Mike, could you tell us a little bit about your share and capital structure? Mike Davies: We currently have 98 million shares outstanding. We trade both on the TSX: GCM, as well as the OTCQX: TPRFF. We have options and warrants and some convertible debentures outstanding. So, on a fully diluted basis, we're about 137 million shares. We have a $300 million senior, unsecured note outstanding, due in 2026. At the end of March 2022, we had US$315 million in the bank, so our balance sheet is pretty strong, and we have $138 million of funds committed to come from Wheaton, under the stream that is not yet recorded on our balance sheet. That'll come during the capital project construction, at Toroparu, in various installments. We also have a normal course issuer bid in place, to buy back the 10% of our stock, from last October through the end of this October. That's about 9.6 million shares in total. We've currently bought back about a million shares under that program. When we come out of blackout the week starting May 16th, with the recent dip in the share price, we'll will be back in the market, buying up some shares to cancel some of our shares, using some of our excess cash flow that we have available to us. So prudent investment in ourselves, to take out our undervalued stock.  We're paying the dividend 1.5 cent Canadian, per share, per month. The next dividend will be paid on May 16th, and we will shortly be announcing the dividend that will be paid out on June 15th. It's a recurring event. It's about a 4% yield, at current prices, and it's been well received by our shareholders. It's one of the highest paid dividends, amongst the mining stocks, and the only one that pays on a monthly basis. Dr. Allen Alper: That's truly excellent, that's really great! Mike, could you summarize the primary reasons our readers/investors should consider investing in your Company? Mike Davies: We have high quality assets, two cornerstone assets and great jurisdictions, which have scale, and have significant exploration upside. One is currently generating free cash flow, the other one is two years away from generating significant free cash flow and doubling our EBITDA. We pay a monthly dividend. We have a very strong Management Team, with a track record of building and operating projects, of these scales, in Latin America. It's a tremendous price point, for an entry into this story, at this point, not only given the upside, but as the diversification strategy plays out, you're being paid a relatively handsome dividend, while you wait for this story to play out.

We're paying the dividend 1.5 cent Canadian, per share, per month. The next dividend will be paid on May 16th, and we will shortly be announcing the dividend that will be paid out on June 15th. It's a recurring event. It's about a 4% yield, at current prices, and it's been well received by our shareholders. It's one of the highest paid dividends, amongst the mining stocks, and the only one that pays on a monthly basis. Dr. Allen Alper: That's truly excellent, that's really great! Mike, could you summarize the primary reasons our readers/investors should consider investing in your Company? Mike Davies: We have high quality assets, two cornerstone assets and great jurisdictions, which have scale, and have significant exploration upside. One is currently generating free cash flow, the other one is two years away from generating significant free cash flow and doubling our EBITDA. We pay a monthly dividend. We have a very strong Management Team, with a track record of building and operating projects, of these scales, in Latin America. It's a tremendous price point, for an entry into this story, at this point, not only given the upside, but as the diversification strategy plays out, you're being paid a relatively handsome dividend, while you wait for this story to play out.  Dr. Allen Alper: Those are fantastic reasons for our readers/investors to consider investing in your Company. You have great projects, investments, diversity, a fantastic Team, and you are generating cash. With your extensive exploration, you're adding to resources, and you have a great new project that will get into production in 2024. Those are all outstanding reasons to consider investing in GCM Mining. Mike Davies: Yes, I agree. Thank you.Dr. Allen Alper: You are welcome. We'll publish your press releases, as they come out, so our readers/investors can follow your progress. https://www.gcm-mining.com/Mike DaviesChief Financial Officer(416) 360-4653investorrelations@gcm-mining.com

Dr. Allen Alper: Those are fantastic reasons for our readers/investors to consider investing in your Company. You have great projects, investments, diversity, a fantastic Team, and you are generating cash. With your extensive exploration, you're adding to resources, and you have a great new project that will get into production in 2024. Those are all outstanding reasons to consider investing in GCM Mining. Mike Davies: Yes, I agree. Thank you.Dr. Allen Alper: You are welcome. We'll publish your press releases, as they come out, so our readers/investors can follow your progress. https://www.gcm-mining.com/Mike DaviesChief Financial Officer(416) 360-4653investorrelations@gcm-mining.com