Minaurum Gold drills (ultra) high grade silver at Alamos

Approximately two months after releasing a first set of drill results from the Alamos Silver project in Mexico, Minaurum Gold (MGG.V) has now released a second batch of results, of which hole AL17-07 has returned jaw-dropping metal grades.

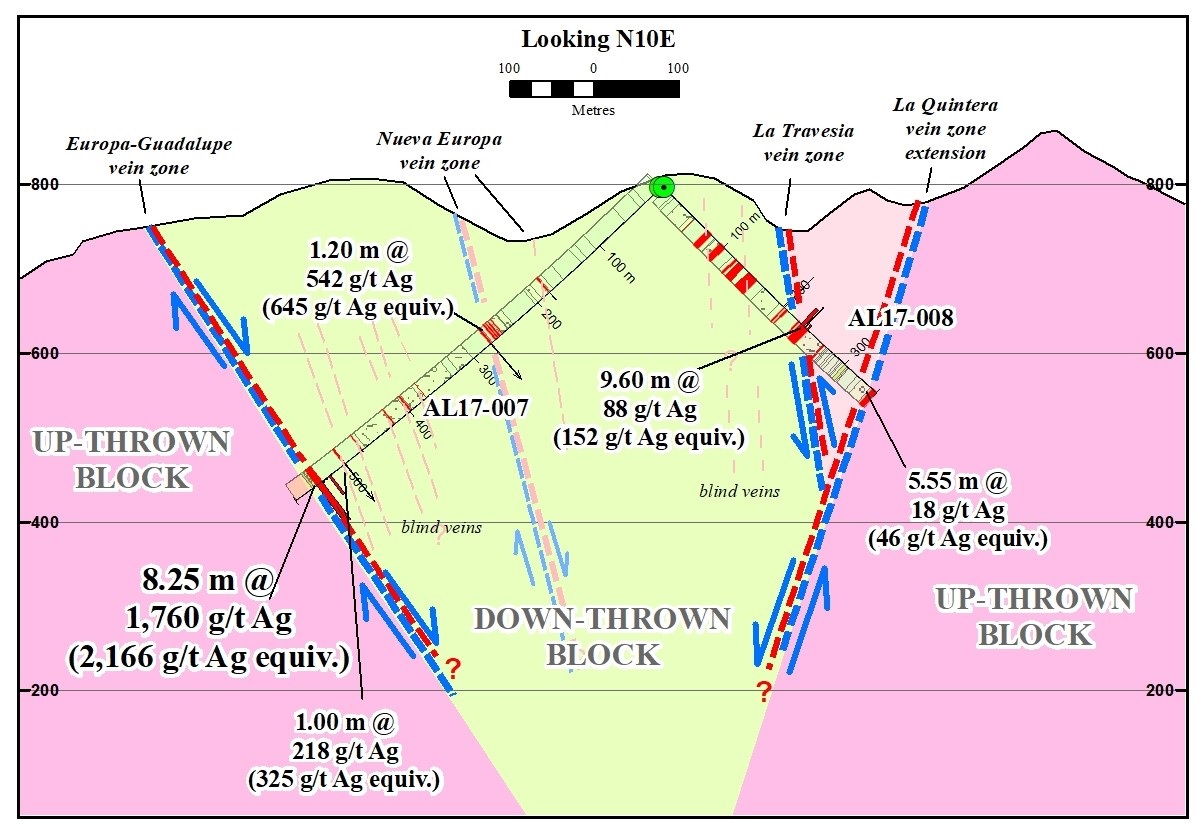

Although the assay results of three holes were published, it's really only hole 7 which was the first ever hole drilled in the Europa-Guadelupe vein system which reported noteworthy results (hole 8 also contained mineralization but the 9.6 meters at 88 g/t silver and 0.7% ZnPb is relatively deep). At hole 7, the drill bit has intersected the Nueva Europa vein, the Europa-Guadelupe vein as well as - and this is perhaps even more important than the reported grades - two blind veins with intervals of 0.5 meters at 81 g/t silver and 1 meter containing 218 g/t silver.

This sounds less flashy and impressive than the Nueva Europa vein (1.2m at 542 g/t silver) and the Europa-Guadelupe vein (2.2 meters of almost 5,100 g/t silver within a broader interval of 8.25 meters containing 1,760 g/t silver indicating the 6.05 meters outside the ultra-high-grade 5,100 g/t interval still carried a grade of in excess of 600 g/t silver), but these first holes into the Alamos silver project were also meant as an attempt to confirm the exploration theory we explained in previous updates.

As two blind veins have been encountered in hole 7, we dare to say Peter Megaw's theory has now been confirmed and this was immediately reflected in Minaurum's share price which moved from C$0.265 to C$0.44 before settling at C$0.39 for a gain of almost 50% in just a few trading days. Based on a share count of 238M shares, this represents a C$30M increase in Minaurum's market capitalization. Although we would expect Minaurum Gold to continue to drill at Alamos Silver (whilst the other Mexican exploration projects will also be subject to additional exploration programs), we don't have the impression MGG will raise more cash anytime soon. As of at the end of October, the company had a working capital position of C$3.7M, and this should allow it to keep going for the next little while.

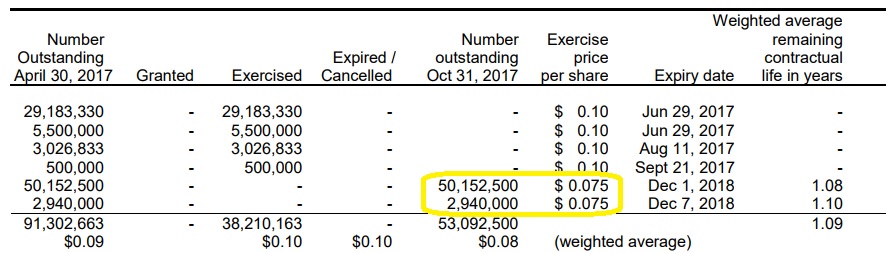

An additional 53M warrants (at C$0.075) will be exercised before the end of this year, which will allow Minaurum to raise an additional C$4M. So if Minaurum plays its cards right, it won't have to raise any more money this year.