Miner Explores 'Exciting Economics' of Prospect in Northern Canada

In conversation with Maurice Jackson, the CEO of Rover Metals discusses the firm's milestones achieved in 2020 as well as prospects for continued growth in 2021.

In conversation with Maurice Jackson, the CEO of Rover Metals discusses the firm's milestones achieved in 2020 as well as prospects for continued growth in 2021.

Maurice Jackson: Joining us for conversation is Judson Culter, the CEO and director of Rover Metals Corp. (ROVR:TSX.V;ROVMF:OTCQB).

A pleasure to be speaking with you today to provide us with an overview of some of the key milestones as we look back on the successes of 2020 and then take a look forward into 2021.

Mr. Culter, before we begin, for someone new to the story, what is Rover Metals, and what is the value proposition the company presents to the market?

Judson Culter: We are a precious metals mining company at the exploration stage. The value proposition is we're about to bring our first resource as a mining company to the public markets sometime this year. And this is arguably the most valuable time to invest, and if you look at the lifecycle of a mining company investment, you want to get in when the company is undervalued, and that's the value proposition that we're bringing this year.

Maurice Jackson: Last year was a banner year for Rover Metals. Sir, please provide current and prospective shareholders with some of the key milestones that Rover Metals accomplished in 2020.

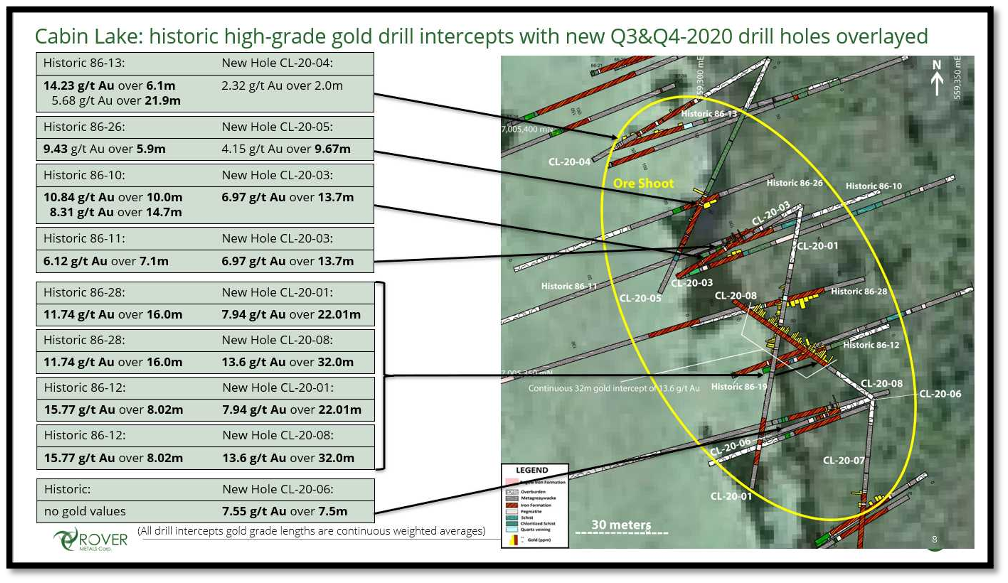

Judson Culter: Well, we knew we had a winner in northern Canada, and I'm speaking of the 60th parallel, which is the Northwest Territories in Canada, where we have our project portfolio, which has demonstrated some high-grade historical drilling dating back to the 1980s, and we just wanted to get to work and develop that project. And thankfully, in 2020, we were able to find the financing we needed. And we went in and not only did we rediscover some of the historical targets, but we doubled the length of any of the historical drill holes.

In our November press release (click here), the results of our drill program, we discovered 32 meters of continuous high-grade gold intercepts averaging 14 grams per ton. Now just think about 32 meters, and consider how long that is. There were only 15 meters of overburden, so that's basically at the surface. Speculators should strongly consider the exciting economics of that for a second.

Maurice Jackson: That's truly impressive. Let's look at 2021. Rover finished the year with an important press release that I think the market may have overlooked. Walk us through the press release (click here), because it exemplifies the business acumen of the management team.

Judson Culter: Well, the goal for the Cabin Lake Project is to conduct 70% of the annual exploration spend in the wintertime. And so the press release that you're referring to was [about] the fact that we've made an application to have ice road access off of the existing highway system. So that negates the need to use a helicopter for exploration in the wintertime and brings our cost down in terms of our exploration bang for our buck. I think we're a couple of weeks away from getting that permit, and that permit will be valid for the next four to five years. And again, our hope is this will be the window, sort of between January and April, where we do about 70% of our exploration work on this project each year.

Maurice Jackson: And any updates on the Uptown Gold Project?

Judson Culter: We've submitted an agreement with the Venture exchange on which we trade and we are listed as our primary exchange in Canada to sell 75% of the Uptown Gold Project to a new group. And we hope that we will mentor and work with that group in terms of the knowledge transfer of that project, and that when they have success, we have success, because we would like to joint venture with that newly listed company as they continue to put dollars into the ground on the exploration.

But really, what it did [for] us, was [enable us] to offload about $1.5 million in current liabilities to another group and share in the future success of that project on a non-dilutive basis, as they pay for the exploration, and then we have the right to acquire the remaining 25% interest in Uptown.

And that project is right in Yellowknife, close to where Newmont Corp. (NEM:NYSE) has options. The Con Mine claims to a competitor, and we're on that Yellowknife Gold Belt, where there's a lot of juniors working away just to give you one comparable. GoldMining Inc. (GOLD:TSX; GLDG:NYSE.American) recently released an inferred resource of a couple of million ounces just north of us at the Discovery Project.

Maurice Jackson: Looking forward, what are the company's goals for 2021?

Judson Culter: For 2021, we have three major objectives. The first one is to immediately get in and pick up where we stopped in October on our drilling. We want to replicate the great success of that program.

Also, we have 12 new targets, if you can believe that, based on the geochemistry, the correlation from the assays that we just received, understanding of what's hosting this primary gold deposit. The existing target, which is now what we're calling an ore shoot discovery that needs to get tested at depth as well. And so we're going to be in there, hopefully in February, mobilizing the site. So that's a huge goal of ours. We would like to bring an Inferred category resource to market by this summer on the Cabin Lake Project.

Another goal we have is to go out and acquire another project. We are looking for something a little bit farther south, so that'll be our summer project. And, so we're still active on the M&A (merger and acquisition) side.

And other good news to share is, well, I think we'll be announcing shortly the closing of a million-dollar financing at $0.10/share. And that money goes toward the mobilization here to Cabin Lake.

And any other corporate goals past Q2/2021. . .we're just kind of chipping away at, really, the next six months. And I don't think, much like lots of other juniors, we are looking past the six-month time frame.

Maurice Jackson: We've covered the goals. What is the next unanswered question for Rover Metals? When can we expect a response, and what will determine success?

Judson Culter: Well, I think the unanswered question for us is Cabin Lake. Are there 12 new ore shoots on the project? We've got one ore shoot. If it's every 1 kilometer along a 10 to 15-kilometer iron formation that we have, because if these things will pinch and swell, do we have 10 ore shoots on this project? There's a lot of blue sky here, we want to know what it is, and we'll be here in the next three months.

Maurice Jackson: Switching gears, Mr. Culter, please provide us with an update on the capital structure for Rover Metals.

Judson Culter: We have 77 million shares outstanding today. The million-dollar financing that we're about to close within the next week or so will add another 10 million, so 87 million shares outstanding.

Maurice Jackson: What is the burn rate?

Judson Culter: Burn rate outside of exploration season is roughly $40,000 to $50,000 a month. And, during exploration season it's much higher, so we're looking into a two-month program here from the February to April time frame. We'll spend about $2 to $3 million just on exploration here in this next quarter.

Maurice Jackson: And you somewhat alluded to it, but how's the treasury looking right now?

Judson Culter: Treasury is healthy. There's still money from the last financing last year. And, the wires are already piling in here from the current financing. So, we're in really good shape and able to execute our goals.

Maurice Jackson: Judson, any final words for shareholders?

Judson Culter: No, I think we've covered it on this. I think this is a company, certainly, where there's going to be news coming in the next three months. I think a lot of other juniors and competitors are waiting for melt-off and to get summer programs going, so we're ahead of the curve, and we will be bringing assays to market here in the May time frame. So, that's an exciting opportunity right there.

Maurice Jackson: Sir, what keeps you up at night that we don't know about?

Judson Culter: Oh, that's a stumper of a question. Nothing right now. Things have been going well in 2020, and I think I'm sleeping pretty easily, and this is fun. There's not a lot of stress in my life right now, and everything's just really becoming fun. So not much; pretty much nothing keeps me up at night.

Maurice Jackson: I love the modest response because you and I correspond offline. And I know you're very excited about the opportunity before you, so I'll have to pick on you when we get offline here.

All right, sir, last question: What did I forget to ask?

Judson Culter: Well, I think you're going to want to know where we're going to acquire our next project, but I couldn't tell you that right now. But I will say that we look at a new project every week, and we're super picky, so when we do decide to announce a new acquisition that it should be a goody.

Maurice Jackson: Mr. Culter, if investors want to get more information about Rover Metals, please share the contact information.

Judson Culter: Encourage readers to visit our website, www.rovermetals.com.

Maurice Jackson: Mr. Culter, thank you for joining us today. Wishing you and Rover Metals the absolute, sir.

As a reminder, I'm a licensed broker for Miles Franklin Precious Metals Investments where we provide unlimited options to expand your precious metals portfolio, from physical delivery, offshore depositories, and precious metals IRAs. Call me directly at (855) 505-1900 or you may email [email protected].

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

[NLINSERT]Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Rover Metals. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Rover Metals is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of GoldMining Inc., a company mentioned in this article.

Disclosures for Proven and Probable: Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.