Miners, commodities hit as US-China trade war heats up

Mining companies saw its shares plummet along with metal prices on Wednesday as trade tensions between the United States and China escalated, with Beijing hitting back at Trump's plans to impose $50 billion in tariffs to goods from the Asian superpower.

China retaliated with a list of duties on key US imports, including soybeans, planes, cars, whiskey and chemicals, less than 11 hours after Washington announced the proposed tariffs on Chinese goods.

The escalating trade tensions between the world's two largest economies led to a sharp selloff in global stock markets and commodities.

Even with the tariffs not yet in place, the news had an immediate impact on markets.Copper, which is seen as a barometer of global economic conditions due to its multiple uses in manufacturing, transportation, construction and power sector, fell 2% on the London Metal Exchange to $6,668.5 a tonne.

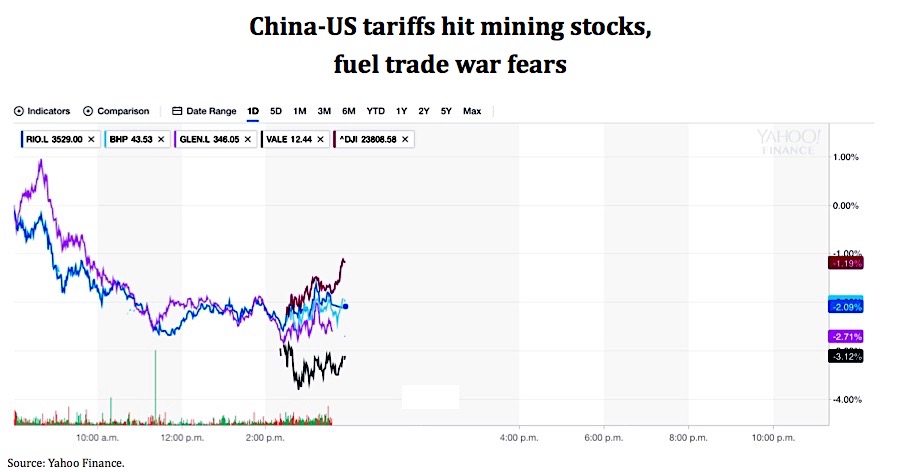

Shares in BHP (LON:BLT) (NYSE:BHP), the world's largest miner, were down almost 3% in London to 1,367p, close to the end of Wednesday trading session. The stock was also down in New York (1.93%) to $38.69 at 10:00Am local time.

World's No.2 mining company, Rio Tinto (ASX, LON:RIO), closed slightly down in Sydney on Wednesday, but was down 2.8% in London late afternoon to trade at 3531p.

Other top miners were also in the red on Wednesday. Glencore (LON:GLEN) was falling 2.6% in London to 347.05p; Vale (NYSE:VALE) was 2,6% down to $12.43 at 10:11AM ET, and Anglo American (LON:AAL) dropped 3.8% to trade at 1578p by 12:36PM GMT.

Futures on both the Dow Jones Industrial Average and S&P 500 fell more than 1% at 8:44 a.m. New York time. Today's selloff means the Dow is now 11% off its record high, leaving it in correction territory.

Hong Kong's Hang Seng Index dropped 2.2%, and South Korea's main exchange was down more than 1%. In Europe, all major markets opened lower.

Copper, seen as a barometer of global economic conditions, fell 2% on the London Metal Exchange to $6,668.5 a tonne.Gold, a traditional safe haven, went the opposite way. June gold gained 1%, or $13.40, to $1,350.70 an ounce in early trade. The metal halted a string of consecutive gains in the previous session amid a rise in the equity market and easing global tensions.

Heavy equipment maker Caterpillar (NYSE: CAT -0.37%) recouped much of its earlier loss while Deere (NYSE: DE 3%) remained sharply lower close to the end of today's trading session, as investors show heightened concern over the effects of China's proposed tariffs on agricultural related products.

The rising tensions between the two countries follows an investigation into Chinese intellectual property practices ordered by Trump. The escalating trade showdown also comes at a time when the US is entering negotiations with Beijing over its $375.2bn trade deficit in goods with China.