Miners increased spending positive, but far from reaching staff just yet

While mining companies have resumed projects that were placed in the back burner last year and upped capital spending, employees have yet to benefit from the surge in commodity prices.

While most miners have managed to straighten balance sheets, they have not began preparing to deal with a new looming risk - their ability to access workers with the skills needed in an upswing.The issue is not only evident in the wages department, but especially when it comes to training, says Simon Houlding, Vice-President of Professional Development for InfoMine Inc., and head of EduMine, the professional development division.

He believes that education is an area where companies can gain a significant advantage by planning ahead. However, he also says training should be no exception to the general acceptance that mining needs to become lean, mean and competitive in a tougher world.

"There is a growing number of companies moving to online, self-directed training wherever possible," he says. "Not only has online training been proven more effective at knowledge retention, it is also less costly in terms of dollars and time and workplace disruption than traditional methods."

Houlding warns that, as the latest analysis on Canada's mining labour market shows, most companies have managed to straighten their balance sheets, but they have not began preparing to deal with a new looming risk - their ability to access workers with the skills needed in an upswing.

Courtesy of Canada's Mining Industry Human Resources Council (MiHR), August 2016.

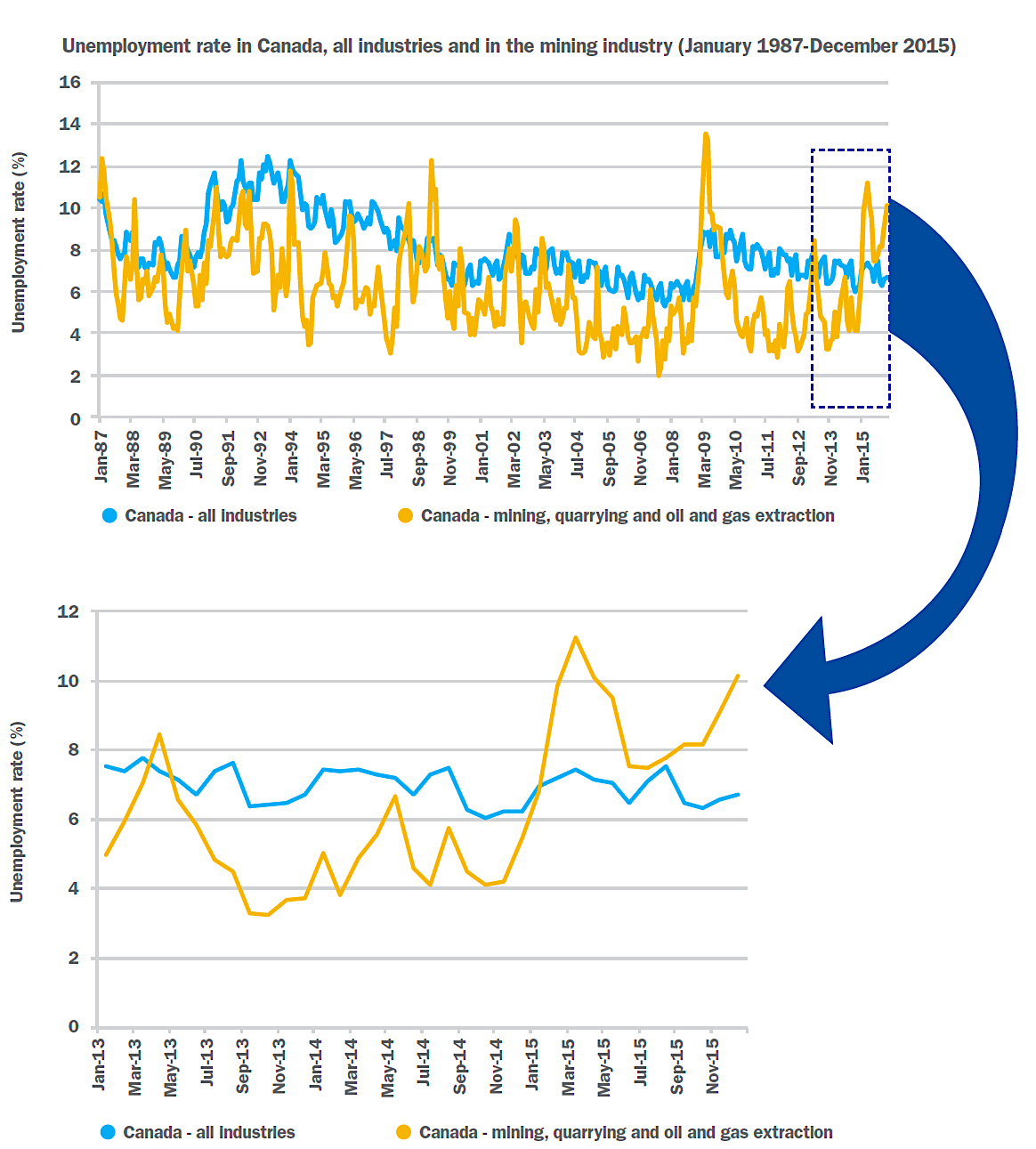

Canada's mining industry endured an economic downturn that continued throughout 2015. Due to this trend, a number of mining operations faced the decision to keep their operations running, but in less than optimal conditions. Others, particularly in the oil sands sector, simply scaled back production or shut down their operations, laying off hundreds of workers.

As a consequence, mining employers face a cumulative hiring requirement of almost 86,000 workers under an industry contraction scenario, the report on Canada's mining labour market shows. The figure includes replacing about 49,000 workers over the next decade due to retirement.

Houlding says that now, more than ever, the mining industry needs to look at its future labour market needs and begin putting in place collaborative strategies to ensure it has a robust, appropriately skilled supply of workers - both now and in the coming decade.