Miners wrote off almost one-third of investments over last decade

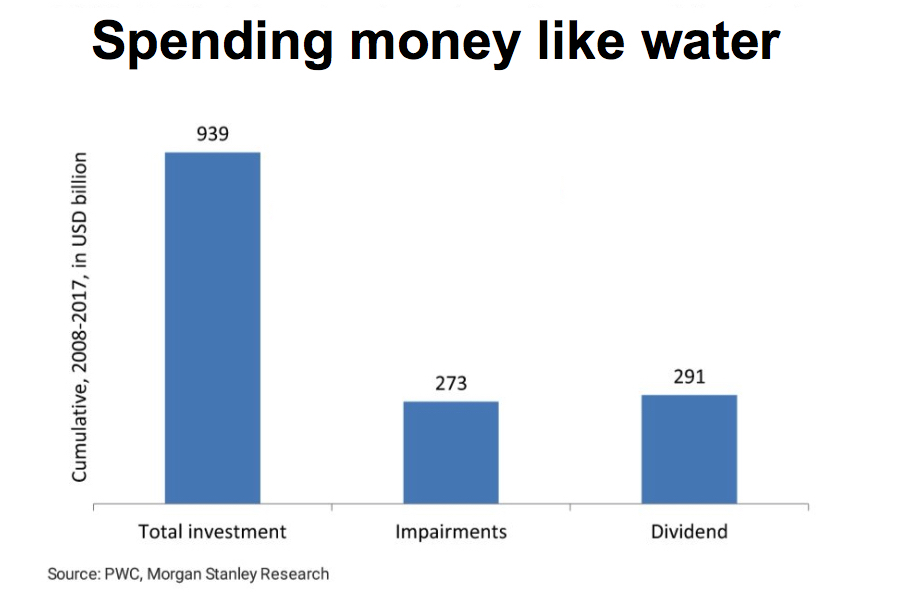

While global miners invested almost $1 trillion in major projects over the last decade, almost one-third of that - $273 billion to be precise - was written off, research from Morgan Stanley shows.

In a study carried out in conjunction with PricewaterhouseCoopers (PwC), the American investment bank found that the extent of the write-downs was almost as high as the dividends paid by the world's top 40 mining companies by market capitalization between 2008 and 2017.

Australian majors contributed to the high percentage of lost investments, the report shows, with Rio Tinto's losses on aluminum and coal projects and BHP's multi-billion dollar write-off of shale oil assets being the most significant ones.

But the experts also say the industry has made key changes that suggest the "capital destruction" of the last 15 years should not repeat.

Dividend payout ratios sit now at a range of between 40%-50%, with more cash returned to shareholders when profits climb, which decreases the risk of throwing money around during booming cycles.

Courtesy of Morgan Stanley.

Morgan Stanley and PwC also say that miner now have more realistic growth assumptions, compared to the overly optimistic assessments in years previous to the 2015-2017 downturn, which were the catalyst for poor investment decisions.

And boards also have stricter remuneration policies, extending the timeline for share-based incentives and increasingly using return on capital as a core performance metric.