Mining capital projects: Are you ready for the next CapEx investment cycle?

By Marc O'Connor, Deloitte Mining Capital Programs leader and Bora Pasuljevic, Director, Mining Capital Projects, Deloitte UK

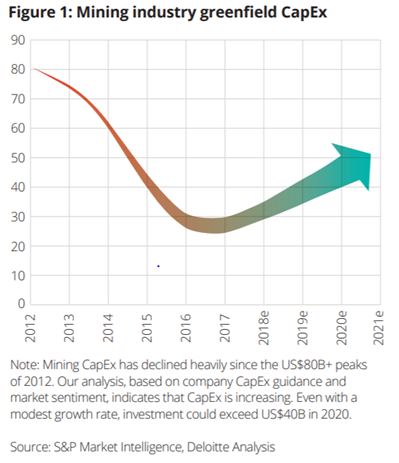

With global economic activity improving and new technologies providing opportunities for growth, mining companies are preparing to launch into a new wave of investment. But as they eye the next uptick in the CapEx cycle, mining companies should first focus on rebuilding trust with stakeholders and in the sector's ability to deliver value in the longer term.

There has been some progress made - mining companies have improved project delivery performance - but the goalposts have moved since the last cycle. The challenge for mining companies will be in finding the right balance between in-house exploration, joint ventures and acquisitions and developing their own projects, whilst also overcoming multiple barriers such as operating in challenging geographies, constrained capital budgets, complex supply chains and a shortage of skills. The winners in the next cycle will be those that create repeatable value through effective project development.

Building capital project delivery confidence requires maturity across multiple areas of capability. Below are the five most important levers mining companies should act upon to both restore investor confidence and improve project success throughout the next upcycle and beyond.

1. Apply the right owner delivery model and capabilities at the right time

With smaller project teams and continued pressure to control costs, the delivery models adopted by mining companies in the last cycle need a rethink. Mining companies have to strike the right balance between owners, partners, and suppliers through a leveraged owned model, whilst transitioning capabilities effectively throughout the project lifecycle, and should look to other industries that have led the way in project delivery innovation. For example, in the UK construction industry there is an increased use of alliancing and other collaborative contracting strategies. In such cases innovation is encouraged and risks are transparent and jointly managed.

By taking a long-term view as to how to select, control, and share risk with delivery partners, value can be maximized, people allocated efficiently, and confidence in delivery increased. And for projects to progress effectively, the required capabilities need to evolve in line with the project so that value delivery doesn't diminish.

2. Utilize data and digital technologies to optimize project execution and operational readiness

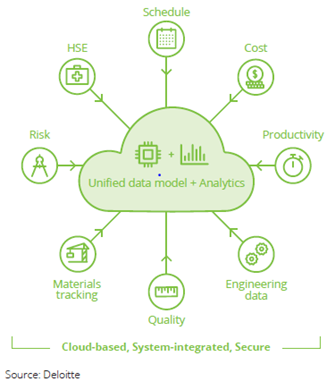

Mining companies must do more to make the most of their data. They need to shift from "doing digital" to "being digital" by achieving the right blend of digital technology, data, and advanced analytics. This means attracting and developing new skillsets and expertise not typically associated with the sector's workforce.

Just as important, mining companies need to view data as an asset to be managed throughout the entire project lifecycle. Data can be optimized by standardizing and collecting it consistently into a unified data model, which, in turn, can enable predictive analytics and form the foundation of data driven decision making. The codifying of data requirements and specifications will also drive consistency between projects and operations, as well as ensure data management costs are focused on information that adds the most value.

Leveraging the right technologies, such as Building information Management (BIM), can not only help with safety performance, design, modular construction and accurate budgeting, but can also facilitate smoother handover of data to enable a continuous maintenance regime pre and post first ore.

3. Implement highly effective project controls to deliver confident decisions

Today's capital projects are more complex, with more partners, and increased internal and external scrutiny. To maintain control in this environment requires an owner led project controls strategy that is established early in the project lifecycle and applied across all operating model layers: organization, process, technology, data, and governance. Success depends on integrated relationships and ways of working within the organization. Success depends on integrated relationships and ways of working within the organization.

Investing in information technology that facilitates accurate, on-demand reporting and rigorous performance review will help support project controls. Visualizing centralized project information appropriately for each stakeholder will also help inform insight-driven decision making. But for predictive project management to optimize cost and schedule, there needs to be continuous monitoring of project performance, tracking costs, and schedule trends.

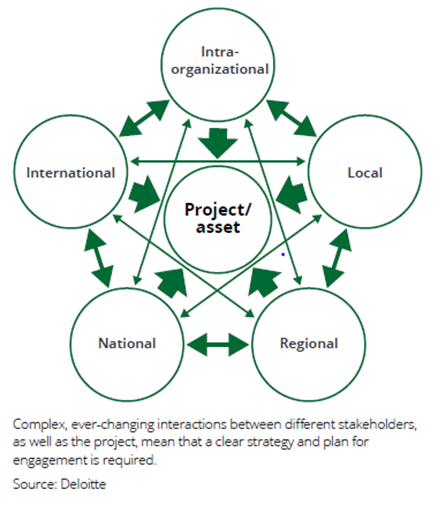

4. Have a customer mindset and invest in your license to operate

To overcome the negative perceptions that have dogged the sector, mining companies need to evolve their approach to engagement. Today's diverse stakeholders require a proactive, customer mindset to fully realize common benefits. It is more important than ever to develop an approach that balances the need for strategic long-term planning and shorter-term budgeting with delivering shared value to local communities and the supply chain.

This means building an organizational model that enables effective relationship-building throughout the entirety of the project lifecycle. Mining companies have to embrace more collaborative modes of engagement designed to get local communities better invested in mining operations. They also need to demonstrate a capacity to deliver greater value; understanding customer needs and delivering against them is now critical. By improving processes, systems, and governance, mining companies can proactively influence key stakeholders and mitigate critical issues.

5. Balance the portfolio of investments and partner to win

Although mining companies have taken significant steps to optimize their portfolios, they still have difficulty reacting to market shifts. Mining companies should learn from other sectors like oil and gas, where companies have reduced risk by engaging in shorter-cycle projects designed to rapidly generate positive cash flow and ensure portfolio agility. For mining companies, a phased approach to the largest investments could spread the risk in a similar fashion. They should continuously evaluate early-stage projects and use flexible, driver-based modeling to give visibility into multiple 'what if' scenarios. They should continuously evaluate early-stage projects and use flexible, driver-based modeling to give visibility into multiple 'what if' scenarios.

Also, by defining what drives partnering decisions and developing their partnering ecosystem, mining companies can partner more strategically. It is key that partnerships and joint ventures are developed within partnering frameworks and adhere to operational controls so as to embed the right behaviors throughout the deal and project lifecycles. This includes pursuing grassroots partnerships with junior mining companies as well as entering into joint ventures to uncover new deposits, better share risk, and drive innovation.

In conclusion, by ensuring the right project capabilities are in place, and through transforming traditional operating models, mining companies can select the right investments, find the best partners and deliver capital projects with confidence to the benefit of investors, employees, and local communities. But, those who navigate these challenges first will reap the richest rewards.

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited ("DTTL"), its global network of member firms and their related entities. DTTL (also referred to as "Deloitte Global") and each of its member firms are legally separate and independent entities. DTTL does not provide services to clients. Please see www.deloitte.com/about to learn more.