Mining in 2018: Copper price to power on

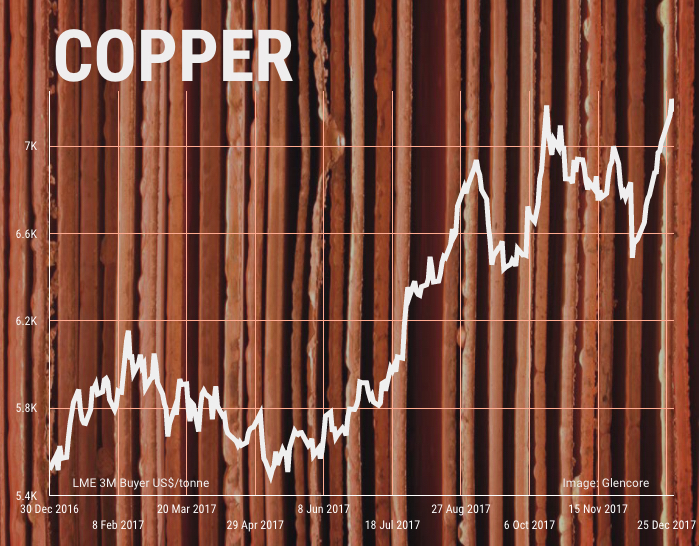

The price of copper ended 2017 near a four-year high of $3.30 a pound ($7,260 per tonne) extending the bull run in the red metal for a second year. Measured from its multi-year lows struck at the beginning of 2016, copper has gained more than 70% in value.

The copper price surged by 30% in 2017 to levels last seen early 2014

What happened in 2017

The run started on hopes (since dashed) of massive infrastructure investment in the US following the presidential election, but strikes in Q1, which at one point saw nearly a tenth of global production go offline, really set the tone for the year.

By mid-year the rally was flagging, but talk of a Chinese ban on scrap imports saw the price take off again. The year-end surge may have been mostly due to dollar weakness but the buoyant mood evident throughout the year (not least among speculators on futures markets) was underpinned by prospects of a demand spike in coming years on the back of an electric vehicle boom.

How things could change in 2018 (and beyond)

2017 is likely to have been the first year in 12 to see a decline in global mine production, but growth should return this year as world number two producer Peru adds some 300,000 in new production, mines like Norilsk's Bystrinsky mine in Russia ramp up output, Glencore restarts its Zambian operations and greenfield commissioning such as First Quantum's Cobre Panama mine begins to factor into supply projections."The markets where technology hasn't substantially shortened the supply cycle, and where cost are rising, (i.e. copper) have the greatest long-term upside in prices"But as happened last year labour action is likely to crimp any projected output growth. Wage negotiations could trigger disruptions at mines producing about 40% of global supply according to Barclays. INTL FCStone is penciling in a 1.26m tonne or 6% disruption allowance and most analysts see widening - if smallish - deficits.

The upside:

Factories around the world are buzzing - the JP Morgan composite PMI index is at its highest since February 2011 - and concerted global economic growth could hit 4% this yearWarehouse and exchange inventories are under control - Comex is up sharply, but Shanghai is down despite winter refinery shutdowns and at 200,000 tonnes, LME is nowhere near peaks seen during copper's bear yearsChina's pollution clampdown and shake-up of state-owned industry open up gaps for producers elsewhere - refined imports have held up surprisingly well and concentrate shipments are at record highs hitting 1.8m tonnes in NovemberThe switch to electric vehicles, the build out of EV infrastructure (Beijing's promised 4.8m charge points by 2020) and green energy investment lives up to the hypeLong-standing industry issues are not going away: Declining grades, rising costs, dirty concentrates, water and other environmental concerns, stricter regulations, community opposition, agonizingly slow project permitting processes and exploration activity still in the doldrumsOn the downside:

Cooler heads prevail and Chile's biggest ever year of copper mine wage negotiations concludes without major disruptionsThe Chinese construction market correction turns into full-blown slump, transport slows and the scrapping of subsidies puts the brakes on EV sales - the biggest sources of demand for the metal in a country that consumes nearly half the global totalHigher prices encourage Chinese miners to ramp up output, domestic secondary supply rises and the purported ban on scrap imports never materializeCopper from large scale expansions - Oyu Tolgoi and Grasberg going underground spring to mind - and greenfield projects like Udokan, Wafi-Golpu and Quellaveco - reach the market before new wave of demand from EVs does.Key event to watch in 2018

Mid-year wage negotiations at Escondida - the globe's only 1m tonne copper mine - crippled by 44-day strike last year.

All bets are off if...

The promised $500 billion infrastructure investment program in the US gets off the ground, especially if the money goes into the electricity grid

Quote for the year

"The markets where technology hasn't substantially shortened the supply cycle, and where cost are rising, (i.e. copper) have the greatest long-term upside in prices. The lack of investment over the past few years implies that copper mine production is likely to decelerate notably after 2019, given its long-cycle nature" - Goldman Sachs

MINING.com's call

Above $3.50 ($7,800 a tonne) by the end of 2018 and a rising trend into 2019. And that may be conservative.