Mining stocks rally as iron ore price surges 7%

Investors piled into to the metals and mining sector in a big way on Monday after a strong start to the Chinese new year commodities demand and a rally on the country's stock markets.

On the Comex market in New York copper for delivery in May climbed 2.5% to $2.1325 a pound or $4,700 a tonne. The red metal is up more than 10% from a six-year low hit mid-December. Other industrial metals also gained led by zinc which rose to a four-month high of $1,790 a tonne on Monday, aluminum gained 1.6% to $1,574 while nickel climbed more than 2% to $8,755 a tonne on the LME. Nickel was last year's worst performing metal with a 40% decline but has recovered 7% from multi-year lows struck in November.

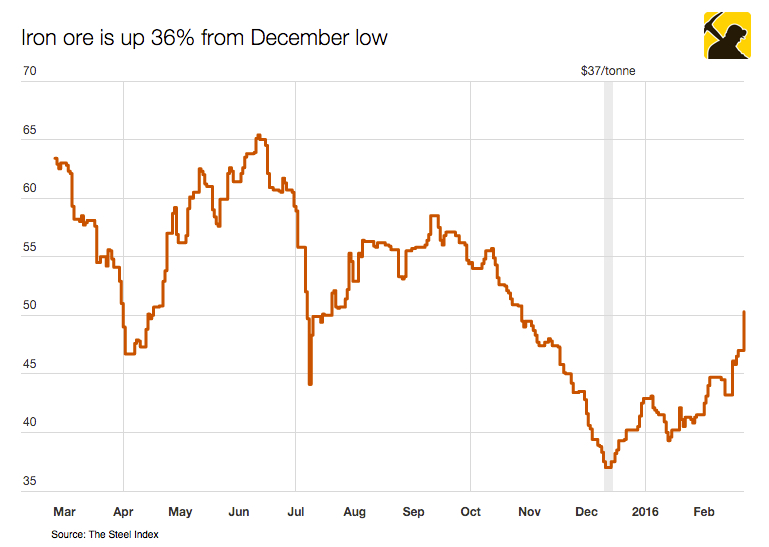

A 20% rise from near 13-year lows barely two weeks ago is convincing investors that deflation in the sector may finally be at an endIron ore was the biggest winner on the day with the benchmark price continuing its rebound with a 7% jump on Monday to retake the $50 a tonne level. At $50.30, iron ore is up a stunning 36% from near decade lows hit December 11. Chinese steel prices hit the highest levels since September on Monday thanks to a seasonal pick-up in demand and as Beijing tackles problems in the country's construction sector.

The surge in US benchmark oil price underpinned the positive mood in the sector after crude surged more than 7% to $31.75 a barrel. A more than 20% rise from near 13-year lows barely two weeks ago is convincing investors that deflation in the commodities sector may finally be at an end.

Iron ore and copper are seen as bellwethers for the sector and the brighter prospects convinced some investors that the sell-off in mining stocks had been overdone. There was a broad advance among mining's heavyweights led by Freeport McMoran and Teck Resources - both miners also have exposure to oil. Two of the biggest losers of 2015 - Glencore and Anglo-American - also continued to make strong gains.

Freeport-McMoRan (NYSE:FCX), which vies with Chile's state-owned Codelco as the world's number one copper miner in terms of output, rocketed 13.8%. Volumes were simply massive with more than 52 million shares changing hands by lunchtime, making it by far the most actively traded stock on the New York Stock Exchange. The Phoenix-based company, now worth $8.6 billion also benefitted from the stronger oil price - each $5 rise in the crude prices adds $170 million to its operating cash flow, while a $0.10 change in the copper price adds $350 million. Year to date Freeport is up 14.3%.

Vancouver's Teck Resources has soared 50% over just one week of tradingTeck Resources (NYSE:TCK) was the best performer on the day surging as much as 22.7% in morning trade. The Vancouver-based company is Canada's largest coal, copper and zinc producer and has invested heavily in the oil sands with its Fort Hills project scheduled to go into production next year. Teck is up an astonishing 50% over just one week of trading and is now worth $4 billion in New York after 15 million shares changed hands.

Anglo American (LON:AAL, OTCMKTS:NGLOY) continued its recovery adding 8% in New York. The counter and is 52% year to date hitting a market value of $9.8 billion. Anglo, the world's fifth largest publicly held mining company in terms of output, has embarked on a radical downsizing program that has been welcomed by investors even as its credit rating is slashed and it racks up annual losses of $5.6 billion. Anglo plans to exit sectors like coal, nickel and iron ore to focus on copper, diamonds and platinum, reducing the number of mines it operates from 55 to a mere 16.

Like BHP, Vale is still in the red for 2016 with a looming $7 billion settlement with the Brazilian government over the November disasterGlencore (LON:GLEN) advanced 11.3% in London on Wednesday, bringing its gains in 2016 to a whopping 46%. The Swiss mining and trading giant is recovering from record lows hit last year after investors welcomed a $13 billion debt reduction program that includes asset divestments, stake sales in its agriculture business, budget cuts and streaming deals.

Shares in world number one BHP Billiton (NYSE:BHP) also made strides in New York, gaining 5.7%. The $67 billion Melbourne-based company which relies on oil and iron ore for the bulk of its earnings hit near decade lows last year following a catastrophic dam burst at an iron ore mine in Brazil it jointly owns with Vale. Shares in Vale (NYSE:VALE.P), the world's top iron ore producer, jumped 10.5% in New York on Wednesday Like BHP, Vale is still in the red for 2016 with a pending settlement with the Brazilian government over the disaster that could include a fine of as much as $7 billion.

The world's second largest miner based on revenue Rio Tinto (NYSE:RIO) added 6% in New York affording it a market cap of $53 billion. The Melbourne-HQed recently posted a loss of $866 million for 2015 after writing down the value of its investment in its Simandou iron ore mine in West Africa. Simandou, which Rio is building together with Chinese investors, is the world's largest mining project and could have a final price tag of as much as $20 billion.

The company has been slashing costs and freezing wages across the board and enjoys the lowest cost base in iron ore, but promised to trim an additional $2 billion in costs this year and next.