Mixed Feelings About New Gold

Q4 2018 was good for New Gold.

The 2019 production guidance is a slight disappointment.

The 2019 cost guidance is a big disappointment.

New Gold share price will most probably remain below the $1 level for a better part of 2019.

After the positive operational results were reported back on January 8, New Gold (NGD) share price improved notably. The new wave of optimism was initiated by 77,202 toz gold produced at the Rainy River mine in Q4. This is a new record high. The mill was finally operating close to its nameplate capacity, and the gold grades also improved notably. There was a good reason to believe that brighter days are finally ahead for New Gold. Also, the Q4 financial results released today confirmed the positive trend. However, the 2019 guidance is a cold shower. The brighter days are postponed by one year (at least).

Data by YCharts

Data by YCharts

In Q4, the AISC declined to $688/toz gold, which is 3.6% less than in Q3. New Gold was able to record revenues of $157.4 million. Operating cash flow from continuing operations climbed to $57.8 million, or $0.1 per share, and adjusted operating cash flow equaled $0.13 per share. Net earnings look pretty scary, as New Gold recorded a net loss of $727.7 million, or $1.26 per share. However, the number is significantly impacted by an impairment loss of $671.1 million ($452.9 million attributable to Rainy River and $218.2 million attributable to Blackwater). Adjusted net earnings equaled $0.04 in Q4.

The total 2018 revenues equaled $604.5 million. The operating cash flow from continuing operations equaled $193 million, and net loss equaled $1.07 billion (including impairment charges of $953.2 million). New Gold ended the year 2018 with a cash balance of $103.7 million. Moreover, the company also has an undrawn credit facility of approximately $280 million. And the money will be really needed. According to New Gold's CEO:

Our liquidity position will support the execution of our operational plan in 2019, which includes the completion of all remaining construction and mill upgrades at Rainy River that will position the asset for profitable operations beginning in 2020.

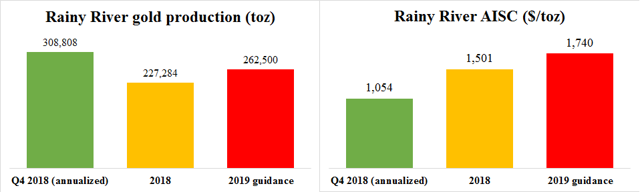

And here comes the negative news: the 2019 production and, especially, cost guidance. As can be seen in the chart below, Rainy River should produce 262,500 toz gold (the middle of the guidance range) in 2019. It is more than 227,284 toz gold produced in 2018; however, given that the mine was able to produce 77,202 toz gold in Q4 alone, which means an annualized production level of almost 309,000 toz gold, the 2019 guidance is slightly disappointing. However, this is not the main reason for the steep share price decline. The problem is the expected AISC. In 2018, the AISC equaled $1,501/toz. However, the improved performance of Rainy River led to AISC of $1,054/toz in Q4. That is a reason for some optimism, however, not in 2019, as the AISC should climb up to $1,740/toz (the middle of the guidance range). It means that the Rainy River mine will generate huge losses in 2019 (unless the gold price climbs above the $1,800/toz level pretty quickly).

(Source: Author's own processing, using data of New Gold)

The high AISC will be caused by $210-230 million of sustaining capital. New Gold estimates that 72% of the projected sustaining CAPEX ($150-165 million) should be used to complete the deferred mine construction activities. The most expensive will be the construction of the second stage of tailing facilities ($65-70 million) and a waste dump ($45-50 million). Capitalized mining will cost another $33 million.

Assuming that the sustaining CAPEX will equal $220 million and Rainy River will produce 262,500 toz gold in 2019, the sustaining CAPEX/toz gold should be around $838. If there were no deferred capital expenditures, the sustaining CAPEX/toz gold would be around $238. And the AISC would be around $1,150/toz, which is more than in Q4 2018 (especially due to the increased capitalized stripping costs) but significantly less than the 2019 guidance. The good news is that this should be a one-time event, and from 2020 on, the mine should finally start to be profitable.

Although the New Afton mine should do as well as usual, it won't be able to outweigh the negative results of Rainy River. New Afton should produce 60,000 toz gold and 80 million lb copper (or 230,000 toz of gold equivalent) in 2019. The AISC is estimated at negative $480/toz gold. As a result, New Gold's overall 2019 production is estimated at 317,500 toz gold and 80 million lb copper (492,500 toz of gold equivalent) at an AISC of $1,420/toz.

New Gold investors should prepare for a year of heavy losses. But the situation should improve significantly in 2020. It is very important, as during the 2021-2023 period, the New Afton mine will require significant capital investments too:

Growth capital (for New Afton) for 2019 is estimated to be between $40 and $45 million, which primarily consists of advancing an exploration decline and the purchase of required mobile equipment and infrastructure ($5 to 7.5 million).Growth capital in 2020 is expected to be consistent with 2019 and during those years the operation is expected to deliver a strong positive cash flow stream. Growth capital is expected to increase substantially during the period from 2021 to 2023, during which time the operation is expected to remain cash flow neutral. The operation is expected to return to positive cash flow status beginning in 2024 as remaining capital requirements decline and are spread over the years 2024 and 2025.

Right now, it seems that New Gold will have a hard time to deal with its debt load. The $400 million revolving credit facility matures in August of 2021, senior unsecured notes worth $500 million mature in November of 2022, and senior unsecured notes worth $300 million mature in May of 2025. Especially the $900 million maturing in 2021 and 2022 will need to be refinanced, as at the current gold price and at the projected capital expenditures, the company has no chance of repaying it.

Conclusion

New Gold's Rainy River mine should be profitable, but not in 2019. The sustaining CAPEX will include deferred construction expenditures of more than $150 million, which will push the AISC to $1,740/toz. Although the sustaining CAPEX will decline significantly in 2020, big CAPEX spending is scheduled for the New Afton mine during the 2021-2023 period. Besides all of this, New Gold will have to deal with debt maturities in 2021 and 2022. This level of uncertainty will probably mean that New Gold shares will have a hard time breaking the $1 level again before the end of 2019. I wouldn't be surprised if the share price declines back to the $0.7-0.8 level where it was moving before the recent rally.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Peter Arendas and get email alerts