MMG swings to loss and books $784 million write down

China-backed miner MMG Ltd (HKG:1208) revealed Wednesday it lost $1.05 billion last year as metals prices traded at multiyear lows, forcing it to book a $784.3 million write down.

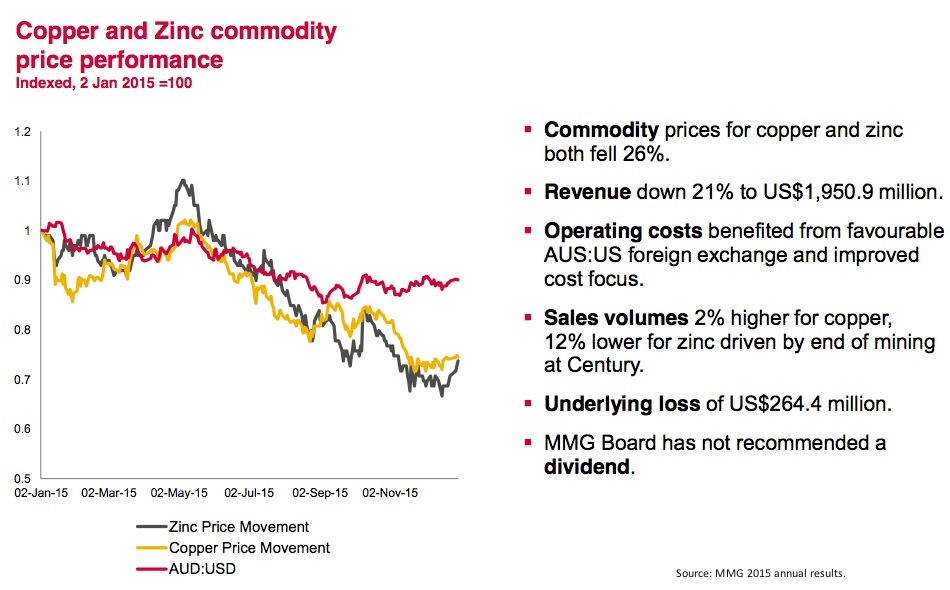

The overseas unit of China's largest state-owned copper and zinc producer said revenue fell 21% to $1.95 billion in the year to Dec. 31, despite achieving record copper production, as prices for the industrial metal were down 20%. Zinc prices, in turn, were 11%, the company said.

Despite the results, the miner said it was optimistic about the medium and long-term future.

Revenue fell 21% to $1.95 billion in the year to Dec. 31, despite achieving record copper production."Our people demonstrated their resilience and focus on safety, production volume and costs while we delivered the world's next major copper mine," CEO Andrew Michelmore said in a statement.

He was referring to Las Bambas copper mine in Peru, which began producing earlier this year and it is expected to produce between 250,000 to 300,000 metric tons in 2016, and close to 400,000 tonnes in 2017.

More supply doesn't seem to be what the market needs now, analysts and competitors say. Chile's Codelco, the world's No. 1 producer of the industrial metal, warned last week that prices are likely to stay at to around $2 to $2.10 a pound for at least two years. And Freeport-McMoRan (NYSE:FCX), the largest publicly traded copper producer, said that not even output cuts would be enough to end the surplus this year, as demand won't catch up with supply until 2017, Bloomberg reported.

Copper prices have collapsed in the past three years as China, the biggest consumer, headed for its slowest economic growth in a generation following years of investment in output by miners. According to figures published by the World Bureau of Metal Statistics, copper production exceeded demand by roughly 147,000 tons in 2015, the biggest glut since 2009.