Monetary Policy Trend Is Favorable For Gold

Global central bank policy has become more supportive for gold.

Falling bond yields and inflation rate outlook point to higher gold prices.

Gold mining stock improvements are also starting to show up.

Throughout the year, reports of gold's demise as a top-performing asset and safety vehicle have proven to be premature. Whenever gold suffers even the slightest of setbacks, the bears have attempted to break the metal's longer-term uptrend but have consistently failed in this attempt. Gold's latest show of weakness in September was again met with a renewed safety-related bid, which was based in part on the prospect of looser monetary policy on the part of the world's leading central banks. In this report, we'll review the various factors that warrant an optimistic stance toward gold.

The fear engendered by global trade-related friction has been one of gold's biggest allies this year. Each time it has looked like trade relations between the U.S. and China were on the verge of improving, something has occurred to upset investors' sanguine expectations. As a result, uncertainty has remained a steady fixture in the financial market, and this has been a powerful argument in favor of owning gold as a safety hedge. And while the latest developments in the trade war saga have been encouraging, gold certainly isn't lacking for supporting factors.

On the economic front, for instance, the Conference Board's Leading Economic Index (LEI) for September revealed a decline of 0.1%. This followed a downward revision in the August LEI of 0.2%. Not only does this provide investors with another reason to maintain gold holdings as an insurance policy against potential future economic weakness, it also lends itself to continued support from the Federal Reserve in the way of monetary stimulus.

Along those lines, New York Fed President John Williams last week assured investors that the central bank would adjust its plans to provide liquidity to funding markets "as appropriate." This was welcome news to gold investors, who view accommodative Fed policies as being largely beneficial for the inflation-sensitive gold market.

Moreover, as far as the Fed's rate policy goes, investors definitely believe the Fed will cut its benchmark interest rate at its next meeting later this month. According to the CME FedWatch Tool, the probability for a 25-basis point rate cut has risen to around 90% as of Oct. 19. This compares to a 67.3% probability only a week earlier.

It's not just the Fed that is finally heeding the financial market's demand for lower rates and loose money. Other central banks around the world have become more accommodative with monetary policy, including the European Central Bank (ECB) and the Bank of Japan (BOJ), which said last week that it could further ease its monetary policy if economic conditions called for it. Even the National Bank of Hungary has embarked upon a looser monetary course in recent months. Increasing expectations for lower rates and monetary stimulus - thanks largely to a sub-par inflation outlook - will benefit gold since the metal has historically outperformed whenever central banks have embraced a looser policy.

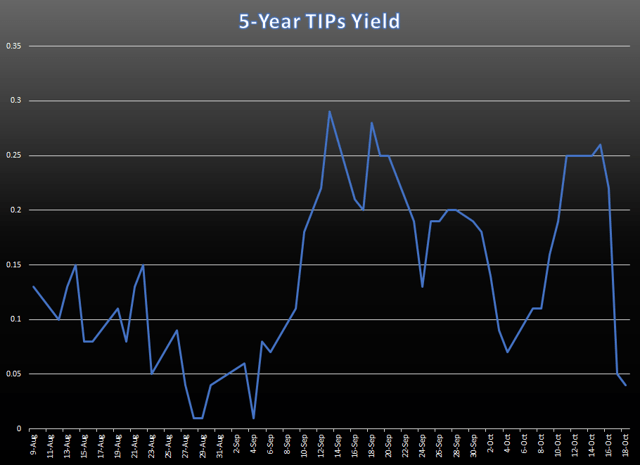

Our review of monetary conditions and the inflation outlook wouldn't be complete without an examination of one of my favorite coincident indicators. I'm referring to the 5-year TIPs yield, which is an excellent barometer of investors' inflation expectations. Due to gold's sensitivity to inflation, the metal's price tends to move inversely to the yields on inflation-protected Treasury securities, or TIPs. Shown below is the performance of the 5-year TIPs yield. The rally in the TIPs yield in early September coincided with a pullback in the gold price as investors fled the safety of the bond market. Higher rates make non-yielding bullion less attractive to investors, which partly explains why a rising TIPs yield is normally bad news for gold's near-term outlook.

Source: Treasury Department

The TIPs yield was also on the rise earlier this month, which partly accounted for gold's languid performance. However, the TIPs yield has since fallen back dramatically as of Oct. 17. If it remains low in the coming days, this would create a favorable bond rate backdrop from which gold can eventually launch a renewed rally.

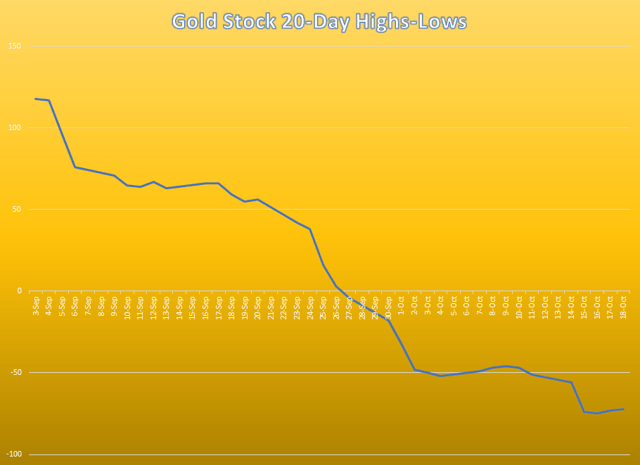

Another variable which casts a positive light on gold's near-term outlook is the latest show of relative strength among several major U.S. and Canadian gold mining shares. Most major gold stocks have experienced a needed cooling off phase over the last six weeks after becoming overheated during this summer's fevered rally. But now that many weak-handed, smaller investors have been shaken out of the market, the gold stocks are in a better technical condition in which they can launch a renewed rally later this autumn.

The slow-but-gradual internal improvement in the gold mining shares can be seen in the following chart, which shows the near-term path of least resistance for most miners. This graph features the 4-week rate of change (momentum) of the new highs and lows for the 50 most actively traded U.S.-listed gold shares. I use this indicator to show, among other things, whether selling pressure is increasing or decreasing for the gold stocks as a group. The chart shows that the selling pressure that plagued the gold stocks over the last several weeks has slowed to a crawl in recent days and has all but abated for now. What's more, if this indicator turns up in the coming days then we'll likely have a renewed breakout signal very soon.

Source: NYSE

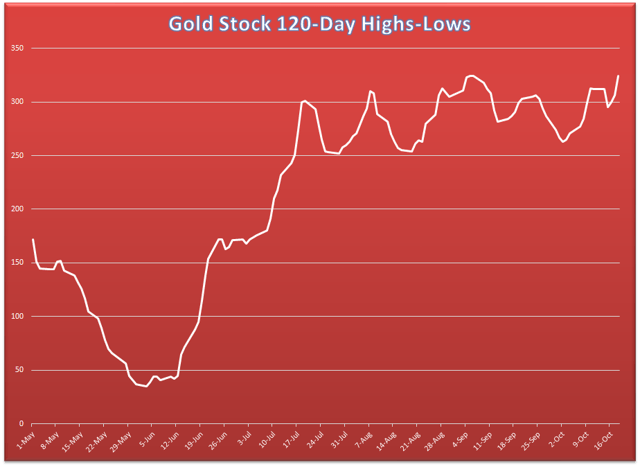

The 120-day high-low momentum indicator for the most active gold stocks, meanwhile, has been in a holding pattern since summer. This suggested to me that the impressive gold stock rally from earlier this spring had overshot on the upside and is still "correcting" itself. This largely internal corrective process continues, but the major upward trend in the 120-day indicator is still decisively to the upside. This tells us that the main intermediate-term trend for the gold mining stocks is also still rising. It has potentially bullish implications major gold stocks in the coming weeks and months once the latest consolidation in the mining shares has finished.

Source: NYSE

More importantly, the 120-day momentum indicator is beginning to increase. Based on my rate of change projections, the rise in this indicator will continue accelerate in the next several days. Assuming that happens, we may well have a confirmed buy signal for several leading gold mining stocks before the end of this month.

Between a more accommodating monetary policy on the part of the world's major central banks and a continued economic basis for owning gold as a safe haven asset, the yellow metal should continue its bull market in the coming months. The 5-year TIPs yield, which is a confirming indicator for gold demand, reflects the market's outlook for lower interest rates and lower inflation. Gold stocks have also shown signs of relative strength lately, which, if it continues, bodes extremely well for bullion's prospects this fall. In view of the combined technical and fundamental evidence reviewed here, investors are justified in maintaining a bullish intermediate-term (3-6 month) stance on gold and gold mining shares.

On a strategic note, I'm waiting for both the gold price and the gold mining stocks to confirm a breakout by closing the required two days higher above the 15-day moving average before initiating a new trading position in the VanEck Vectors Gold Miners ETF (GDX). GDX is my preferred trading vehicle for the gold mining stocks and the ETF I refer to most frequently in this report. I'm currently in a cash position in my short-term trading portfolio.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in GDX over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts