Money Flow Data Supports Higher Gold Prices

Demand for safety still runs high despite U.S.-Mexico trade resolution.

Falling bond yields also increase non-yielding gold's attractiveness.

South African gold mining stocks among the biggest winners right now.

One question that gold investors have been asking lately is, 'Can the gold rally continue if worries over global trade diminish?' After all, there's no denying that the initial impetus behind gold's June rally was the fear generated by the U.S.-Mexico tariff threat. Now that this particular trade dispute has been resolved, gold bulls are concerned that there isn't enough of the "fear factor" left to keep gold prices buoyant. In this report, I'll dispel that notion by pointing out that there's still plenty of fear to support the gold market's "wall of worry." We'll also look at money flows into other safe-haven vehicles, which further shows that gold's fear factor is safe.

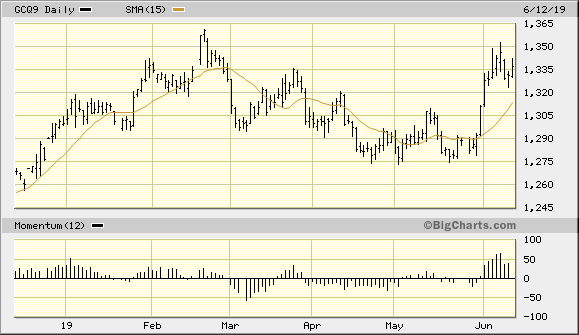

Gold had no problem attracting money flows earlier this month when investors' fears were at a fever pitch and the demand for safety was at a multi-month high. The S&P 500 Index (SPX) fell to a 3-month low on June 3 as trade-related worries proliferated. It was at that time that the investors turned their collective gaze toward gold. Consequently, the August gold futures price rose nearly 5% and is close to its previous peak from February. Fear, in other words, allowed gold to retrace most of its losses from the preceding three months in just under two weeks.

Since then, however, the market's worries over global trade have been put on hold and equity prices have been on the upswing. The abeyance in global trade worries has put a slight dent in gold demand in recent days, which can be seen in the August gold futures chart below. While the gold price has held near its recent peak, it also hasn't made much headway in recent days. Essentially, gold has used the stock market's rally as a time to consolidate its gains.

Source: BigCharts

Should gold investors be worried if the stock market continues to rally in the coming weeks? An examination of money flow data into other safe-haven instruments would answer this question in the negative. As it turns out, investors are still somewhat panic-stricken over the thought of an all-out trade war developing by later this year. Let's take a look at the evidence.

According to Deutsche Bank analyst Parag Thatte, money flows into bond funds have witnessed inflows of $17.5 billion last week, bringing total bond inflows for 2019 to $261 billion. Indeed, the trend toward safe-haven purchases of sovereign, corporate, and municipal bonds has continued all year and seems to be increasing.

Meanwhile, flows into money market funds were $31.3 billion last week. In the past six weeks, money markets have seen $138 billion in inflows, according to Deutsche Bank. All of this implies that, below the surface at least, fear is one of this year's constant factors. This bodes well for the intermediate-term (3-6 month) gold outlook and tells us that gold's fear factor is still very much alive and well.

With gold's fear factor seemingly in good shape, why then is the metal having trouble moving even higher? Gold analyst Frank E. Holmes points to Venezuela as being a key factor in gold's sluggish performance in recent days. Venezuela reportedly defaulted on a $750 million gold swap agreement with Deutsche Bank. In a recent article, Holmes observed:

A big headwind for gold in the past few months has been the troubled South American nation's gold reserve selling, which amounted to $570 million in just May alone. Any wonder why gold was having difficulty going up when you have a significant distressed seller in the market?"

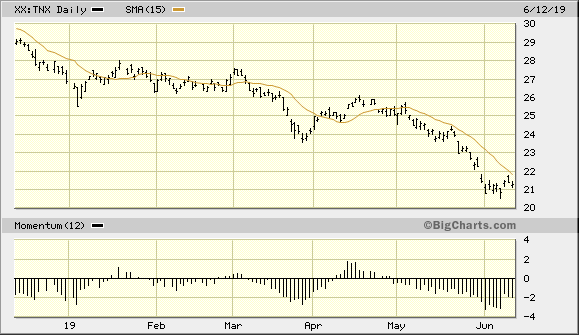

There are reasons for believing, though, that gold will soon get past this setback and continue its upward path. Aside from continued angst over the U.S.-China trade war, the diminished competition from higher bond yields is also a supporting factor for gold prices going forward. Below is the 10-Year Treasury Note Yield Index (TNX), which shows the extent to which government bond yields have tumbled in the last few months. Higher bond yields are one of non-yielding bullion's biggest threats. So, with U.S. government bond yields falling, gold faces one less headwind on its ascent to the February 20 peak price of $1,360.

Source: BigCharts

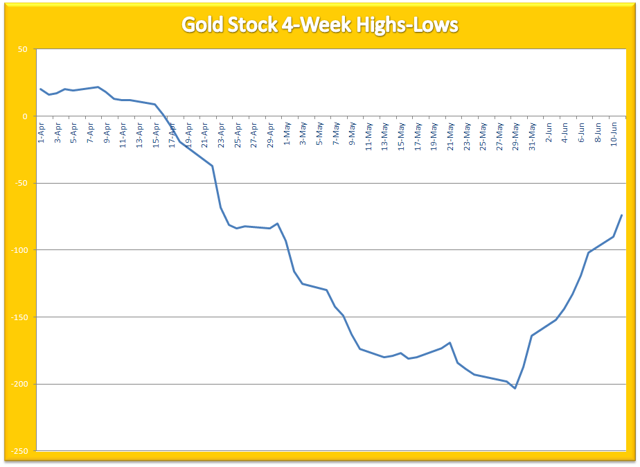

Let's now turn our attention to the gold mining stocks. As I've argued in the last several reports, gold stocks should outperform the physical metal in the coming weeks. I've based this argument on the observation that gold stocks were by and large extremely "oversold" technically at last month's low, and many of them offer superior value based on forward earnings and revenue expectations. What's more, the internal momentum profile for the gold mining stock industry is quite impressive.

Shown below is my favorite way of capturing the internal momentum for the 50 most actively traded U.S.-listed gold stocks. It's a 4-week rate of change indicator of the new highs and lows for the 50 gold stocks and it reflects the net demand for these stocks. When this indicator is rising, it suggests that the near-term path of least resistance for the gold mining stocks, in general, is to the upside. It's based on the fact that more gold stocks are making new highs than new lows, which requires a lot of sustained demand to achieve.

Source: NYSE

As you can see here, gold stock market internal momentum is still quite strong and, therefore, supports higher gold stock prices. One area of the gold mining industry which shows by far the most relative strength of any other is the South African miners. Below is a chart showing the extent to which the South African gold mining companies have outperformed their U.S. and Canadian counterparts in recent months. Investors should focus at least part of their portfolios on outperforming mining stocks from this segment of the market.

Source: GoldCharts'R'Us

In summary, the continued strong demand for cash among investors along with falling Treasury yields suggests that there's still a lot of fear in the market. This bodes well for gold since gold typically attracts the most attention when fears are running high. Continued uncertainty over the U.S.-China trade outlook should support gold prices in the coming weeks. From a technical perspective, rising internal momentum behind the actively traded gold mining shares - particularly those of a South African provenance - should also help propel gold stock prices higher in the coming weeks. In view of these factors, investors are justified in maintaining a bullish bias for gold and the mining shares.

On a strategic note, I'm currently long the VanEck Vectors Gold Miners ETF (GDX) using a level slightly under the $20.42 level (the May 29 closing price) as the initial stop-loss on an intraday basis. Investors can also maintain longer-term investment positions in physical gold. The latest weekly close under the 50-day moving average in the U.S. dollar index should help support the intermediate-term outlook for gold prices.

Disclosure: I am/we are long GDX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts