Money Metals 2019 Precious Metal Markets Outlook / Commodities / Gold & Silver 2019

Precious metals markets enter 2019 withan opportunity to shine. Several major bullish drivers are lining up to startthe New Year – including technical, fundamental, monetary, and politicaldrivers.

Precious metals markets enter 2019 withan opportunity to shine. Several major bullish drivers are lining up to startthe New Year – including technical, fundamental, monetary, and politicaldrivers.

Before delving into each of them, let’sconsider where we’ve been over the past 12 months.

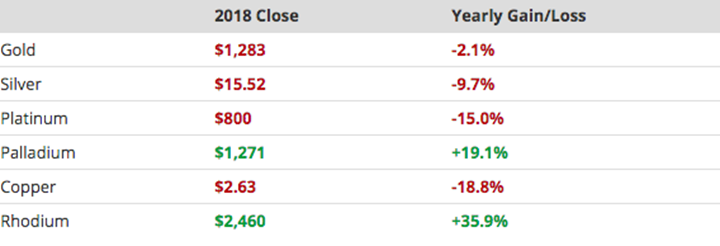

To be frank, 2018 wasn’t a particularlybright year for gold and silver prices. Gold will finish with a slight loss;silver with a larger loss just shy of 10%.

It could have been worse.

Sentiment toward metals got extremelydepressed mid year. Speculators took out record short positions in the futuresmarkets. Meanwhile, sales of American Eagles and other popular retail bullionproducts slowed to a trickle.

By late summer, the money metals were making new yearly lows as the stock market headed for newrecord highs. But in September, the Fed went one hike too far.

After monetary authorities pushed theFederal Funds Rate slightly above 2% (“neutral”), investors began to fearcascading negative effects in the housing, industrial, and consumer sectors.

That fear – and the rotation out ofstocks that followed – helped slowly reinvigorate safe-haven buying in preciousmetals.

From late November through the end of theyear, gold and silver prices rallied to multi-month highs. Momentum could carryforward to a strong first quarter of 2019.

Silver’s Technical Launching Pad

Silver looks especially interesting onthe charts. Prices formed a long, drawn out double bottom base from Augustuntil Christmas week. Silver then broke out sharply through its $15.00/ozresistance level. The price action resembles an early stage liftoff from alaunching pad. Silver is famous for its vertical moves, both to the upside andthe downside.

The price action resembles an early stage liftoff from alaunching pad. Silver is famous for its vertical moves, both to the upside andthe downside.

There is a good chance its downside wasfully exhausted in 2018.

One indication of just how depressedsilver prices got: the silver:gold ratio hit its lowest point in a quartercentury. Silver briefly got as low as 1/86th the price of gold.

One trend to look for in 2019 is anarrowing of the price spread between gold and silver.

The way that usually happens is thatsilver gains more than gold during rallies, so simply owning silver is a goodway for most investors to play it. More sophisticated traders can try puttingon long silver/short gold trades or selling their physical gold in exchange forsilver.

Supply and Demand Fundamentals

The mining industry has suffered setbackafter setback in recent years due to low metal prices (sometimes below averageall-in production costs) and poor management decisions. The strong companieshave managed to survive and some even turned profits in 2018.

However, the industry as a whole in itsweakened state lacks the capacity to ramp up production in 2019.

Analysts at Refinitiv GFMS (formerlyThomson Reuters) project gold mining output will decrease slightly in the yearahead – from approximately 3,282 tonnes in 2018 to 3,266 tonnes.

Silver mining is more difficult toforecast since two thirds of silver production comes from the mining of otherprimary metals (mainly copper, lead, and zinc). The share prices of base metalsminers got hit hard in the second half of 2018, so some large-scalecapital-intensive expansion projects may have to get scrapped.

The physical silver market has been amply supplied in recent years by growing productionout of Mexico. But it may have now peaked. We will find out in the year aheadwhether the new leftist government in Mexico is mining friendly.

Political risk is growing in other partsof the world, especially South Africa – a major supplier of gold and theworld’s leading supplier of platinum and palladium. However, the mining industrythere faces escalating political threats as the government threatens to seizewhite-owned land without compensation and impose crippling regulations onbusinesses.

Demand for precious metals and basemetals is likely to show a small increase in 2019, barring a major globaleconomic contraction. For gold and silver, investment demand could swing pricesat the margins.

People tend to buy precious metals whenthey are fearful of holding conventional financial assets.

If investors continue to flee equitiesand cryptocurrencies, then it will be a question of whether hard money or theU.S. dollar serves as the premier safe haven. It only takes a small proportionof investors choosing precious metals to have a big impact on these relativelytight markets.

Central bank buying will continue to be asignificant source of gold demand.

According to the World Gold Council,central bank demand for gold came in 22% higher in the third quarter of 2018compared to the prior year.

In 2018, new sources of official buying emerged.For one, the Hungarian National Bank purchased 28.4 tonnes of gold – its firstmajor gold purchase since 1986.

The Polish central bank steadilyaccumulated gold last year, too, bringing its total reserves over 117 tonnes.Turkey also got in on the action, adding 18.5 tonnes in the third quarter.

Russia, meanwhile, continues to be theworld’s most aggressive gold buyer. The Russians are adding about 20 tonnes totheir reserves every month as they liquidate holdings of U.S. Treasuries.

Another major state buyer of gold isChina – and it is likely buying much more than it reports publicly. With thegrowth of the Shanghai Gold Exchange, precious metals are increasingly flowinginto Asia to satisfy growing monetary, investment, and jewelry demand in the region.

Wild Card: Will the Fed Back Down and Reverse Course onRate Hikes?

Contrary to popular misconceptions,rising interest rates aren’t necessarily bearish for precious metals prices;nor are falling rates necessarily bullish.

Other factors, such as trends ininflation, the economy, and financial markets can move metals markets – as canmetals’ own particular supply/demand fundamentals.

That said, if Federal Reserve policyczars were to do an about-face on rates in early 2019, the U.S. dollar wouldlikely get sold off. That translates into upward pressure for hard assets, atleast in dollar terms.

U.S. monetary planners ideally wanted toget the Federal Funds Rate up to 4% before changing course. If they stop shortof 3%, they will be working with a stripped down set of conventional tools forstimulating the economy out of the next recession.

During a downturn, the Fed typically cutsby about 4 full percentage points. If it doesn’t have room to do that beforereaching zero, it might look to negative interest rates, Quantitative Easing,or other unconventional liquidity-injection programs.

The Fed will face tremendous politicalpressure in the months and years ahead not only to hold interest ratesartificially low but also to monetize soaring U.S. debt.

Political Dysfunction to Put Downward Pressure on Value ofU.S. Dollar

As a new Democrat-controlled Congresstakes power amidst a partial government shutdown, the political theater thatgrabs headlines will be a distraction to the larger tragedy playing out –namely the national debt.

The federal government is projected tobegin running trillion-dollar budget deficits in 2019. It will also be facing afunding crisis for Social Security and Medicare in just a few short years. WithWashington mired in dysfunction, there is little chance of any bipartisansolution emerging.

President Donald Trump ran as an outsiderwho vowed to “drain the swamp.” He has yet to fully embrace that role. Only inthe last few days of Republican control of Congress did he put up a fight overthe budget – and only over the issue of funding for border security.

If Trump doesn’t get a handle on deficitspending, then rising borrowing costs will counteract the tax cuts and otherpro-growth policies he championed. The Trump boom in the stock market may havealready come and gone.

Yes, he can blame the Fed for spoilingthe party. But the next infusion of monetary stimulus won’t necessarily createanother boom on Wall Street. It might generate a boom in commodities andconsumer prices – i.e., the “bad” kind of inflation.

The Fed is in a tough spot. It can’tforce Congress to pass balanced budgets or reduce its need to borrow.

Since members of Congress know thatwhatever new debt they take on can be papered over by an increase in the currencysupply, they have no particular incentive to be fiscally responsible.

Under our fiat monetary system, the “endgame” isn’t a debt default. It is instead a perpetual slow-motion default onthe value of the currency in which the debt is denominated.

A weaker dollar is coming. You can takethat to the bank – or more wisely, a safe for precious metals storage.

Stefan Gleason isPresident of Money Metals Exchange, the national precious metals company named 2015"Dealer of the Year" in the United States by an independent globalratings group. A graduate of the University of Florida, Gleason is a seasonedbusiness leader, investor, political strategist, and grassroots activist.Gleason has frequently appeared on national television networks such as CNN, FoxNews,and CNBC, and his writings have appeared in hundreds of publications such asthe Wall Street Journal, Detroit News, Washington Times, and National Review.

© 2018 Stefan Gleason - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2018 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.