NASA And Big Tech Are Facing Off Over This Rare Gas / Commodities / Investing 2021

Smartinvestors are preparing to profit from a supply squeeze in an $18-billionmarket.

So,what’s a supply squeeze?

Simple:When the supply of something goes DOWN at the same time demand for it goesUP...

Asupply squeeze triggers.

Whenthat happens, you can potentially make more in a short time than you wouldnormally make over a lifetime.

Forexample, it just happened with lumber.

Thecoronavirus shut down logging. Supply DOWN.

Atthe same time, the coronavirus ramped up home remodeling. Demand UP.

Inone year, you could have made 400%... morethan you would have made in a lifetime.

Evenbetter … if you invested in the smaller lumber companies in this supercycle—theones whose earnings are tied directly to the price of lumber--you could havemade even more.

Earlyinvestors in the lumber supply squeeze saw share price increases of over 400% onWest Fraser Timber (NYSE:WFG) ... 515% on Canfor (OTCMKTS:CFPZF)

...677% on Interfor Corporation(OTCMKTS: IFSPF)…

Butlumber is a renewable resource. We can always plant more trees.

Butwhen it happens with a non-renewable resource… prices can go exponential.

Sonow, early investors are getting in position for a new supply squeeze in a relativelyunder the radar non-renewable resource -- helium.

Inshort: A post-coronavirus supply squeeze could trigger helium sooner than wefirst thought – helium is already a market projected to be worth $18.1 billion by 2025.

Why?40% of supply has been taken off the market.

Here’sone stock that could profit from it…

RARE AND GETTING RARER: 40% OF U.S. SUPPLY IS ABOUT TODISAPPEAR... AND IT'S HEADED TO ZERO

So,what's about to happen?

Theglobal market for this non-renewable resource is set to grow—even byconservative estimates—at a CAGR of over 11%by 2025…

Since the First World War, a federal reserve in Amarillo, Texas,has been stockpiling this strategic gas, providing some 40% of the supply.

Most of that has been used up now. Between 2005 and2018, the Reserve sold off more than $2 billion in theseprecious reserves.Now, it’s mostly been depleted, and in September, the reserve will be shut down, while the existing price ceilingwill disappear.

“Inthe past, we were considered a flywheel—whenever there were impacts in thedelivery system, we could ramp up and produce … where the shortages wereshort-term,” Samuel Burton, BLM manager for Reserve told the Smithsonian Magazine. “Now, aswe wind down our program, there really needs to be more […] found, moreproduction created, and more secure delivery systems in place.”

Longerterm, the supply of this non-renewable resource could be heading toward zero.

In fact, prices have just broken out of their 19-year trading pattern...

Raw helium is now selling for ~$350 per Mcf,while refined helium is selling for a whopping $600-$650 per Mcf, making it afantastic low volume/high-value commodity.

That’s what happens when the US takes over 2 billioncubic feet off the market.

Andcould go exponential as this news filters up through the media.

WHY YOU HAVEN'T HEARD ABOUT THIS SUPPLY AND DEMAND SQUEEZE(YET)

Whilethis “boring” resource is quietly going up… the smartest resource investors arepiling in before the squeeze.

Theymay soon be followed by the really big money...

Includingresource ETF firms like BlackRock and Vanguard... with $9T and $7T in assetsunder management.

So,right now, there's a small window of opportunity to get in... ahead of the big money.

Whenthis big money floods in, you can expect the price of this resource to go muchhigher...

Withthe price of small stocks like this one with the potential to go up substantially.

Investorshaven't heard about it yet because it doesn't affect their daily lives...

Butsoon they will because it could affect everything from computers to MRIs...

ToGoogle, Facebook, Amazon, Netflix and more.

SUPPLY SQUEEZE 2021:

Google,Facebook, Amazon, and Netflix could soon be locked in a battle for thisresource because existing mines are rare.

There are only 14 refineries in theentire world, with 7 in the United States.

Butone little known stock is building up a portfolio of some of the most favorableland where this non-renewable resource can be extracted in North America.

Infact, Beacon Securities Limited recently initiated coverage on this tiny stock...

And said it could deliver well-levelpayouts of only a few months and IRRs of 122%-635%. Returns like thesewould rival (or beat) most O&G plays in Canada and the U.S… and that doesn’t even factor in that the heliumsupply squeeze is likely just beginning.

Smartinvestors will want to be in before the story of this non-renewable resource --helium -- is all over the news.

Fewpeople know anything about this $18.1 billion helium market...

Whichmakes it the go-to commodity when it comes to cooling.

Thereis no substitute.

Liquidhelium is used for cooling everything from magnets in MRI machines andventilator machines to supercomputers and data centers.

About 30% of the world’s helium supplygoes into MRI scanners...

While another 20% ofthe world’s helium supply goes into the manufacture of hard disks andsemiconductors.

With Big Tech companiessuch as Google, Facebook, Amazon, and Netflix being heavy users of helium intheir massive data centers, we may soon see them all scramble to secure it.

Ifthat happens... the earliest investors will be rewarded with more gains in ashort time...

Moregains than you would normally make in a lifetime.

THE #1 STOCK TO PLAY THE 40% DROP IN THIS NON-RENEWABLERESOURCE

Canadian junior explorer Avanti Energy Inc. (TSX:AVN.V; USOTC:ARGYF) is in aprime position to benefit from the emerging helium rush.

It has a team with a proven explorationand discovery track record, working to discover key tracts of Canada’s Montney(for $8 billion oil giant Encana), one of the richest natural gas deposits inthe world. Now, it’s snapping up prime new helium territory ahead of whatmight be the biggest rush in history.

Avanti have made four key license acquisitions--two in Alberta andtwo in Montana (the Montana acquisitions are not closed yet, but the Company isconfident they should close soon).

On June 14th, Avanti announcedits biggest play yet, an intention to acquire the helium license rights a massive ~50,000 acres of highly prospective helium landin Montana. If completed, that will bring its total prospective helium holdingsto some 75,000 acres in North America.

Remember, these are the same guys who discovered the Montney.

Sowhy is Beacon Securities Limited so bullish on this stock? Lets try to readbetween the lines…

REASON#1: We are running out of helium. The US government has nowsold off 2 billion cubic feet of the helium it had in reserve. That reserve was40% of supply. And by September, by law, it has to begin disposal of all heliumassets and operations, including the helium storage reservoir and pipelinesystem.

Canaccord Genuity CapitalMarket says the helium market is “chronicallyundersupplied”.

Cormack Securities says: “The current landscapefor new entrants into this emerging industry has never been better. Currentlythere is a global helium supply shortage that is being multiplied by thegrowing demand, which “has driven renewed interest into securing reliablesources. This growing demand in part is responsible for the US Federal HeliumReserve depleting its resources.”

Eight Capital says: “Prices have been anywhere from $200 to $400/MCF. As aframe of reference, natural gas trades at about $3/MCF. Base case, we could see helium demandoutpace supply at least until 2025.”

REASON #2: Avanti is acquiring the helium rightsto land in some of the best helium prospecting areas in North America, inAlberta and Montana, both ground zero for helium.

In March, Avanti acquiredthe license for over 6,000 acres from the Government of Alberta inhighly prospective helium territory, and it’ssnowballed from there.

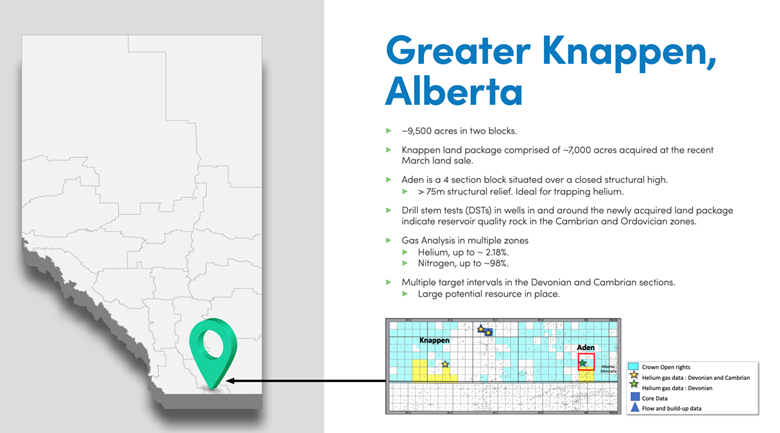

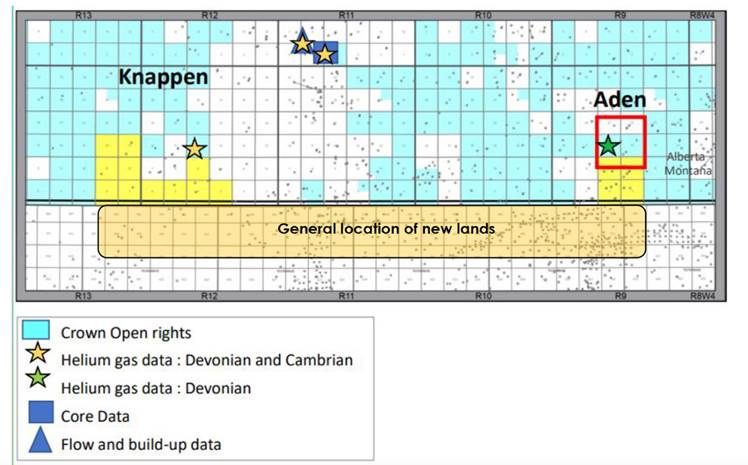

Now, Avanti boasts the Knappen and Aden projects in Alberta and has made itseven bigger strategic move on Montana.

Knappen is ~6,000 acres of nitrogen-rich helium in multiple zones. Gas analysisshows helium concentrations up to 2.18% and nitrogen up to ~98%. It also showsthe presence of several deep structural high features that are ideal fortrapping helium. Aden is a ~2,500-acre play with a closed structural high,also ideal for trapping helium, and multiple shows of up to 2%. It’s also thefirst asset to advance into the exploration phase and drilling is expected bythe end of this year already.

And let’s not forget that Avanti Energy Inc.(TSX:AVN.V; USOTC:ARGYF) is led bythe same team that “identified, modeled anddeveloped” the infamous Montney play for $8 billion oilgiant Encana (now Ovintiv Inc – NYSE: OVV). Beacon’s guidance aptly notes thatthe Montney project has achieved nearly 300,000 boe/d in production over thepast 15 years, so it seems like this team knows how to explore and discover.

Bet the jockey, not the horse… And perhaps double down when you learn that thejockey has a proven track record of discovering gargantuan oil/gas assets formassive conglomerates, and even once more when you learn that the jockey hasbeen buying a considerable amount of stock at levels higher than where the shareprice sits as I write this piece…

Perhaps the early innings of this new heliumexploration gig reminds Bakker and his team of their prior successes?

Is ‘The Montney of Helium’ About tobe Discovered in Montana?

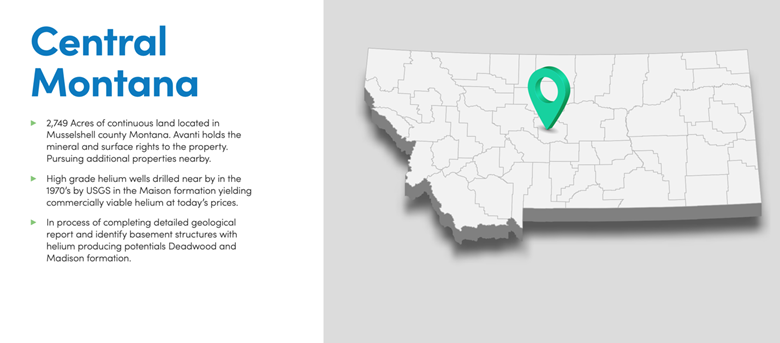

In April, Avanti moved to acquire the license to a 12,000-acreland package in Montana that is on-trend withan active, nitrogen-rich helium drilling area in Saskatchewan. Although theacquisition is not closed yet, it has been announced, and the collection of 2Dand 3D seismic shows several structures prospective for helium trapping, whilemultiple gas analyses show notable concentrations of helium, suggesting upwardmigration of helium and good potential for deeper helium-rich zones. (In the1970s, the USGS drilled high-grade helium wells nearby, yielding commerciallyviable helium at today’s prices.)

And the biggest move yet … on June 14th, Avanti announced itsintention to capture ~50,000more acres of licenses in Montana.

The highlights from this highly prospective helium property are enough to boostinvestor confidence many times over. They include:

The next moves that could boostthis stock will be the finalization of due diligence on this 50,000 acres,which is expected to be done next month, and then the start of the drilling campaignbefore the end of this year.

REASON #3: You can’t invest in helium directly. Mostof these companies are private and super profitable so their executives arecollecting multi-millions in profits every year. There are very few publiccompanies for investors to get in on. That makes Avanti a rare opportunity to potentiallyget in on the ground floor of the next big supply squeeze for a gas that is oneof the most critical drivers of the global economy.

That’s why Beacon Securities Limited has set an initial price target of $3.80 pershare on AvantiEnergy Inc. (TSX:AVN.V; US OTC:ARGYF), noting: “We believe critical masshas been achieved and Avanti now has a key asset on which its world-classtechnical team can explore. We maintain our $3.80 price target and our Spec Buyrating.”

And in their report BeaconSecurities Limited indicates that Avanti may deliver well-level payouts of onlya few months and a IRR of 122-635% on its land packages; and Beacon furtheropines that “Returns like these would rival (or beat) most oil and gas plays inCanada and the US”.

Everything’s lined up here:

Asupply squeeze is coming SOON, and September marks the end of the massivelyimportant US federal helium reserve in Texas.

Pricesjust broke out of a 19-year trading pattern but will almost certainly gohigher. Small stocks like Avanti could go up even more.

BeaconSecurities Limited has placed its initial bet on Avanti and sees upside to$3.80, but we think it could potentially go higher because longer-term thisresource is non-renewable... and currently appears headed toward zero supply.

Plus,Google, Facebook, Amazon, and Netflix may need to battle over it.

By: Richard Sanderson

** IMPORTANT NOTICE ANDDISCLAIMER -- PLEASE READ CAREFULLY! **

PAID ADVERTISEMENT. Thisarticle is a paid advertisement. GlobalInvestmentDaily.comand its owners, managers, employees, and assigns (collectively “the Publisher”)is often paid by one or more of the profiled companies or a third party todisseminate these types of communications. In this case, the Publisher has beencompensated by Avanti Energy Inc. (“Avanti” or “AVN”) to conduct investorawareness advertising and marketing. Avanti paid the Publisher to produce anddisseminate four similar articles and additional banner ads at a rate of seventythousand US dollars per article. This compensation should be viewed as a majorconflict with our ability to be unbiased.

Readersshould beware that third parties, profiled companies, and/or their affiliatesmay liquidate shares of the profiled companies at any time, including at ornear the time you receive this communication, which has the potential to hurtshare prices. Frequently companies profiled in our articles experience a largeincrease in volume and share price during the course of investor awarenessmarketing, which often ends as soon as the investor awareness marketing ceases.The investor awareness marketing may be as brief as one day, after which alarge decrease in volume and share price may likely occur.

Thiscommunication is not, and should not be construed to be, an offer to sell or asolicitation of an offer to buy any security. Neither this communication northe Publisher purport to provide a complete analysis of any company or itsfinancial position. The Publisher is not, and does not purport to be, abroker-dealer or registered investment adviser. This communication is not, andshould not be construed to be, personalized investment advice directed to orappropriate for any particular investor. Any investment should be made onlyafter consulting a professional investment advisor and only after reviewing thefinancial statements and other pertinent corporate information about thecompany. Further, readers are advised to read and carefully consider the RiskFactors identified and discussed in the advertised company’s SEC, SEDAR and/orother government filings. Investing in securities, particularly microcapsecurities, is speculative and carries a high degree of risk. Past performancedoes not guarantee future results. This communication is based on informationgenerally available to the public and on interviews with company management,and does not (to the Publisher’s knowledge, as confirmed by Avanti) contain anymaterial, non-public information. The information on which it is based is believedto be reliable. Nevertheless, the Publisher cannot guarantee the accuracy orcompleteness of the information.

SHARE OWNERSHIP. ThePublisher owns shares and / or options of the featured company and thereforehas an additional incentive to see the featured company’s stock perform well.The Publisher does not undertake any obligation to notify the market when itdecides to buy or sell shares of the issuer in the market. The Publisher willbe buying and selling shares of the featured company for its own profit. Thisis why we stress that you conduct extensive due diligence as well as seek theadvice of your financial advisor or a registered broker-dealer before investingin any securities.

FORWARD LOOKING STATEMENTS. This publication contains forward-looking informationwhich is subject to a variety of risks and uncertainties and other factors thatcould cause actual events or results to differ from those projected in theforward-looking statements. Forward looking statements in this publication includethat prices for helium will significantly increase due to global demand and usein a wide array of industries (including key technology sectors) and thathelium will retain its value in future due to the demand increases and overallshortage of supply; that Avanti can pursue exploration of the recently acquiredlicenses of property in Alberta; that Avanti’s licenses in respect of theAlberta property can achieve drilling and mining success for helium; thatAvanti will be able to acquire the rights to helium on the 12,000 acres of landin Montana pursuant to its recent letter of intent announced on April 16, 2021,and the helium rights to the ~50,000 acres of land in Montana pursuant to itsrecent letter of intent announced on June 14, 2021; that the Avanti team willbe able to close on the aforementioned Montana helium license acquisitions;that the Avanti team will be able to develop and implement helium explorationmodels, including their own proprietary models, that may result in successfulexploration and development efforts; that historical geological information andestimations will prove to be accurate or at least very indicative of helium;that high helium content targets exist in the Alberta and both Montanaprojects; and that Avanti will be able to carry out its business plans,including timing for drilling and exploration. These forward-looking statementsare subject to a variety of risks and uncertainties and other factors thatcould cause actual events or results to differ materially from those projectedin the forward-looking information. Risks that could change or preventthese statements from coming to fruition include that demand for helium is notas great as expected; that alternative commodities or compounds are used inapplications which currently use helium, thus reducing the need for helium inthe future; that the Company may not fulfill the requirements under its Albertalicenses for various reasons or otherwise cannot pursue exploration on theproject as planned or at all; that the Company may not be able to acquire thehelium rights to the Montana lands as contemplated in the letter of intent orat all; that the Avanti team may be unable to develop any helium explorationmodels, including proprietary models, which allow successful explorationefforts on any of the Company’s current or future projects; that Avanti may notbe able to finance its intended drilling programs to explore for helium or mayotherwise not raise sufficient funds to carry out its business plans; thatgeological interpretations and technological results based on current data maychange with more detailed information, analysis or testing; and that despitepromise, there may be no commercially viable helium or other resources on anyof Avanti’s properties. The forward-looking information contained herein isgiven as of the date hereof and we assume no responsibility to update or revisesuch information to reflect new events or circumstances, except as required bylaw.

INDEMNIFICATION/RELEASEOF LIABILITY. By reading this communication, you acknowledge that youhave read and understand this disclaimer, and further that to the greatestextent permitted under law, you release the Publisher, its affiliates, assignsand successors from any and all liability, damages, and injury from thiscommunication. You further warrant that you are solely responsible for anyfinancial outcome that may come from your investment decisions.

TERMSOF USE.By reading this communication you agree that you have reviewed and fully agreeto the Terms of Use found here http://GlobalInvestmentDaily.com/Terms-of-Use. If you donot agree to the Terms of Use http://GlobalInvestmentDaily.com/Terms-of-Use, pleasecontact GlobalInvestmentDaily.com to discontinue receiving futurecommunications.

INTELLECTUALPROPERTY.GlobalInvestmentDaily.com is the Publisher’s trademark. All other trademarksused in this communication are the property of their respective trademarkholders. The Publisher is notaffiliated, connected, or associated with, and is not sponsored, approved, ororiginated by, the trademark holders unless otherwise stated. No claim is madeby the Publisher to any rights in any third-party trademarks.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.