Nasdaq Outperforms on Semiconductor Strength

The S&P hit a record intraday peak

The S&P hit a record intraday peak

News of a trade truce between the U.S. and China sparked a stock surge out of the gate today, sending the Dow up 290 points in early trading and the S&P 500 to a fresh record high. However, a lack of details from the meeting between Presidents Donald Trump and Xi Jinping and some lackluster factory data had the major indexes paring their earlier gains. The Nasdaq eased back from its session highs, too, though the tech-heavy index outperformed its peers on strength in semiconductor stocks.

Continue reading for more on today's market, including:

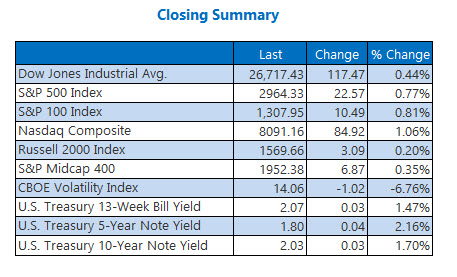

One reason to watch for a VIX spike this July, courtesy of founder and CEO Bernie Schaeffer.Why MasterCard bears could be caught off guard.2 more reasons to like Twilio stock.Plus, 3D Systems flashes bearish signal; the news that sank Coty; and the biotech buoyed by drug data.The Dow Jones Industrial Average (DJI - 26,717.43) gained 117.5 points, or 0.4%. Twenty-four of the Dow's 30 components closed higher, led by a 1.8% pop for Apple (AAPL). Boeing (BA) paced the six decliners with its 2.1% drop.

The S&P 500 Index (SPX - 2,964.33) hit an all-time intraday peak of 2,977.93, before settling up 22.6 points, or 0.8% -- a new record high close. The Nasdaq Composite (IXIC - 8,091.76) jumped 84.9 points, or 1.1%.

The Cboe Volatility Index (VIX - 14.06) fell 1 point, or 6.8%.

5 Items on our Radar Today

Kim Kardashian West said she would change the name of her shapewear line from "Kimono," after the announcement sparked backlash, accusations of cultural appropriation, and a #KimOhNo hashtag on Twitter. Earlier today, Kardashian tweeted an appreciation for a "direct line of communication with my fans and the public," and said she'll "be in touch soon" with a new name. (CNBC)Police in Hong Kong stormed the Legislative Council building after demonstrators vandalized the structure, wearing riot gear and firing tear gas. This comes amid weeks of sometimes violent protests over a now-suspended bill to allow extraditions to China, and occurred on the 22nd anniversary of Hong Kong returning to Chinese rule. (MarketWatch)3D Systems flashed a bearish signal during its recent run higher.The news that sank cosmetics stock Coty.This biotech was buoyed by well-received drug data.There are no earnings to report today.

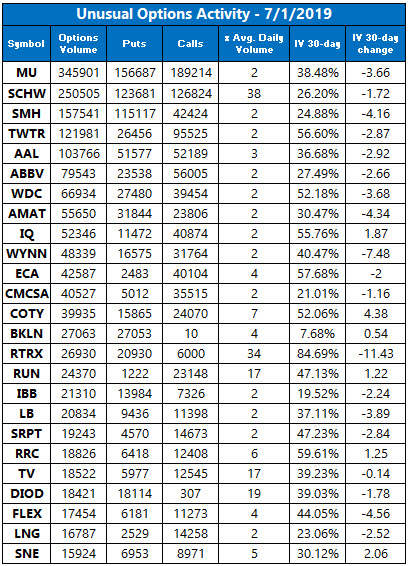

Data courtesy of Trade-Alert

Crude Gains on OPEC Buzz; Gold Sinks on Trade News

Oil got a boost today on reports the Organization of the Petroleum Exporting Countries (OPEC) and Russia plan on extending production cuts for up to nine months. After topping the $60 per barrel mark in intraday action, August-dated crude closed up 62 cents, or 1.1%, to settle at $59.09 per barrel.

Gold tumbled today as U.S.-China trade development's lessened the safe-haven asset's appeal. At the close, gold for August delivery was down $24.40, or 1.7%, at $1,389.30 an ounce -- its biggest one-day drop in over a year.