National Financial Outlook Very Positive For Gold

There are some very solid reasons to add gold to your portfolio today in order to protect your wealth.

The Federal government's financial position continues to deteriorate and will likely not improve anytime soon.

There are policymakers actively talking about MMT, an economic theory that gives the State license to print money.

In reality, this will cause the value of the U.S. dollar to decline due to the increased amount of money chasing the same amount of goods and services.

There is highly likely to be a recession within the next year or two, and such a scenario would also prove positive for gold.

I have found myself thinking increasingly often about investing in gold (GLD) over the past week or two, which comes about largely in response to a few factors. The most significant of these revolves around the financial prospects for both the Federal and the various state and local governments, which are quite dismal and growing ever more so. This is increasingly likely to lead to money printing in order to satisfy these financial demands, which is an environment that should prove to be good for gold. We also see increasingly signs that a recession may be imminent, which is also something that historically benefits gold as investors flee to its perceived safe haven status. It may therefore be a good idea to add some gold to your portfolio now, if for no reason than to protect your hard-earned wealth.

U.S. Federal Deficit

One of the biggest problems facing the United States today is the Federal debt. As of the time of writing, the US National Debt sits at $22.147 trillion, which works out to roughly $67,400 per citizen and $180,800 per taxpayer. This is 105.3% of gross domestic product, which is well above the 90% ratio that academic research (Reinhart & Rogoff, Growth in a Time of Debt, American Economic Review, May 2010) states is the maximum an economy can support without beginning to greatly curtail its growth. As any of us that have ever borrowed money know though, the problem with debt is that you need to pay interest on it, which is overall a net drain on your income. The same is true of the Federal Government, which must pay interest on the national debt.

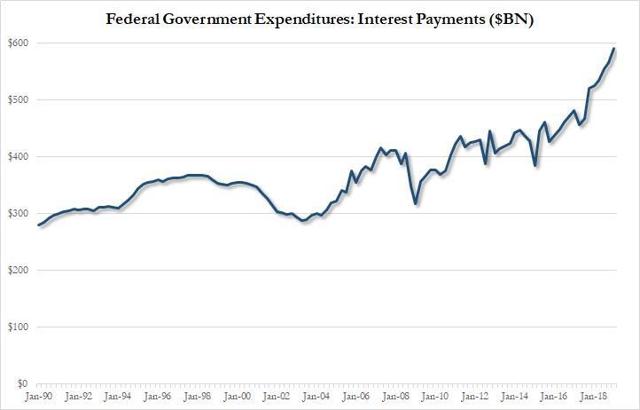

Historically, the United States Federal Government has been considered the most creditworthy borrower in the world, which is why Treasury securities are oftentimes considered to be a risk-free asset. This has resulted in the government generally having low interest rates (at least compared to other loans), and indeed, due to both this and the ultra-low interest rates from the Federal Reserve, has resulted in the government paying interest rates that were barely above zero for most of the past decade. That has begun to change now that the Federal Reserve has been hiking rates for the past year or two. These rising interest rates have caused the nation's debt payments to rise, and in the first five months of the fiscal year, the government paid out $221 billion in interest payments on the debt. The payments on national debt are now at record levels:

Source: Zero Hedge

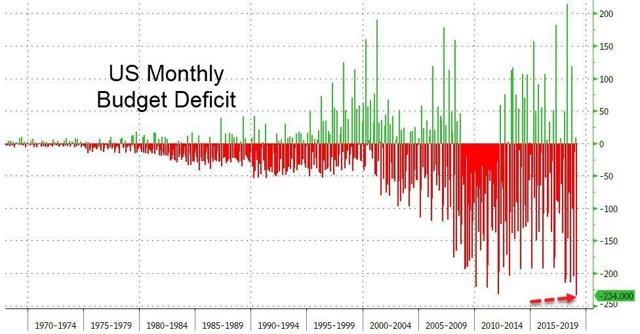

This alone might not even be a problem if the government were actually running a surplus and could thus reduce the amount that it has to service. Unfortunately, this is not the case, and indeed, signs are beginning to point to this year having the highest or one of the highest budget deficits on record. In the month of February, the U.S. Federal Government posted a budget deficit of $234 billion, higher than the $227 billion that was expected and setting a new monthly record.

Source: Zero Hedge

So far this fiscal year, the Federal Government has posted a budget deficit of $544 billion, which puts it on track to reach or exceed $1.2 trillion. That is lower (but not by much) than the $1.413 trillion budget deficit that the Federal Government had in 2019 to combat the effects of the last financial crisis and resulting recession. It is important to keep in mind too that this is during a supposedly good economy, so we can imagine what could happen when the next recession hits and the safety net programs expand to help people cope.

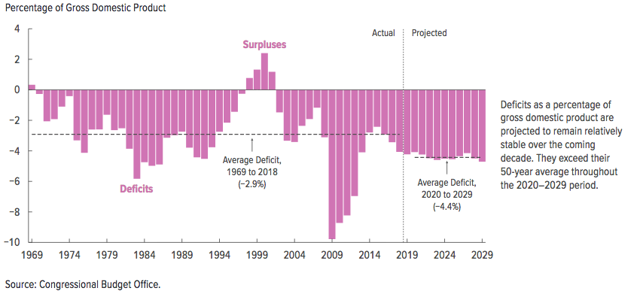

There are no indications that these budget deficits will decline anytime soon. In fact, the Congressional Budget Office projects that the budget deficit will increase going forward, due mostly to the rising costs of the major entitlement programs as the Baby Boomer generation continues to retire.

The U.S. government has historically been able to fund its deficits by borrowing money from China, Japan, the major oil-exporting nations, and a few others. However, as I discussed in a past article, there are signs that these countries are either growing unwilling or unable to continue to finance these deficits. This leaves the government with the unpleasant choice of cutting spending, which it cannot do politically, or possibly printing money.

Modern Monetary Theory

There are increasingly suggestions by policymakers that Modern Monetary Theory may offer a solution to this problem. According to this theory, the value of money is established because the State forces people to pay taxes with the money that the State has decided upon. The theory also posits that a government can control the value of its currency by declaring how much it is willing to pay for a specified good or service from the private sector. Unlike more mainstream views of money in which a currency is a representation of work, under this theory money is an arbitrary claim on the economy's production.

As this theory states that money is only worth something because tax payments have to made with it and that the government can set the value of money by declaring that it will only pay a given price for a given item, the theory effectively gives the government the ability to print an unlimited amount of money. The problem is, though, that the theory does not work in practice. If the State sets the price of an item too low (for example, below the cost of production), then nobody will sell the item to the State, so that part of the theory does not work in a free society. In addition, the resources of an economy are not infinite, as people must perform work to produce goods and services. Thus, as the money supply increases, we end up with a situation where there is an ever-greater amount of money chasing a finite quantity of goods and services. This naturally pushes prices up as buyers compete against one another to obtain the resources that they desire. This is exactly what would happen should this theory ever be put into practice in the United States as a way to finance government spending.

Admittedly, I have no idea whether or not this theory will be tested in the United States. The fact that several policymakers are talking about it alone is reason enough for me to get some of my savings out of the U.S. dollar and into gold as a hedge though. Historically, gold is an excellent hedge against inflation and currency declines due to the fact that it is finite, so should benefit from the same forces that push up the prices of other things in such an environment, and has been considered a store of wealth for more than 5,000 years.

Recession Fears

In various past articles, I discussed that the economy is increasingly flashing warnings signs of a coming recession. This is admittedly in contrast to the strong economy claims that are coming out of Washington, although the recent comments by the Federal Reserve are supportive of a conviction of impending economic weakness.

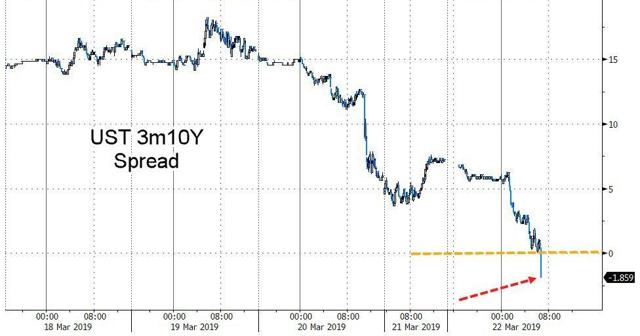

On Friday, we saw yet another warning sign for the economy. This warning comes in the form of the 3-month to 10-year Treasury spread, which just inverted for the first time since 2007:

Source: Zero Hedge

There have been six times in the past 50 years that the spread between these two Treasury securities has inverted. In each case, an economic recession began an average of 311 days later.

The occurrence of a recession should also prove good for gold, although the impact may be somewhat muted. This is due to the fact that in a recession, particularly in the early stages of one, money tends to pour into safe haven assets. Due to gold's historical use to preserve wealth, it is such an asset. However, the U.S. dollar is also a safe haven asset, so it will also likely increase in value in such a scenario. This may mute any potential appreciation in gold, as it is uncertain which asset will increase more in the short term. For the long-term holder though, gold is clearly the better asset to use to preserve your wealth due to the terrible financial position of the Federal Government that will likely continue to deteriorate.

At Energy Profits in Dividends, we seek to generate a 7%+ income yield by investing in a portfolio of energy stocks while minimizing our risk of principal loss. By subscribing, you will get access to our best ideas earlier than they are released to the general public (and many of them are not released at all) as well as far more in-depth research than we make available to everybody. We are currently offering a two-week free trial for the service, so check us out!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I will likely acquire some physical gold at some point in the near future. I will most likely not use an ETF.

Follow Power Hedge and get email alerts