NatWest, rate hike worries knock FTSE 100 lower

Oct 29 (Reuters) - UK shares tracked global markets lower on Friday, with anxiety over potential interest rate hikes and a slide in state-backed bank NatWest dragging the blue-chip FTSE 100 index.

NatWest (NWG.L) fell 4.5% even though its profit tripled in the third quarter, as its margin contracted in a sign of how rock-bottom central bank rates have squeezed the income it can make from lending. read more

"It was well overdue for a pullback and today's numbers have given investors the perfect reason. Profits were still lower than Q2 and net interest margin hasn't improved," said Michael Hewson, chief markets analyst at CMC Markets.

"While they've had a good run, it was time to take some money off the table."

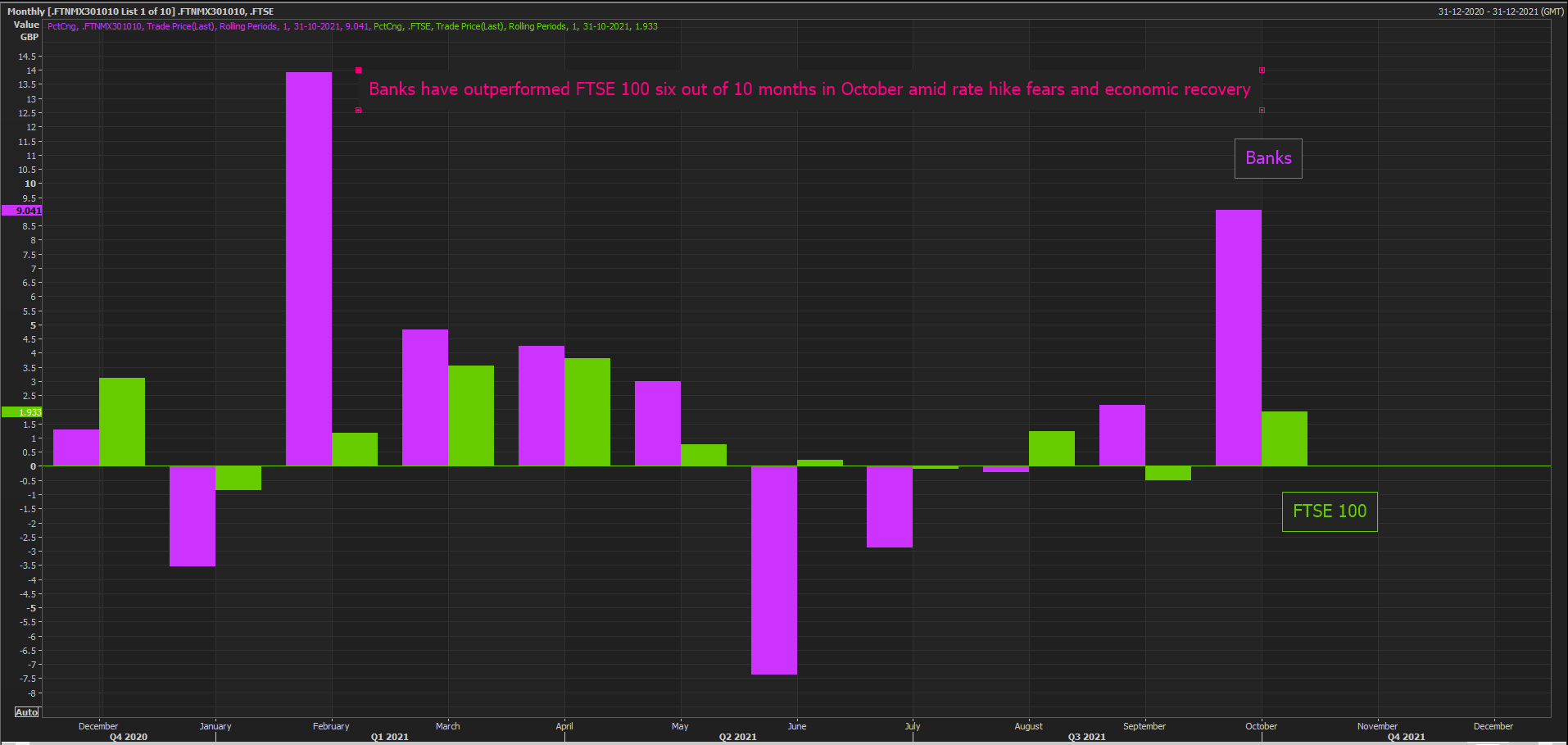

However, heightened expectations of an interest rate hike amid a broader economic recovery has given banks a shot of optimism, sending the subindex (.FTNMX301010) 9.2% higher to their best month since February 2020.

Investors are expecting the Bank of England to raise its record-low interest rates as early as next week for the first time since the start of the pandemic.

The FTSE 100 index (.FTSE) ended 0.2% lower, weighed by weakness in energy stocks (.FTNMX601010), down 1.2%, although losses were limited by gains in banks (.FTNMX301010).

Oil majors BP (BP.L) and Royal Dutch Shell (RDSa.L) were among the biggest decliners on the back of weaker crude prices.

With inflation worries and supply-chain constraints weighing on markets, the FTSE 100 has added just 2% this month, underperforming a 4% recovery among its European peers (.STOXX).

The domestically focussed mid-cap index (.FTMC) fell 0.4%, with Games Workshop Group PLC (GAW.L) declining 7.7% after brokerage Jefferies cut its price target for the toymaker.

Banks have outperformed FTSE 100 six out of 10 monthsReporting by Bansari Mayur Kamdar and Amal S in Bengaluru; Editing by Subhranshu Sahu and Devika Syamnath

Banks have outperformed FTSE 100 six out of 10 monthsReporting by Bansari Mayur Kamdar and Amal S in Bengaluru; Editing by Subhranshu Sahu and Devika Syamnath