Necessary Conditions For Gold's Next Buy Signal

Gold's previous rally attempt failed due to the dollar's strength.

Traders should avoid that same mistake during gold's latest rally.

The dollar index needs to reverse its immediate-term uptrend line.

For the first time in weeks, gold investors have reason to smile after the metal's latest rally attempt. The reversal process of gold's 10-week decline, however, has only just begun and faces some hurdles before a renewed buy signal has been confirmed. In today's report, we'll discuss the most requisite factors for gold's next extended rally. As I'll emphasize here, the most important one is a reversal of the dollar's immediate-term upward trend.

The July gold futures price posted its highest close in almost two weeks on Apr. 26. There is some question as to whether gold's latest rally represents genuine safe-haven demand or whether it was merely a technical affair. Short covering is a likely explanation for last week's upside move. However, the revival of global fears - stemming mainly from disappointing economic news in Germany and South Korea - also likely played a part.

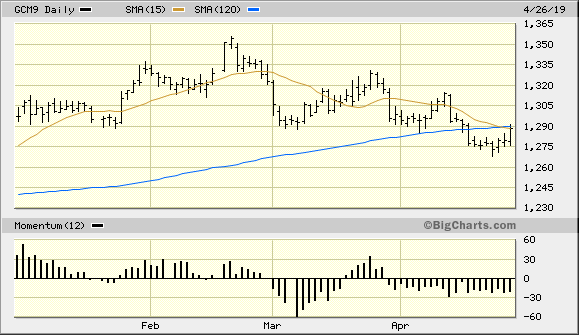

Gold's latest reversal attempt, while impressive, fell short of confirming an immediate-term (1-4 week) bottom signal as defined by the rules of my technical trading system. A 2-day higher close above the flattening 15-day moving average is required to confirm a bottom, and gold hasn't managed this feat in several months. You'll also notice that the gold price fell short of closing above its 120-day moving average (blue line), which is a key long-term trend line for the metal. Both the 15-day and 120-day MAs have converged at the $1,290 level as shown in the following graph.

Source: BigCharts

The moving average convergence at $1,290 is a fortuitous occurrence since it highlights a price level which many traders deem to be technically (and therefore psychologically) significant. For it was the $1,290 level which served as a support for the gold price in the three months prior to gold finally breaking below this level in April. A 2-day higher close above the $1,290 level would thus underscore the seriousness of the bulls in trying to wrest control of gold's immediate trend from the bears.

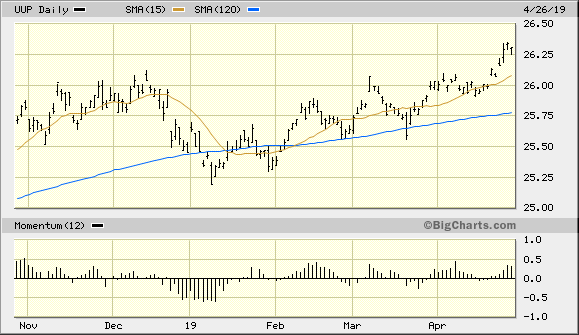

However, even a decisive breakout above the $1,290 level by itself wouldn't be a convincing enough display of gold's returning strength to justify the risk of initiating new long positions in the metal. To satisfy my skepticism, a gold rally should be accompanied by corresponding weakness in the U.S. dollar index. Otherwise, we're likely to see yet another failed rally attempt like the one earlier this month. Shown below is the Invesco DB U.S. Dollar Index Bullish Fund (UUP), which is my favorite proxy for the dollar. As you can see here, UUP is slightly below its latest 52-week high and also above its rising 15-day moving average. This confirms that the dollar's immediate-term trend is still up, which means gold is still facing a strong headwind from its weakened currency component.

Source: BigCharts

As previously suggested, the biggest obstacle standing in the way of a sustained gold rally is a reversal of the dollar's immediate-term trend. The reason why gold's previous turnaround attempt failed a few weeks ago is because it was unaccompanied by a corresponding decline in the dollar's value. Traditionally, when the gold price rallies without its currency component strengthening, the rally is eventually doomed to failure. This means we should see a decisive close below the 15-day moving average in the dollar index ETF shown above before we get the next "all clear" entry signal for gold. Until this happens, any gains made by gold in the coming days should be viewed with suspicion.

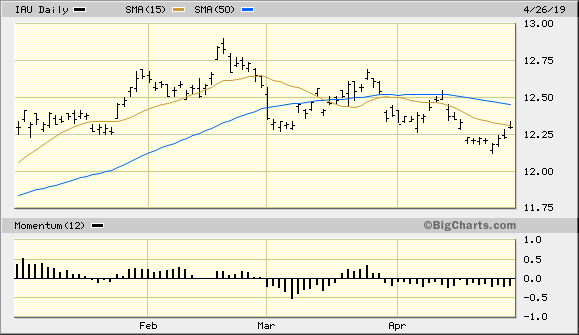

Turning our attention to the gold ETF covered in this report, the iShares Gold Trust (IAU) hasn't yet confirmed a new buy signal based on my trading discipline. As the following chart shows, the IAU price remains under its 15-day moving average as well as its more popular 50-day MA (blue line). Both trend lines are also currently downward sloping, which suggests IAU still faces some short-term downside momentum. What's more, the overhead supply between last week's low of $12.15 and the $12.50 level (which encompasses April's trading range for the ETF) needs to be fully absorbed before IAU is fit to rally again on a sustained basis. For now I recommend that ETF traders remain in a cash position until the next immediate-term buy signal is confirmed in IAU.

Source: BigCharts

Meanwhile on the international front, renewed signs of economic weakness in Italy, along with the latest downgrade by economists to South Korea's GDP forecast, have given gold's "fear component" a needed boost. With fragility in the global economy still very much in evidence, gold should have no trouble attracting safety-related demand in the coming months. As discussed in today's report, the main obstacle to gold's next rally remains the strong dollar, which should be the focus of gold traders and investors in the days and weeks ahead. Until we see significant weakness in the dollar, gold's latest rally attempt is likely to face stiff headwinds. Moreover, a strong dollar will only increase gold price volatility. For now, a defensive position is still warranted with no new buying recommended.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts