Netflix Options Price in Volatile Earnings Reaction

NFLX earnings are due out after the close tomorrow, July 17

NFLX earnings are due out after the close tomorrow, July 17

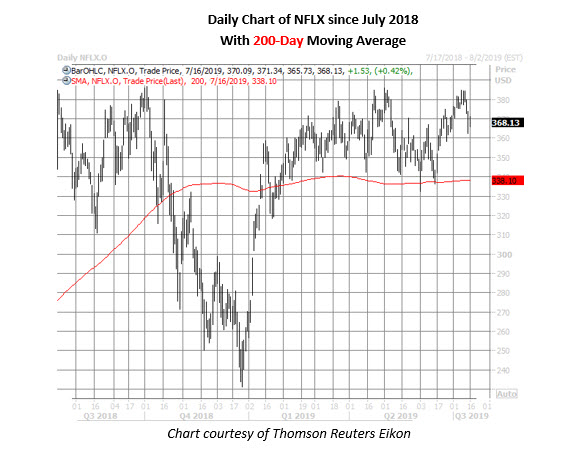

Netflix, Inc. (NASDAQ:NFLX) has been relatively quiet on the charts over the past month, per its 30-day historical volatility of 24.3%, which registers in just the 3rd percentile of its annual range. That could all change with the streaming giant slated to unveil its second-quarter financial results after the close tomorrow, July 17, with the options market pricing in a much larger-than-usual post-earnings move for the FAANG stock.

At last check, Trade-Alert put the implied earnings deviation for NFLX at 11.3%, nearly double the 6.3% next-day move the stock has averaged over the last two years. The reactions have been evenly split between positive negative in the past eight quarters, and there's been just one post-earnings move that was large enough to match or exceed what the options market is anticipating this time around -- a 13.5% single-session pop in July 2017.

Options traders have been positioning for a positive earnings reaction. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), speculative players have bought to open 86,168 calls over the last 10 days, compared to 57,548 puts. The resultant call/put volume ratio of 1.50 ranks in the 69th annual percentile, meaning the rate of call buying relative to put buying has been quicker than usual.

This optimism toward NFLX is seen outside of the options pits, as well. While 23 of 27 analysts maintain a "buy" or better rating on the FAANG stock, a slim 4.3% of the security's float is sold short.

Looking at the charts, Netflix stock rallied hard off its December low near $231, and was trading near the $360 region by mid-January. Since then, the shares have been chopping higher atop their 200-day moving average, though the $285 region has emerged as a ceiling -- just as it did last October. Today, NFLX is trading up 0.4% at $368.13.