Netflix Stock Heading into Historically Bullish Quarter

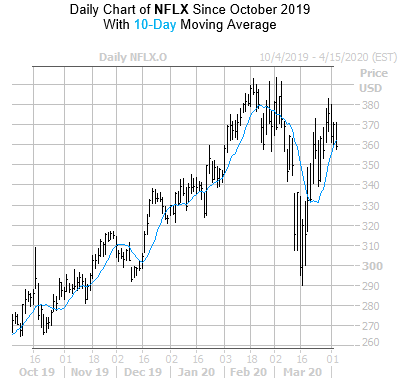

NFLX's 10-day moving average has stepped up as support lately

NFLX's 10-day moving average has stepped up as support lately

Netflix Inc (NASDAQ: NFLX) has held on to a 11% 2020 gain in the face of a global economic meltdown, no doubt in part due to an increase in lockdown measuresin response to the coronavirus pandemic. And although NFLX is down 2.9% at $359.32 at last check, if past is precedent the upcoming quarter could be a friendly one for the FAANG name.

Schaeffer's Senior Quantitative Analyst Rocky White broke down the best performing stocks for the second quarter in the last 10 years, and NFLX topped all other stocks in the general retail sector. Looking back over the last decade, NFLX averaged a second quarter gain of 13.8% with an 80% win rate, ahead of other notable names such as Ulta Beauty (ULTA) and Amazon.com (AMZN).

Netflix has had no trouble staying afloat while more and more people are self-isolating to reduce the risk of being exposed to COVID-19. Over the past six months, rarely has NFLX stock found itself below its 10-day moving average; however, the security is still looking to break above its 12-month breakeven level.

Meanwhile, analysts are still extremely bullish on NFLX stock. Currently, of the 27 analysts in coverage, a whopping 19 rate Netflix as a "buy" or better. The remaining eight are split evenly down the middle between a "hold" and "strong sell" position. Juxtaposing these positions is the equity's consensus 12-month target price of $369.74 which sits at a minimal 2.8% premium to its current levels.

Similarly, calls rule the roost in the options pits for NFLX. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the equity sports a 10-day call/put volume ratio of 1.84 that sits higher than 93% of readings from the past year. Not only does this suggests the rate of call buying has eclipsed put buying by a two-to-one margin, the ratio suggests puts are outpacing calls at a faster-than-usual clip.