New Gold's Q3 Results: Has The Inflection Point Finally Arrived?

New Gold generated operating cash flow of $43.2 million and net loss of $1.6 million in Q3.

Rainy River's Q3 performance was disappointing once again.

There is a light at the end of the tunnel, as Rainy River did very well in September.

If the September Rainy River production numbers are also reached in the coming months, Q4 may become a turning point for New Gold.

New Gold (NGD) released its Q3 2018 financial results. As usual, the investors and financial analysts paid attention especially to the Rainy River mine. The mine was expected to become New Gold's flagship asset, however, its construction cost $300 million more than originally projected and the significant cost overrun was followed by a series of disappointing operational results. Although New Gold was trying to eliminate the issues step by step, the situation wasn't good as of the end of Q2. All of the issues were reflected also by New Gold's share price.

NGD data by YCharts

NGD data by YCharts

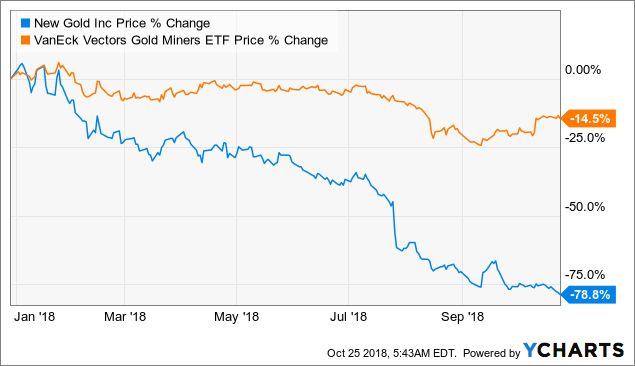

New Gold's shares are almost 80% down year-to-date which is a disastrous underperformance. For comparison, over the same time period, the VanEck Vectors Gold Miners ETF (GDX), that represents the gold mining sector, is down only by less than 15%.

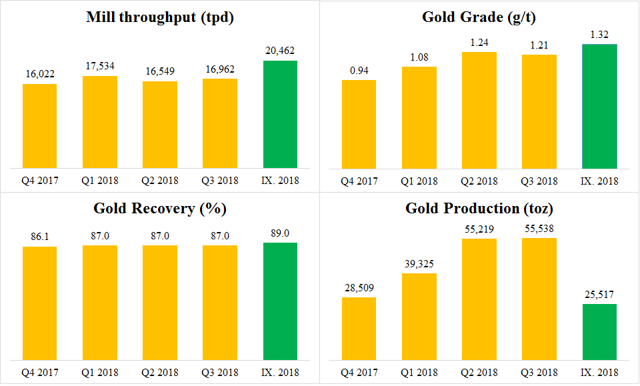

The Q2 2018 financial and production results released back in July were a disappointment. Despite some relatively optimistic statements made over the preceding months, the mine was still underperforming heavily. The Q2 gold recoveries improved to 87%, and the feed grades improved to 1.24 g/t. The problem was that the throughput rate was only 16,300 tpd which means that the mill operated 22% below its nameplate capacity. As a result, the AISC stood at $1,295/toz.

Also in Q3, the Rainy River mine underperformed heavily, producing only 55,538 toz gold, which is only 0.6% more than in Q2. The throughput rate increased by 2.5%, to 16,692 tpd. And while the gold recoveries remained at 87%, the feed grade declined to 1.21 g/t gold. However, a light at the end of the tunnel has shown up in late Q3, as Rainy River did very well in September.

Source: own processing, using data of New Gold

Source: own processing, using data of New Gold

In September, the throughput rate increased to 20,462 tpd, the feed grade improved to 1.32 g/t gold and the gold recoveries improved to 89%. As a result, 25,517 toz gold were produced in September alone. It means that the single month accounted for 46% of the overall Q3 gold production. The situation at the Rainy River mine has improved due to some mill upgrades that took place in late August:

During the quarter, overall operational performance at Rainy River improved, particularly following the completion of a five-day mill shutdown in late August. During the shutdown, the work completed included a Semi-Autogenous Grinding (SAG) mill reline, modifications to the elution circuit and the replacement of carbon elution circuit screens. Immediately following the upgrade, mill availability, processing rates and metal recoveries improved and supported the best-ever monthly performance in September.

If a similar performance is recorded also during the coming months, more than 75,000 toz gold should be produced at Rainy River in Q4. Along with growing production volumes, the unit production costs should decline notably. In Q3, the Rainy River AISC climbed to $1,546/toz gold.

As the Mesquite mine was sold and the Cerro San Pedro mine is in the closure process, New Afton is the only operation that holds New Gold above water right now. New Afton was able to produce 19,916 toz gold and 21.7 million lb copper in Q3, at an AISC of $-1,057/toz gold. At a co-product basis the AISC stood at $588/toz gold and $1.44/lb copper.

Together, New Gold's continuing operations (Rainy River and New Afton) produced 77,533 toz gold, 21.7 million lb copper and 200,000 toz silver in Q3. The total cash costs were $239/toz gold and AISC stood at $984/toz gold. In comparison to Q2, the total cash costs declined by 47% while the AISC increased by 12%. In Q3, New Gold's continuing operations generated revenues of $147.1 million.

The operating cash flow equaled $43.2 million, the net loss equaled $1.6 million and adjusted net loss to $4.6 million. In other words, in Q3, New Afton's great results were able to mitigate the impacts of Rainy River's continuing underperformance. But given the September results from Rainy River, New Gold seems to be finally primed for a good quarter, after a year of struggling.

Conclusion

New Gold's market capitalization is only slightly more than $400 million right now. It is a very low value for a company that is able to produce more than 300,000 toz gold and 80 million lb copper per year (given the Q3 production volumes). However, given the recent issues, it will take some time to restore investors' confidence. First of all, the Rainy River mine needs at least several good quarters to prove that the problematic ramp-up period is finally over.

Also New Gold's debt level is pretty high and although the maturities are relatively far away (senior unsecured notes ($500 million - November 2022 and $300 million - May 2025), revolving credit facility ($160 million - August 2021)), New Gold needs to start generating more cash flow to get into a more comfortable debt position.

As of the end of Q3, New Gold held cash of $129 million (not including $158 million that should be received after the sale of the Mesquite mine is completed), which doesn't seem that bad. But a substantial investment (probably more than $350 million) is needed to develop the New Afton mine's C-zone. It means that New Gold needs to start generating more cash pretty soon.

After the Q2 results, when the share price stood at $1.83, I wrote that a further decline should be expected. However, I must admit that I didn't expect that the share price will tank by another 60%. After the Q3 results, given the much-improved performance of the Rainy River mine in September, I think that New Gold's share price is pretty close to its bottom. If there are no negative surprises, I expect the share price to climb back to the $1 level before the Q4 financial results are released, sometime in February 2019.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in NGD over the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.

Follow Peter Arendas and get email alerts