New Gold: Bought Deal Financing Makes Me Think Twice

New Gold posted revenue of $155.1 million for Q2'19, down 20.6% from the same quarter a year ago and down 7.6% sequentially.

Production was 132,556 Au Eq. Oz in 2Q'19. Rainy River is now well-positioned to deliver on its 2019 objective.

The company announced on August 8, a C$150 million Bought Deal Financing.

I recommend to be careful here and wait until the effect of such equity financing makes its way fully into NGD.

Image: The Rainy River gold/silver mine in northwestern Ontario. Source: New Gold, Inc.

Investment Thesis

The Canadian-based New Gold, Inc. (NGD) is mainly a gold producer with two producing mines in North America, the New Afton and the Rainy River mines. The company also owns the Blackwater project.

New Gold presents some potential growth, particularly in 2020, when the Rainy River will be fully operational and CapEx will drop much lower.

The new project called the Blackwater open-pit mine could be an exciting play assuming higher gold price (with proved and probable reserves of 8.2 Au M Oz and Ag 60.8, respectively).

However, after experiencing some severe problem last year at the Rainy River, the company is now returning to normal, and the mine is expected to perform as guided.

In the conference call, the company stated that the milling facility has now exceeded its design criteria, while mining activities are ramping up. The construction permit has been received, and the construction activities are expected to ramp up in the second half of the year. Below is the Rainy River progress for 2Q'19:

Source: NGD

New Gold Inc. - Balance Sheet in 2Q 2019. The Raw Numbers

| New Gold NGD | 3Q'17 | 4Q'17 | 1Q'18 | 2Q'18 | 3Q'18 | 4Q'18 | 1Q'19 | 2Q'19 |

| Total Revenues in $ Million | 142.5 | 193.5 | 193.2 | 195.3 | 147.1 | 157.4 | 167.9 | 155.1 |

| Net Income in $ Million | 27.0 | -195.6 | -29.5 | -302.0 | -168.5 | -727.7 | -13.4 | -35.7 |

| EBITDA $ Million | 88.4 | -230.0 | 59.9 | -305.5 | 73.4 | -614.9 | 64.9 | 32.4 |

| EPS diluted in $/share | 0.05 | -0.34 | -0.05 | -0.52 | -0.29 | -1.26 | -0.02 | -0.06 |

| Cash from Operating activities in $ Million | 83.2 | 111.6 | 65.1 | 66.0 | 51.1 | 62.9 | 74.3 | 50.2 |

| Capital Expenditure in $ Million | 135.6 | 100.2 | 68.7 | 50.1 | 56.4 | 39.4 | 50.4 | 37.8 |

| Free Cash Flow in $ Million | -75.1 | 11.4 | -3.6 | 15.9 | -4.7 | 23.5 | 23.9 | 12.4 |

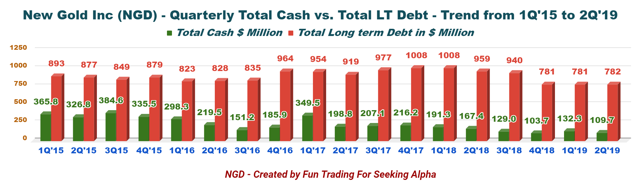

| Total Cash $ Million | 207.1 | 216.2 | 191.3 | 167.4 | 129.0 | 103.7 | 132.3 | 109.7 |

| Total Long term Debt in $ Million | 977 | 1008 | 1008 | 959 | 940 | 781 | 781 | 782 |

| Shares outstanding (diluted) in Million | 576.2 | 578.1 | 578.7 | 578.7 | 578.7 | 579.1 | 579.1 | 579.1 |

Sources: Company filings and Morningstar/YCharts

Balance Sheet And Production Discussion

1 - Revenues of $155.1 in 2Q'19 New Gold posted revenue of $155.1 million for Q2'19, down 20.6% from the same quarter a year ago and down 7.6% sequentially.

New Gold posted revenue of $155.1 million for Q2'19, down 20.6% from the same quarter a year ago and down 7.6% sequentially.

Net loss for the quarter was $35.7 million or $0.06 per share with an adjusted net loss of $7.2 million or $0.01 per share. Finally, operating cash flow from continuing operations was $50.2 million or $0.09 per share.

Rob Chausse noted in the conference call:

Higher gold production as compared to the prior year quarter is primarily due to higher productivity at Rainy River.

2 - Free cash flow

Free cash flow for 2Q'19 was $12.4 million. It is the third quarter in a row that the company manages positive free cash flow.

Free cash flow for 2Q'19 was $12.4 million. It is the third quarter in a row that the company manages positive free cash flow.

Free cash flow yearly is now $55.1 million after a long negative trend with significant CapEx due to Rainy River and New Afton mines.

NGD passes the FCF test.

Source: NGD Presentation

Source: NGD Presentation

3 - Net debt has been reduced this quarter as promised

New Gold is showing a reduced net debt of $672.2 million, an increase of $22.6 million sequentially.

The company has a $400 million credit facility maturing in 2021 with an undrawn part of $285 million (approximately $112 million of $400 million has been used for Letters of Credit as at June 30, 2019). However, the company has indicated it intends to move out the LoC from the credit facility.

Rob Chausse indicated in the conference call:

[T]he company entered into additional gold price option contracts by purchasing, put options at an average strike price of $1,300 per ounce, and selling call options at an average strike price ranging from $1,355 per ounce to $1,415 per ounce for a total of 168,000 ounces of gold production for 2020.

Finally, New Gold has a gold stream obligation (Royal Gold (RGLD) on Rainy River) totaling $167.5 million as of June 30, 2019.

4 - Gold production details as of June 30, 2019

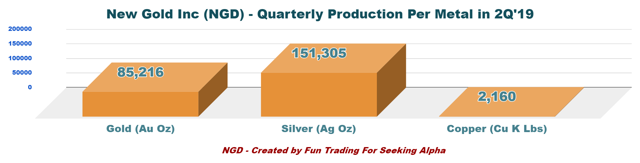

Production was 132,556 Au Eq. Oz, which was driven higher mainly by an excellent performance at Rainy River and New Afton mines.

Gold equivalent comes from three different metals: Gold, silver, and copper.

Gold price realized in 2Q'19 was $1,304 per Au Oz.

Details per metal are indicated below:

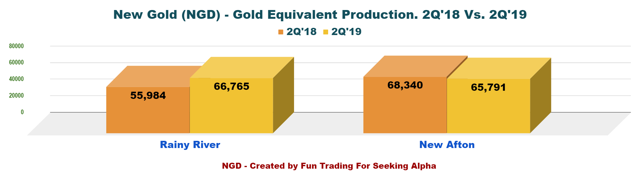

While the Rainy River reported another excellent quarter in gold equivalent production, conversely, New Afton mine delivered a slightly weaker quarter in line with expectation.

Renaud Adams, the CEO, said in the conference call:

Rainy River is now well positioned to deliver on its 2019 objective. The milling facility has now reached and exceed its design criteria, while mining activities are now ramping up.

We have now received all the construction permit and the construction activities are expected to ramp up in the second half of the year, at the time, where the operation is performing extremely well. The New Afton Mine continue to deliver strong operational performance, while efforts are now deployed in developing our future. We continue to evaluate potential new scenario at Blackwater, while we focus on increased grade, lower strip ratio, and reduced capital requirement.

| Gold Production per Mine | 4Q'17 | 1Q'18 | 2Q'18 | 3Q'18 | 4Q'18 | 1Q'19 | 2Q'19 |

| Rainy River | 28,509 | 40,016 | 55,219 | 55,538 | 77,202 | 61,557 | 66,013 |

| New Afton gold production | 22,384 | 19,998 | 18,637 | 19,916 | 18,778 | 17,841 | 19,203 |

Note from the press release about the Blackwater Project:

On June 24, 2019, the BC Ministers of Environment and Climate Change Strategy and Energy, Mines and Petroleum Resources has issued an Environmental Assessment [EA] certificate for the Blackwater Project

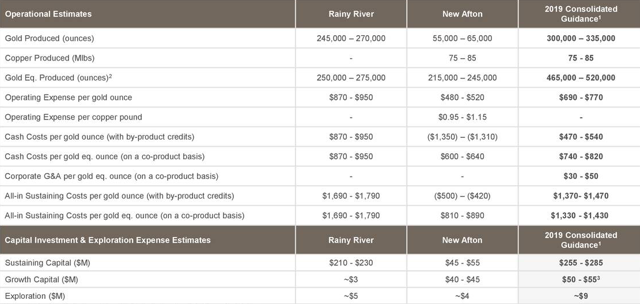

5 - On June 30, 2019, the Company reaffirms that it is on track to achieve annual guidance.

Source: NGD Presentation

The big issue is that AISC per gold equivalent (co-product) is estimated at $1,380 per Au Eq. Oz is due exclusively to Rainy River with a 2019 CapEx of ~$230 million. AISC was $1,314 per ounce in 2Q'19.

Conclusion and Technical Analysis

New Gold delivered a decent second-quarter which beat on earnings but missed on revenues. However, the real story here is the gold price and its strong momentum, which was gradually changing the whole perception and forced me to be more bullish on NGD. However, as soon as I started to get interesting, the company announced on August 8, a C$150 Million Bought Deal Financing.

underwriters have agreed to buy on a bought deal basis 93,750,000 common shares (the "Common Shares"), at a price of C$1.60 per Common Share for gross proceeds of C$150 million (the "Offering"). The Company has granted the underwriters an option, exercisable at the offering price for a period of 30 days following the closing of the Offering, to purchase up to an additional 15% of the Offering to cover over-allotments, if any.

This deal could increase the shares outstanding by a total of 107.8 million which is a substantial share dilution and sets an iron lid on the stock price, which immediately dropped from $1.30 to a close at $1.17, last Friday.

It is the type of news that shareholders - especially new ones - do not want to hear. Such a massive amount of new shares - close to 20% - could eventually push the stock back to its strong support at $0.95-$1.00 and worse, is limiting the potential upside.

Thus, I recommend to be careful here and wait until the effect of such equity financing makes its way fully into NGD. If the gold price starts to weaken a little next week, which is likely after such crazy runoff, then the stock will selloff as well.

Technical analysis

NGD is now falling again after reaching $1.50. The recent bought deal financing is a significant deal, and it is too recent to attempt to find a new trading pattern.

I am assuming a sharp descending channel pattern. In this case, the stock could eventually retest $0.95-$1.00, at which point it could be a good idea to buy and accumulate NGD expecting a bounce in Q3. However, if the gold price continues to stay healthy, the stock may eventually stabilize around $1.20 before starting a new uptrend finally.

Author's note: If you find value in this article and would like to encourage such continued efforts, please click the "Like" button below as a vote of support. Thanks!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Fun Trading and get email alerts