New Gold: Fourth Quarter Will Be Softer; Updated Mine Plans Are Postponed To Q1 2020

New Gold publishes Q3 production numbers.

Rainy River and New Afton are set to reach their full-year guidance.

The fourth quarter will come with lower grades at both mines, leading to higher costs.

Updated life of mine plans are postponed to Q1 2020.

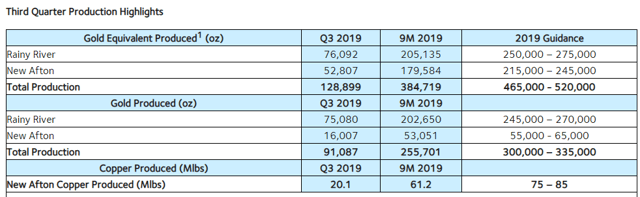

New Gold (NGD) has just published its third-quarter production numbers, providing investors with a chance to look at how the company's two mines are performing. The company's shares have been highly volatile this year as higher gold prices led to a major upside in the stock while the hedging program and the bought deal financing put pressure on shares. Without further ado, let's look at the numbers:

Source: New Gold 3Q 2019 production results

The Rainy River Mine has been stabilized by the company's management and is now on firm path towards achieving the full-year guidance of producing 245,000-270,000 ounces of gold. However, the markets are always forward-looking, and the production update contained several worrisome news for Rainy River.

First, the grades in the fourth quarter are expected to decline from 1.14 g/t in Q3 to 0.8-1.0 g/t. This is the result of moving from the ore from Phase 1 of the mine to the ore from Phase 2 of the mine. Inevitably, this will lead to higher costs in the fourth quarter.

Second, the mine experienced periods of significant rainfall in the second half of the quarter. New Gold stated that it led to increased water levels in the tailings management area and that it can cause interruptions of the processing facilities and/or reduced throughput. Should this happen, further increase in costs must be expected.

Third, the company has postponed the release of the comprehensive mine optimization study. It was previously expected to be presented to investors in the fourth quarter of this year, but now the company promises to release the study in the first quarter of 2020, but no later than mid-February. The optimization study is a critical piece of information for investors, so its postponement leads to increase in uncertainty which always puts at least some pressure on the stock.

The updated life of mine plan for New Afton is now also expected to be released in the first quarter of 2020. Just like Rainy River, New Afton will face lower grades in the fourth quarter. All in all, the fourth quarter is already looking problematic, so the nearest potentially positive catalysts might come in the first quarter of 2020 when the updated mine plans for Rainy River and New Afton will be released.

Technically, shares have breached the $1.10 support level and continue to trend down, returning to sub-$1.00 levels. At these levels, the stock has given up most of the ground it gained during the gold price upside while gold continues to hold near $1,500 per ounce. The above-mentioned dilution and hedging programs have likely resulted in some exodus of speculative traders and investors who moved their funds to other gold plays where the upside is not capped by hedging.

Fundamentally, the positive effect that the new management team had on the company's operations is obvious: Rainy River's gold recovery increased from 87% in Q3 2018 to 91% in Q3 2019 while mill availability improved from 76% in Q3 2018 to 88% in Q3 2019. However, market participants have plenty of stocks to choose from to play the gold price upside so the company must deliver additional positive catalysts.

The fourth quarter is shaping to be a rather tough one - perhaps, the management will find some reassuring words for investors during the third-quarter earnings call which is scheduled for November 6, but it looks like the company's stock will lack catalysts for another major rally in 2019 (unless gold prices surprise us with a successful test of $1,600). Stay tuned.

If you like my work, don't forget to click on the big orange "Follow" button at the top of the screen and hit the "Like" button at the bottom of this article.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I may trade any of the above-mentioned stocks.

Follow Vladimir Zernov and get email alerts