New value-added features on Canadian Insider

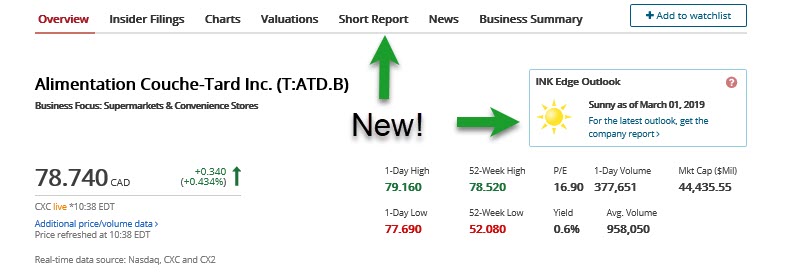

We have re-worked the company pages on Canadian Insider, and they include two new value-added features. First, we now show INK Edge outlooks for all Canadian and US stocks that we rank. For a stock to rank it typically needs to have a market cap of over $25 million and a trading history of at least 6 months.

INK Edge outlooks and short data now on Canadian Insider

The INK Edge process is 100% data-driven with no subjective input from INK analysts. That means no stock promotions. Canadian Insider is supported by our Canadian Insider Club subscribers and we do not accept payments from companies or their promoters for coverage or ratings.

The INK Edge outlook is determined by looking at how a stock ranks based equally on the following factors:

1. Value

P/EP/BookP/Cash flow (or cash)P/SalesEnterprise Value to EBITDAShareholder yield (dividends & buybacks)2. Insider Commitment

Officer and director buyingOfficer and director holdings3. Price Momentum

Short-term relative strengthOne-year relative strengthWe update the INK Edge monthly on Canadian Insider, and daily on INKResearch.com. You can also get the most recent daily update by downloading an INK Company PDF research report from the Canadian Insider company page.

For Canadian Insider Club members, we have some good news on that front. You can now download 30 PDF company research reports for free each month. A Canadian Insider Club membership offers fantastic uncompromised research insights as well as an ad-free experience. If you are not a member, consider joining here.

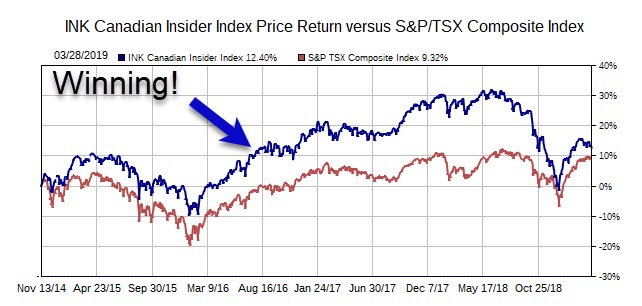

At INK we apply the INK Edge in real life. This is the process we use to manage the INK Canadian Insider (CIN) Index which has outperformed the S&P/TSX Composite Index since its live inception in 2014.

The INK Canadian Insider Index uses the INK Edge outlook process

The INK CIN Index is used by the Horizons Cdn Insider Index ETF (HII) which is a 2017 and 2018 Fundata FundGrade A+ (R) award winner. You can learn more about the INK Edge outlook process in the methodology section of our INK Index page. And, as we always say, INK Edge outlook ranking categories (Sunny, Mostly Sunny, Mixed, Cloudy, Rainy) are designed to identify groups of stocks that have the potential to out- or under-perform the market. However, any individual stock could surprise on the up or downside. As such, outlook categories are not meant to be stock-specific recommendations.

You now also see short data on all Canadian company pages. Looking at insider commitment and short trading sentiment can provide valuable insight (See the silver lining in short data). For example, it is usually a bad combination to see shorts increasing and insiders selling at the same time.