New Wave of Economic Stimulus Lifts Gold Price / Commodities / Gold & Silver 2020

European leaders stroke a historic deal that could be a game-changer and provide a support for the euro and gold against the U.S. dollar.

European leaders stroke a historic deal that could be a game-changer and provide a support for the euro and gold against the U.S. dollar.

Historic deal. Pivotal moment for Europe. On Monday, the EU leaders agreed on a massive economic stimulus plan, after a long and crotchety summit. If passed through the European Parliament and ratified by all EU states, the European Commission could borrow 750 billion euros to finance the recovery fund and distribute 390 billion in grants and 360 billion in loans across the countries most impacted by the Covid-19 pandemic.

That's breaking news and potentially a game-changer. The stimulus could, of course, help somewhat the European economies, supporting the recovery, but the key issue is that the summit’s outcome is an unprecedented act of European solidarity. Some analysts even see the agreement as the first step towards a true fiscal union. It’s still far from it, but the recovery fund marks a precedent for common debt financing at the EU level.

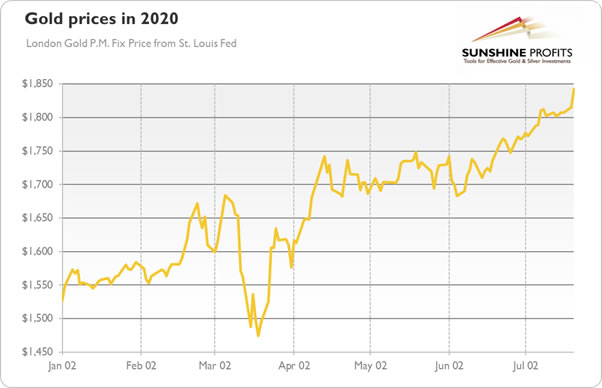

Hence, such a strong signal of internal cohesion and solidarity pushed the European equities higher and strengthened the euro against the U.S. dollar. The weaker greenback helped gold to continue its rally, as the chart below shows.

New U.S. Stimulus and Gold

Now, we are waiting for the U.S. to move. The Republicans are expected to deliver the next stimulus package in a response to the coronavirus crisis in the upcoming days. The bill is expected to cost around $1 trillion. The package will likely include second stimulus checks or some form of direct payment, state and local aid, unemployment benefits, and liability protection. However, many details are still unknown, but the bill should be finalized before the Congress’ summer recess on August 7, or even until the end of July, when the current federal unemployment benefit program expires.

The bill would provide another round of economic stimulus, supporting the recovery and pleasing the Wall Street. As the package would maintain optimism, it should be theoretically negative for the gold prices. However, the first and larger stimulus did not prevent the gold’s rally. Or, it could actually support it.

Implications for Gold

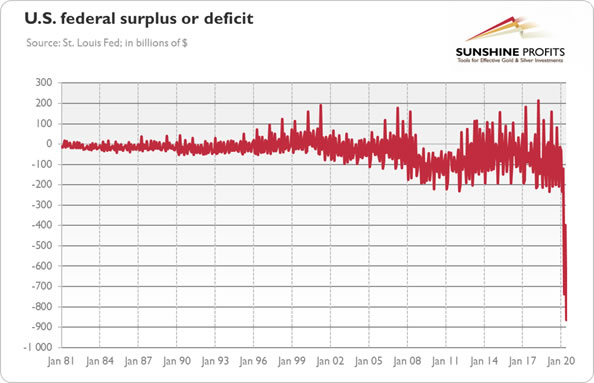

Indeed, gold rallied amid the coronavirus crisis partially because of the authorities’ response to the economic collapse. The current level of fiscal and monetary stimulus is unprecedented. The central banks and governments flooded the economies with mammoth liquidity, boosting both the money supply and fiscal deficits. Together with the negative real interest rates, rising public debts and elevated uncertainty, it creates favorable environment for gold prices.

Indeed, in June, the monthly U.S. federal deficit soared to record $864 billion, as the chart below shows. It implies that with the new stimulus just around the corner, the deficit can skyrocket. According to the Congressional Budget Office’s projections from April, the economic crisis would raise the FY 2020 deficit to $3.7 trillion, and the FY 2021 deficit to $2.1 trillion. The numbers may be even worse, given the new stimulus and downside economic risks. Such a fiscal extravagance, although partially understandable in face of the pandemic and the Great Lockdown (but now it’s clear that the government should tighten its belt in good times), should weaken the U.S. dollar and strengthen gold.

The recent European agreement on the recovery fund and the expected another round of the U.S. economic stimulus make the continuation of gold’s bullish trend very probable. Additionally, the EU’s unprecedented move to issue common debt on behalf of all 27 members – something that Germany always opposed – could increase the faith in euro, weakening the position of the U.S. dollar as the only game in town, which should also support gold.

If you enjoyed the above analysis, we invite you tocheck out our other services. We provide detailed fundamental analyses of thegold market in our monthly Gold Market Overview reports andwe provide daily Gold & Silver Trading Alerts with clearbuy and sell signals. If you’re not ready to subscribe yet and are not on ourgold mailing list yet, we urge you to sign up. It’s free and if you don’t likeit, you can easily unsubscribe. Sign uptoday!

Arkadiusz Sieron

Sunshine Profits‘ MarketOverview Editor

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Arkadiusz Sieron Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.