Newcrest Would Be An Ideal Stock For Gold Exposure When Prices Fall Below $20

Looking to establish a position in Newcrest at under $20 if there is an opportunity.

Newcrest has a strong balance sheet and stable financial and operating performance which makes it ideal for portfolio diversification and exposure to gold.

Trading at a 13% premium to peers in terms of EV/EBITDA multiple, so I am suggesting to wait for a dip in price before accumulating.

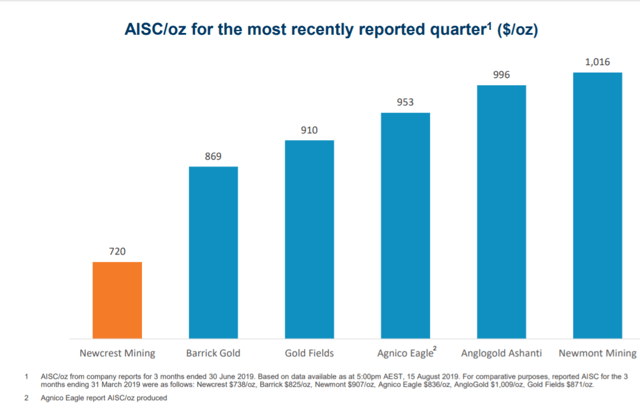

This article is a continuation of my article screening through potential investment targets among gold producers and royalty companies. I narrowed the list down to a further look at Newmont and Australian gold producer Newcrest (OTCPK:NCMGF) (OTCPK:NCMGY). Newcrest strikes me as a fundamentally healthy company with manageable debt, a past 4-year record of dividend growth and is generating free cash flow. Among the mining peers, Newcrest boasts of a low all-in sustainable cost of production as well.

My intention is to invest up to 10% of my portfolio in gold stocks, and Newcrest is now top of the shortlist.

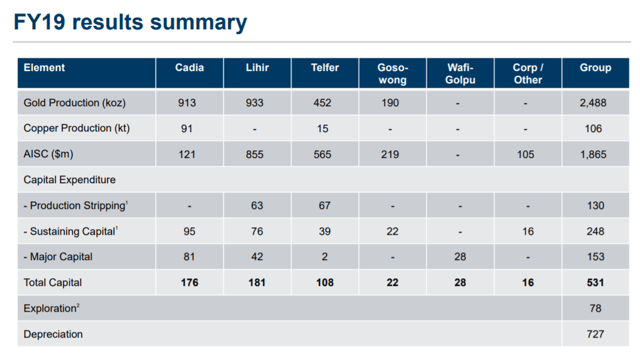

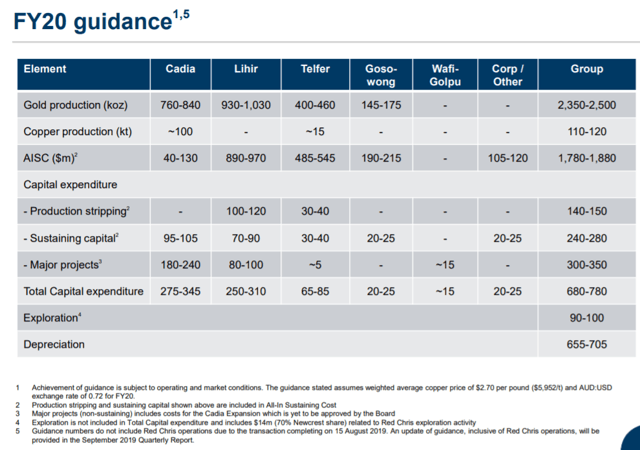

Source: Newcrest August 2019 Briefing Pack

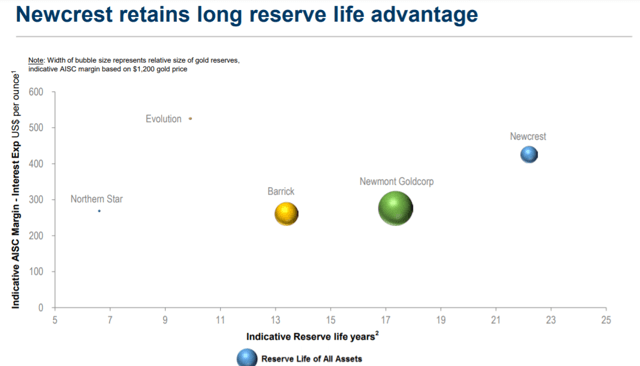

Newcrest has a 22-year gold reserve life with higher margins (based on $1,200 per ounce of gold) as compared to Barrick (GOLD) and Newmont Goldcorp (NEM).

Source: Newcrest August 2019 Briefing Pack

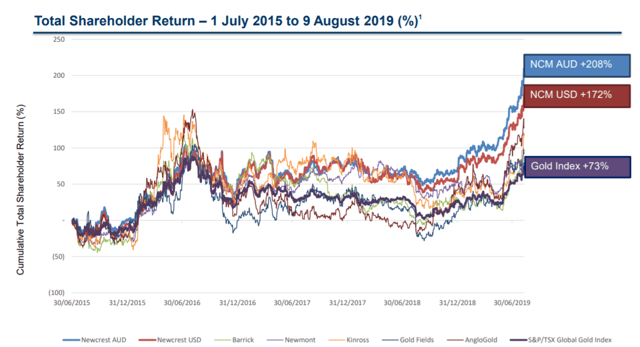

The company's recent financial performance has also been stellar, leading to its share price outperforming its peers.

Source: Newcrest August 2019 Briefing Pack

In terms of valuation, Newcrest trades near or slightly above the median in terms of PE and EV/EBITDA but has a high free cash flow yield of 4.8%.

| Ticker | Name | Est P/E Current Yr | EV/EBITDA FY1(X) | FCF Yield (%) | P/Book |

| Median | Median | 21.93 | 8.18 | 1.50 | 1.67 |

| (SBGL) | SIBANYE GOLD LTD | 23.40 | 5.77 | 10.50 | 1.92 |

| (NCMGF) | NEWCREST MINING LTD | 21.27 | 9.33 | 4.81 | 2.45 |

| (OTC:PGILF) | POLYUS PJSC | 11.15 | 8.18 | 4.49 | 14.78 |

| (NEM) | NEWMONT GOLDCORP CORP | 29.29 | 10.31 | 4.32 | 1.67 |

| (AU) | ANGLOGOLD ASHANTI LTD | 18.37 | 6.14 | 2.80 | 3.14 |

| (GOLD) | BARRICK GOLD CORP | 37.25 | 9.46 | 2.31 | 2.02 |

| (BVN) | CIA DE MINAS BUENAVENTUR-COM | 27.15 | 9.23 | 1.50 | 1.29 |

| (GFI) | GOLD FIELDS LTD | 21.93 | 5.00 | 0.01 | 1.66 |

| (AUY) | YAMANA GOLD INC | 43.54 | 7.07 | (0.30) | 0.82 |

| (HMY) | HARMONY GOLD MINING CO LTD | 9.19 | 3.10 | (1.35) | 1.16 |

| (OTCPK:ZIJMF) | ZIJIN MINING GROUP CO LTD-H | 13.23 | 9.37 | (2.08) | 1.62 |

| (KGC) | KINROSS GOLD CORP | 19.08 | 5.90 | (3.82) | 1.37 |

| (AEM) | AGNICO EAGLE MINES LTD | 69.29 | 15.10 | (3.90) | 2.98 |

Source: Bloomberg

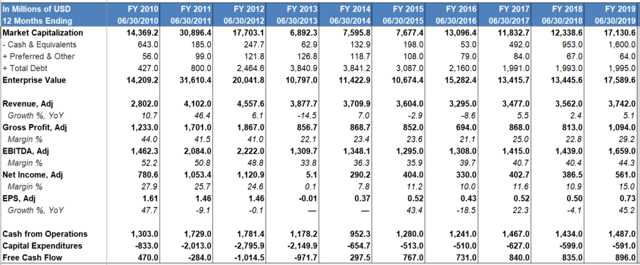

Past 10-year financial performance:

Source: Bloomberg

Newcrest generated positive cash flow from operations consecutively over the past 10 fiscal years, including 7 years of positive free cash flow. Debt levels peaked in 2013, and since then, the company has been shoring up its cash position and currently has a net debt position of $395 million.

What I liked most about the company is the balance sheet strength of the business that provides the business with flexibility to lever up to capitalize on opportunities should they arise.

The company is also looking to return between 10% and 30% of free cash flow as dividends to shareholders, with a minimum of $0.15 per share every fiscal year. 30% of free cash flow roughly equates to $300 million based on fiscal year 2019 reported free cash flow and a possible dividend yield of 1.7%.

Management is guiding for what looks to be a better fiscal year 2020 (ending June 30, 2020) than fiscal year 2019.

Source: Newcrest August 2019 Briefing Pack

I am assuming that Newcrest will be able to maintain its strong financial and operating performance in fiscal year 2020 which makes the company a good pick for my portfolio exposure to gold. Based on management's guidance, it does track the previous fiscal year 2019 pretty closely, and therefore, I also expect the company to turnaround from a net debt position to a net cash position. Gold price assumed by management is also based on $1,200 per ounce which is below current prices of $1,500. If gold prices hold at current levels over the long term, actual IRR on projects expanding Newcrest's gold production would likely be higher than the 18% and 21% returns estimated for the Wafi-Golpu and Cadia projects respectively.

However, the company trades at a roughly 13% premium over its peers in terms of EV/EBITDA and at 2.5x Price-to-Book, Newcrest is expensive relative to other major gold producers like Newmont and Barrick.

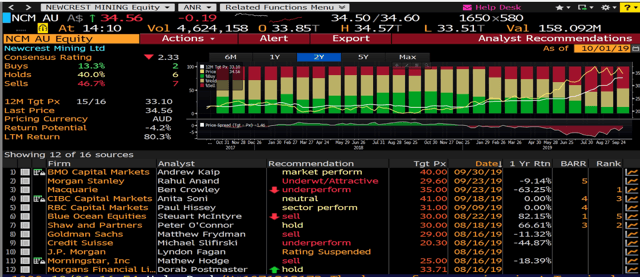

Source: Bloomberg analyst recommendation for Newcrest

The recent run in share price to $23.13 (AUD34.56) has overshot the consensus target price of $22 (AUD33). Hence, my preference is to slowly build a position in Newcrest if the share price falls below $20. This entry price at $20 would bring Newcrest's valuation closer to the peer group's median and provide some margin of safety for investors as well.

I seldom look at mining companies, and this is my first attempt at understanding a gold company. Thus, your comments and opinions are highly valued and would help me greatly in terms of my personal portfolio construction. Do leave your feedback in the comments below, and I will try to research a little deeper on relevant topics.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Big Alpha Research and get email alerts