Newmont Goldcorp: Don't Let A Sloppy Q2 Keep You From Making Money In This Gold Producer

By all accounts, Newmont's recent Q2 EPS report was disappointing and a big miss.

That said, there is a clear line-of-sight toward acquisition synergies and, of course, a strong course for its primary product, gold.

In spite of the messy Q2 report, I reiterate my $45 price target. That equates to a ~16% gain from here.

Potential upside catalysts to my PT are: better and faster than expected synergy realizations, the Barrick JV, negative bond yields, and the price of gold continuing to move higher.

Meantime, the erratic, unstable, and unpredictable policies coming out of Washington, DC these days has led to a level of global uncertainty in everything from global trade to America's dedication to democracies.

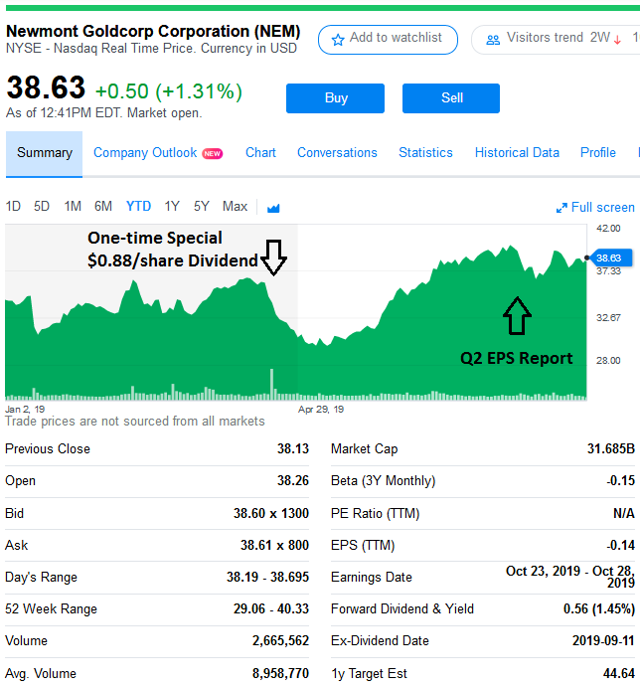

Newmont Goldcorp's (NEM) recent Q2 EPS report was less than inspiring (to put it mildly). Net income was basically $0.00 and adjusted net income was only $0.12/share - which didn't even cover the $0.14/share quarterly dividend obligation. As a result, the stock sold-off after the report on July 25. But note that, today, the stock is higher than it was on the day the EPS report was released. That is because there are a number of bullish catalysts that should propel the stock to my price target of $45/share.

Newmont Goldcorp's (NEM) recent Q2 EPS report was less than inspiring (to put it mildly). Net income was basically $0.00 and adjusted net income was only $0.12/share - which didn't even cover the $0.14/share quarterly dividend obligation. As a result, the stock sold-off after the report on July 25. But note that, today, the stock is higher than it was on the day the EPS report was released. That is because there are a number of bullish catalysts that should propel the stock to my price target of $45/share.

Source: Yahoo Finance

Source: Yahoo Finance

Before we get to the bull case for Newmont, let's take a look at some additional information from the Q2 EPS report.

2019 Annual Guidance Changes

The big EPS miss was driven not only by lower than expected sales, but other higher costs as well.

In addition to the EPS miss, note that Newmont also cut full-year gold production guidance from 7 million ounces to 6.5 million ounces. The company also revised full-year cash cost and all-in sustaining costs ("AISC") guidance by $30/oz to $735/oz and $975/oz, respectively. The weaker production and cost guidance was mainly attributed to near-term operational issues at Goldcorp's legacy mines (Musslewhite, Penasquito, and Red Lake).

Bullish Catalysts

Even with the AISC increase to $975/oz, the company will obviously be throwing off significant free-cash-flow ("FCF") with gold now hovering around $1,500/oz (up 16.5% YTD). In fact, despite the sloppy quarter and integration expenses, note that Newmont has generated $270 million in FCF in the first 6 months of this year.

Production: Back-End Loaded

Newmont's year is heavily back-end loaded. The company produced 1.23 million oz of gold in Q1, and 1.59 million oz of gold in Q2. That's 2.82 million oz of gold production over the first 6 months. To meet the company's new guidance of 6.5 million oz, second half gold production will have to be 3.68 million oz, or 860,000 oz more than in the first half. At $1,500/oz, for example, that equates to a potential additional $1.3 billion in revenue as compared to the first half.

Production is back-half weighted with the completion of the Ahafo Mill Expansion in Africa, the Borden project in Canada and reaching higher grades at Cerro Negro and Pe??asquito.

Also, note the company's gold production guidance doesn't even include production from the Barrick JV. Another potential upside catalyst.

Synergy Realizations

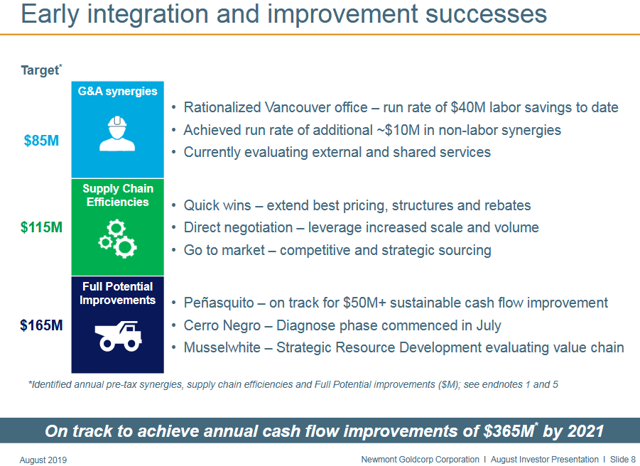

Management still seems confident about reaching its goal of $365 million in annual savings from Goldcorp acquisition synergies:

Source: August Presentation

Source: August Presentation

Management expects 40% of the $365 million in synergy savings to be realized in 2019 and 40% in 2020.

With 768 million shares outstanding at the close of Q2, synergy savings equate to an estimated $0.47/share. Those savings alone more than cover three quarters' worth of the current $0.14/share dividend obligation.

The #1 Bullish Catalyst For Newmont

But the #1 bullish isn't expected production growth, or acquisition synergy realizations, or the back-end 2H loaded production profile. The #1 bullish catalyst is likely, and simply, a major bull market in the price of gold itself. As I have mentioned in previous articles on gold, the Trump/Republican tax-and-spend policies have led to an estimated $1 Trillion+ annual budget deficit for FY2019, up from $666 billion in FY2017.

Meantime, CNBC reports that there are now an estimated $15 trillion in global debt paying negative interest rates. At some point, investors are going to care more about wealth preservation than getting a return on their investment, or in the case of negative rates, no return at all.

And, as I opined in my first Seeking Alpha article on the Possibility Of A Trump Induced Bull-Run in Gold, one of the biggest catalysts is simply a very unstable, erratic, and flippant executive administration in the United States. This has introduced a level of uncertainty and worry on everything from global trade to whether or not America still supports its democratic allies or has instead chosen to cozy up to the world's worst dictators instead.

All of this is super bullish for gold, which should continue to march higher and eventually hit all-time highs sooner rather than later. Yes, that means over $1,900-$2,000/oz.

Summary And Conclusion

Bottom line is that investors desire to preserve wealth in a world where bond yields are dropping like a rock. Legendary investor Mark Mobius says "Buy gold at any level" because:

Gold's long-term prospect is up, up and up, and the reason why I say that is money supply is up, up and up.

Mobius also said:

You have all these currencies, new currencies coming into play. I call them 'psycho currencies,' because it's a matter of faith whether you believe in Bitcoin or any of the other cyber-currencies. I think with the rise of that, there's going to be a demand for real, hard assets, and that includes gold.

In other words, the next time Bitcoin hits a big downturn, expect that money to flee to gold.

Meantime, here's a link to a recent Wall Street Journal article with a very catchy title: Newmont Goldcorp is About to Pan Out. I agree. Gold is likely to pull Newmont's stock way above my current $45 price target. Expect me to raise my target on NEM when gold hits $1,600, which I fully expect before year-end.

Disclosure: I am/we are long NEM. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am an engineer, not a CFA. The information and data presented in this article were obtained from company documents and/or sources believed to be reliable, but have not been independently verified. Therefore, the author cannot guarantee their accuracy. Please do your own research and contact a qualified investment advisor. I am not responsible for the investment decisions you make.

Follow Michael Fitzsimmons and get email alerts