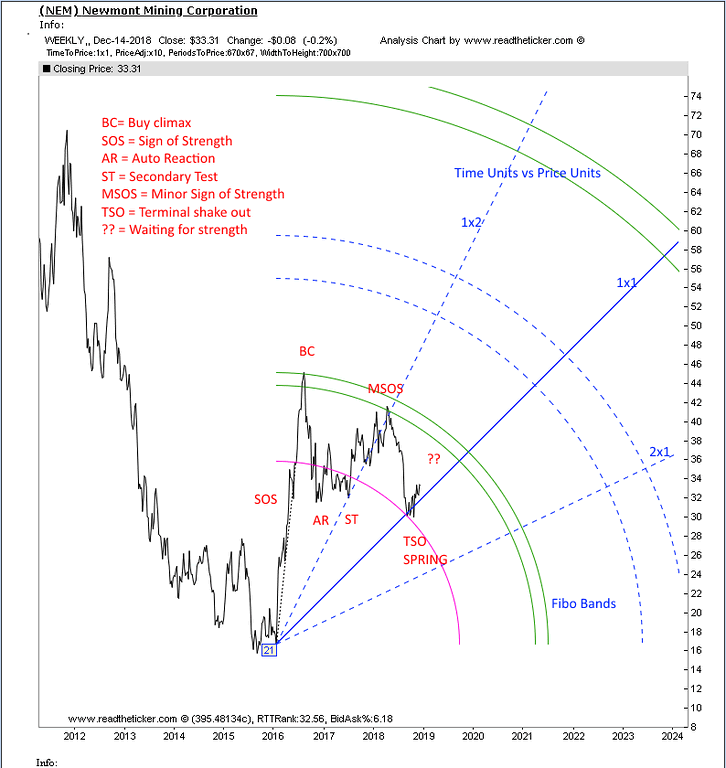

Newmont Mining Gann Angles / Commodities / Gold and Silver Stocks 2018

Newmont Mining (NEM) is a gold stock with plenty of institutional interest. This means due to its huge following it is a good candidate for Gann Angles.

Gold and gold stocks are waiting for the FED and other central banks to swing to dovish monetary policy, Powell hinted this in last speech, and next week the FED is expected to hike 0.25% to 2.5%, however the 3 previously planned hikes in 2019 look very doubtful.

In short the hike from near 0% to 2.5% is all the US economy can take, as things start to break (ie corporate credit funding stuff like share buy backs.) with the US 10 yr above 3%. A concern to Powell is the US stock market gain contributes to a huge amount of tax revenue to the US treasury and higher interest rates will take this away (April 2019 is tax time), therefore Powell will take great care not to break the stock market.

There is a monetary policy change coming in 2019, a swing to more dovish tone which should support gold and gold stocks.

Newmont Mmining Gann and Wyckoff Chart is one to keep am eye on.

Fundamentals are important, and so is market timing, here at readtheticker.com we believe a combinationof Gann Angles, Cycles, Wyckoff and Ney logicis the best way to secure better timing than most, after all these methods have been used successfully for 70+ years. To help you applying Richard Wyckoff and Richard Ney logica wealth of knowledge is available via our RTT Plus membership. NOTE: readtheticker.com does allow users to load objects and text on charts, however some annotations are by a free third party image tool named Paint.net Investing Quote...

.."Without specific, clear, and tested rules, speculators do not have any real chance of success"..Jesse Livermore .."Money couldn't buy friends, but you got a better class of enemy"..Spike Milligan .."If you have trouble imagining a 20% loss in the stock market, you shouldn't be in stocks"..John (Jack) Bogle .."Look at market fluctuations as your friend rather than your enemy; profit from folly rather than participate in it"..Warren Buffett .."The first rule is not to lose. The second rule is not to forget the first rule"Warren Buffett

NOTE: readtheticker.com does allow users to load objects and text on charts, however some annotations are by a free third party image tool named Paint.net

Readtheticker

My website: www.readtheticker.com

We are financial market enthusiast using methods expressed by the Gann, Hurst and Wyckoff with a few of our own proprietary tools. Readtheticker.com provides online stock and index charts with commentary. We are not brokers, bankers, financial planners, hedge fund traders or investment advisors, we are private investors

© 2018 Copyright readtheticker - All Rights Reserved

Disclaimer: The material is presented for educational purposes only and may contain errors or omissions and are subject to change without notice. Readtheticker.com (or 'RTT') members and or associates are NOT responsible for any actions you may take on any comments, advice,annotations or advertisement presented in this content. This material is not presented to be a recommendation to buy or sell any financial instrument (including but not limited to stocks, forex, options, bonds or futures, on any exchange in the world) or as 'investment advice'. Readtheticker.com members may have a position in any company or security mentioned herein.

© 2005-2018 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.