Newmont's gold reserves surpass 100moz, largest in company history

Mine trucks at Newmont's Porcupine mines. (Image courtesy of Newmont Goldcorp | Flickr)

Mine trucks at Newmont's Porcupine mines. (Image courtesy of Newmont Goldcorp | Flickr)

Colorado-based gold miner Newmont (NYSE: NEM, TSX: NGT) has reported gold mineral reserves of 100.2 million attributable ounces for 2019, the largest ever in company history. This represents a 53% increase over the 65.4 million ounces recorded in 2018 following the completion of two major transactions and through ongoing exploration success.

Last year, Newmont added almost 50 million ounces of gold reserves through the acquisition of Goldcorp, the formation of the Nevada Gold Mines joint venture and the continuation of its exploration program, solidifying the company as the world's largest gold miner.

According to President and CEO Tom Palmer, the company's reserve and resource base will be able to support stable production of more than six million ounces per annum for decades to come.

The reported figures include Red Lake and the company's 50% interest in Kalgoorlie Consolidated Gold Mines (KCGM). Newmont successfully completed the sale of KCGM in January and expects to close the divestment of Red Lake in the first quarter of 2020.

Combined, these sites represent approximately 4.5 million ounces of gold reserves and 2.6 million ounces of measured and indicated resources, bringing Newmont's adjusted 2019 reserves to 95.7 million ounces and measured and indicated resources to 74.1 million ounces.

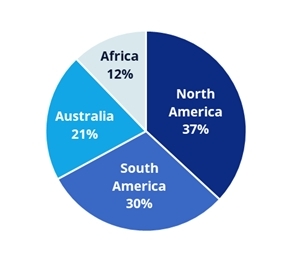

Percentage of gold reserves by jurisdiction. (Credit: Newmont)

Percentage of gold reserves by jurisdiction. (Credit: Newmont)Newmont believes its reserve base is a key differentiator, with 88% of gold reserves located in top-tier jurisdictions in the Americas and Australia, an operating reserve life of more than 10 years and average reserve grade of 1.05 gold per ton.

Additionally, the gold major significantly increased its exposure to other metals over the past year, with an estimated 63 million gold equivalent ounces from copper, silver, zinc, lead and molybdenum.

Newmont plans to spend approximately $230 million on exploration this year - a decrease of 13% from the prior year as it captured $25 million of exploration synergies from the Goldcorp acquisition and about $10 million from the divestiture of KCGM and Red Lake.

Around 80% of total exploration investment would be dedicated to near-mine expansion program, and the remaining 20% would be allocated to the advancement of greenfield projects and innovation programs.

Geographically, the company would invest about 30% in North America, 25% in South America, 20% in Australia, and the remainder in Africa and other locations.